- New Money

- Posts

- Where’s my money?

Where’s my money?

I only have $621.42 left...

Happy Sunday,

Quick intro note from Angelo here

Today’s edition:

The exact process I follow every time I get paid

My monthly portfolio review (it’s been a crazy month)

AI is making young people rich, and gold is coming back

Read time: 4 min 30 seconds

💰 Wealth Tip of the Week

I look broke, only a few hundred dollars in my bank account.

(this is my checking account)

But the truth is my money isn’t gone. It’s already working harder than I ever could.

That’s because I don’t leave it sitting around waiting to be spent—I move it straight into savings and investments the moment it hits my account.

If you want to build wealth, it comes down to one thing: control where your money goes before it decides for you.

That’s the difference between someone who always feels broke and someone who quietly builds wealth in the background.

So instead of leaving it up to chance, I built a system. Every paycheck I get takes the same exact path, every single time. I call it the 4 Money Bases.

A bunch of you saw my Instagram post on the topic, but that was just the highlight reel. Today I’m pulling back the curtain on my full payday routine, the exact system for where I keep my money, and how I move it around.

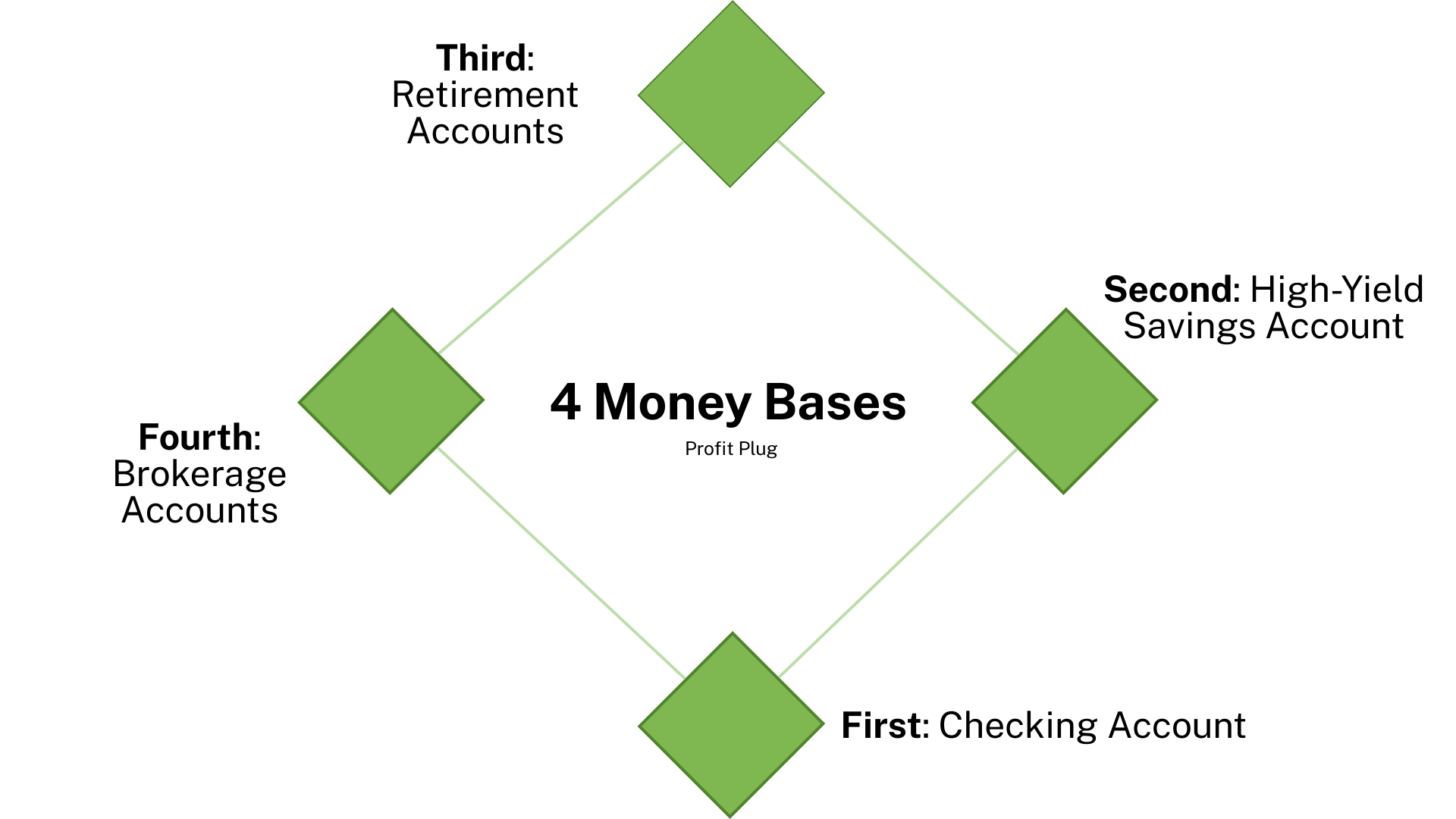

The 4 Money Bases

Every paycheck gets split immediately into four different bases.

No thinking. No deciding. No "I'll save later."

It’s automatic every time.

The 4 Money Bases

First Base: Checking Account

First base is my checking account. I transfer enough to cover my credit card bills, rent, and other living expenses, plus a little extra buffer. Checking accounts earn virtually no interest, so my money doesn’t live here long. It’s just a temporary holding zone.

Second Base: High-Yield Savings Account

Next stop is my high-yield savings account. I’ve set up an automatic transfer so money flows straight from checking into here.

This account earns higher interest, around 3–4%, and Bankrate confirms that’s beating inflation. So this is where I keep my emergency fund (3-6 months’ worth of living expenses).

Check out my HYSA recommendations here.

Third Base: Retirement Accounts

After emergency savings, I move on to third base, which is all about setting myself up for the long game. This is where I put money into my retirement accounts—401k and Roth IRA.

These accounts have major tax advantages but more limits on how much you can contribute and when you can withdraw your money. That’s why they’re perfect for long-term goals, like retirement.

My contributions are automated—either straight from my paycheck or scheduled transfers—so every month I’m paying future me without even thinking about it.

Fourth Base: Brokerage Accounts

Fourth base is where I invest beyond retirement, and I keep it simple. In my taxable brokerage account with Webull, I go for index funds like VOO, VTSAX, and QQQM, bought consistently and left to compound.

No chasing the next hot stock, no stressing about market timing. This is how I build freedom and options for the future.

The best part about this system is once I’ve set aside and invested my money, I get to focus on the good stuff: my guilt-free spending money. This is what I use for dinners out, time with friends, (trips to Thailand), and any purchases that I enjoy.

No stress and no guilt, because I already paid myself first. This is the reward for sticking to the plan.

Here are the exact steps to set up your paycheck in the same way:

Your Step-by-Step Paycheck Protocol

STEP 1: Set Up Your Accounts

Open these accounts TODAY:

Keep your regular checking account

Set up a high-yield savings account: Compare the top options

Open a brokerage account: My favorite is Webull, but you’ll also see Fidelity, Vanguard, and Schwab as top investment platforms.

P.S. this process will only take you 20 minutes.

STEP 2: Calculate Your Numbers

Do the math to figure out what your income and expenses look like.

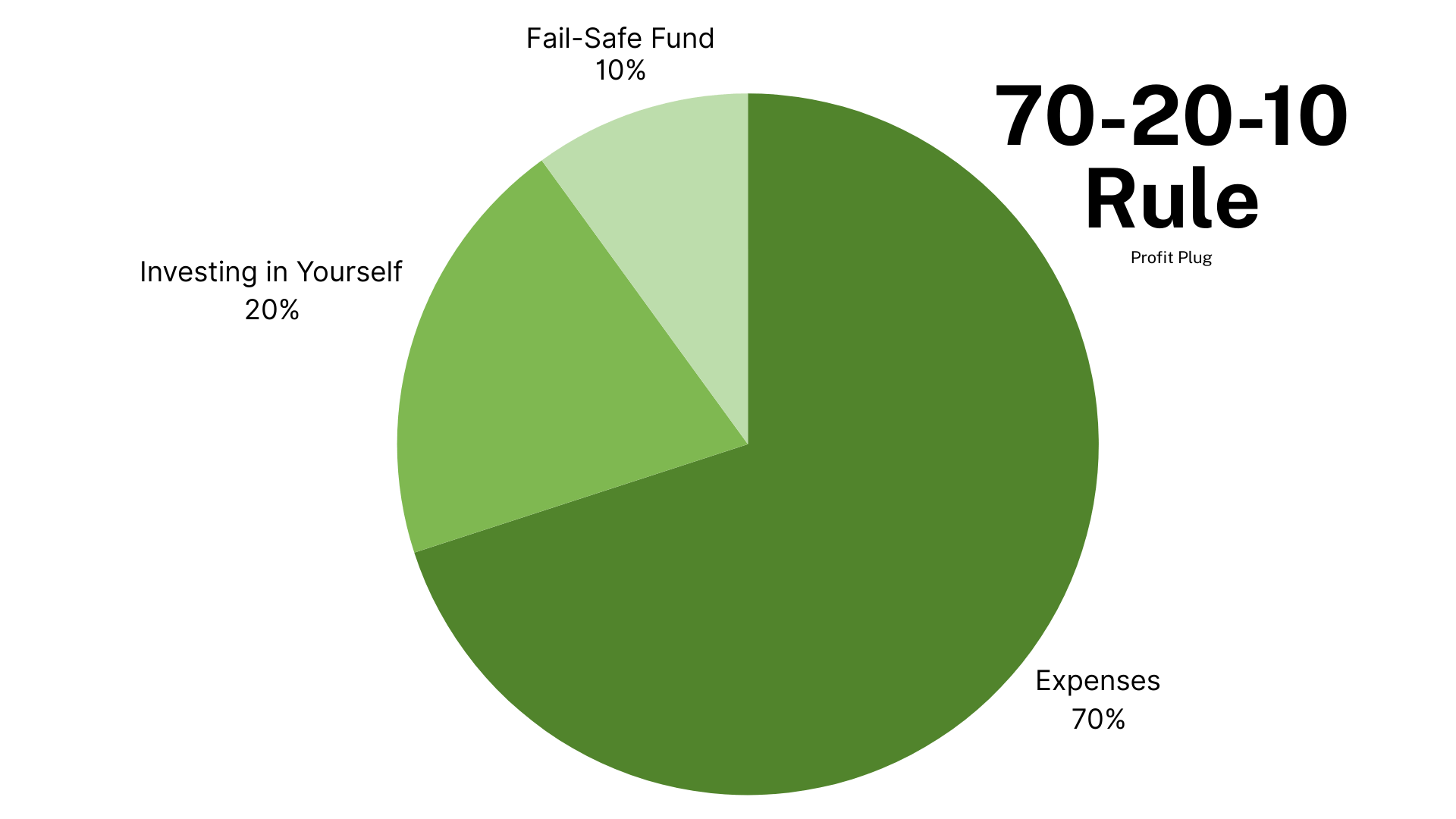

A good rule to follow is the 70/20/10 rule–I walk through it in this YouTube vid.

The math goes like this:

70% of your income at most should go toward expenses, like housing, food, and fun activities.

20% should go toward investments to grow your wealth the passive way.

10% should go toward your emergency fund in case your car breaks down, you break your thumb, etc. You get the idea.

70-20-10 Rule

This is just the starting point. Always try to lower your expenses and increase your investments wherever you can.

STEP 3: Set Up Automatic Transfers

Once you’ve done the math, set up recurring transfers for the moment your paycheck hits, straight into your high-yield savings, retirement, and brokerage accounts.

Inside your investment accounts, make sure that money doesn’t just sit there. Set up recurring buys of index funds or ETFs. No emotions. No market watching. Just consistent, boring wealth building.

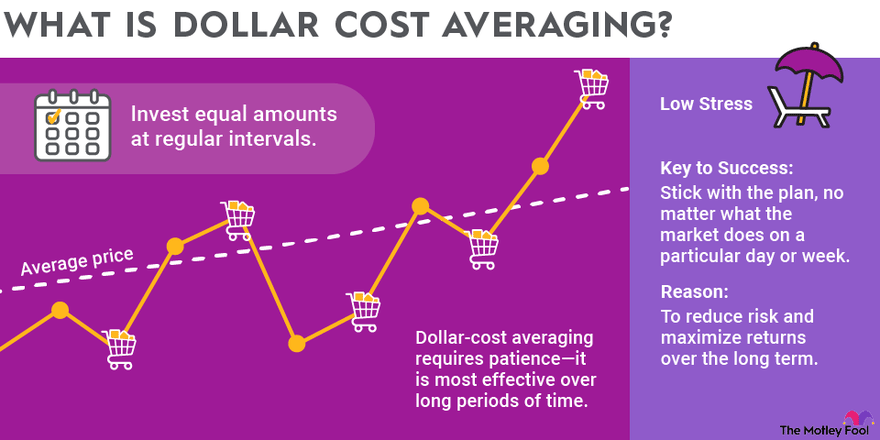

This method is called dollar-cost averaging. You’re investing regularly whether the market is up or down.

Automation removes willpower from the equation (and spoiler…human willpower is actually pretty weak). You’re not relying on remembering or hoping you’ll move money over at the end of the month.

It just happens automatically, and over time, those automatic, steady purchases compound into real wealth.

Why This System Actually Works

The magic is in the automation. By moving your money the moment it hits your account, you remove temptation. You can’t spend what’s already gone.

You’re investing and saving on autopilot, while most people are still overthinking what to do with their paycheck.

This system builds wealth quietly in the background, freeing you up to focus on life instead of stressing about money moves.

Honestly, it’s the advice I wish I’d had at the start of my financial journey and the kind of advice that completely changed the game for me, and now I’m passing it on to you.

Your next paycheck is your first step to financial freedom. Set up the automation today and thank yourself in 10 years.

📉 Market Recap

Check out some of the biggest stories shaking up money, markets, and momentum this week.

Nvidia is still going strong, but is a slowdown looming?

Employers are offering big salaries for young, AI-skilled 20-somethings

JPMorgan doubles down on its credit card dominance

Nike is laying off 1% of its corporate employees to cut costs

Gold prices could rise amidst the battle between Trump and the Fed

Market Overview

👀 In Case You Missed It

Want to know exactly how to invest in 2025? I walk you through the entire process in my latest YouTube video:

See y’all next week 🫡

- Angelo Castillo

How did you like today's newsletter? |