- New Money

- Posts

- Unreal

Unreal

This game-changing trait changed my life

Happy Sunday,

Hope y’all had a wonderful and restful weekend! I made a rash decision to book a flight to Bali a couple days ago…..

I’m staying there for 35 days, which is the most i’ve ever traveled. But it’s for “work”.

I’m gonna create content like a machine!

Okay let’s get into it.

Today’s edition:

The rich habit that makes me six figures

How to get comfortable with your finances

Elon is buying Tesla shares, your interest rates could change, and more

Read time: 5 min 10 seconds

💰 Wealth Tip of the Week

I went from making $12 an hour to six figures in just two years.

And no, my family isn’t rich, and I didn’t win the lottery.

Instead I learned the habits of the rich and stayed disciplined to see the compound effects of those small daily habits.

I want the same for you too, so let’s hack your financial habits to give you the best financial outcomes. Let’s go.

Get comfortable with being uncomfortable

Here’s the truth that honestly sucks: Nothing will change in your life unless you change.

I get it, change is scary. It’s uncomfortable because it’s all new and unknown.

But everything you want is on the other side of that change.

Imagine trying to get stronger at the gym but lifting the same weight every day. You'll never break a sweat and never see results.

Challenging yourself is the only way you'll see what you're really capable of.

When I started investing, I had no clue what to do. But I took the leap and learned along the way.

It’s the same thing with my business. I wasn’t a business guru from day one.

I’m only where I am now because I took the small, uncomfortable steps and learned from doing. And it’s changed my life.

To be successful in anything, you have to put yourself out of your comfort zone, and this will be your game-changing trait.

You’re probably thinking, “Easier said than done.” And you’re not wrong.

So here are the steps to take to get comfortable being uncomfortable.

Acknowledge the discomfort

The first step to getting comfortable with being uncomfortable is to acknowledge that the feeling is normal. It's okay to be scared of starting something new.

The fear and uncertainty are signs that you're on the right track and you're doing something meaningful that will push you forward.

Start small

Don't try to make a massive change overnight.

If you've been avoiding investing, start by opening a brokerage account. You don't have to fund it with a large sum right away. Just go through the process of setting up the account.

Not sure how? Check out NerdWallet’s breakdown of exactly how to open a brokerage account.

If you've been wanting to start a side hustle, start by researching one simple idea for 30 minutes. Check out my YouTube video on 8 realistic side hustles to get you started.

The goal is to take a small, uncomfortable step to get the ball rolling.

Embrace imperfection

Stop waiting for the "perfect" time to start. The truth is the perfect time will never come.

Your first step will likely be messy and imperfect, and that's exactly the point.

My first social media posts were terrible, but I didn't let that stop me. And you know I made so many mistakes when I first started investing that felt like the end of the world.

But none of that really mattered in the grand scheme of things, and I learned from each mistake to make my next post or investment better than the last.

This is how you fail fast and learn even faster.

Find an accountability partner

Sometimes the most uncomfortable part is doing it alone. Find a friend, a mentor, or a community that can support you, because it’s been proven to make a difference.

Share your goals and challenges with them. Knowing someone is there to encourage you can make facing the unknown a little less scary.

Reflect on your progress

Take a moment to look back at how far you've come. Acknowledge the small wins you’ve had from getting out of your comfort zone, and you’ll build some momentum.

And if all that isn’t enough, check out Forbes’s 8 tips to getting comfortable being uncomfortable.

Step out of your financial comfort zone

Many people stay in financial ruts because they're afraid to try something new.

They stick to a traditional savings account that earns pennies because they're uncomfortable with investing or opening a high-yield savings account.

They stay at a job they hate because they're afraid to negotiate for a better salary or start a side hustle.

But growth only happens when you push past what feels safe and familiar.

So this week, I’ve got a challenge for you.

Pick one of the actions below, and just do it. Don’t overthink it, just take the leap.

If you don’t have an investment account, open one this week. It takes less than 15 minutes.

If you've been hesitant to invest, transfer even just $5 into your new account.

If you want to earn more, research one side hustle idea or practice your negotiation pitch for a raise.

Remember: The pain of regret is always worse than the pain of failure.

If I never went outside my comfort zone and failed, I would never be where I’m at today.

So let’s take charge of your financial success.

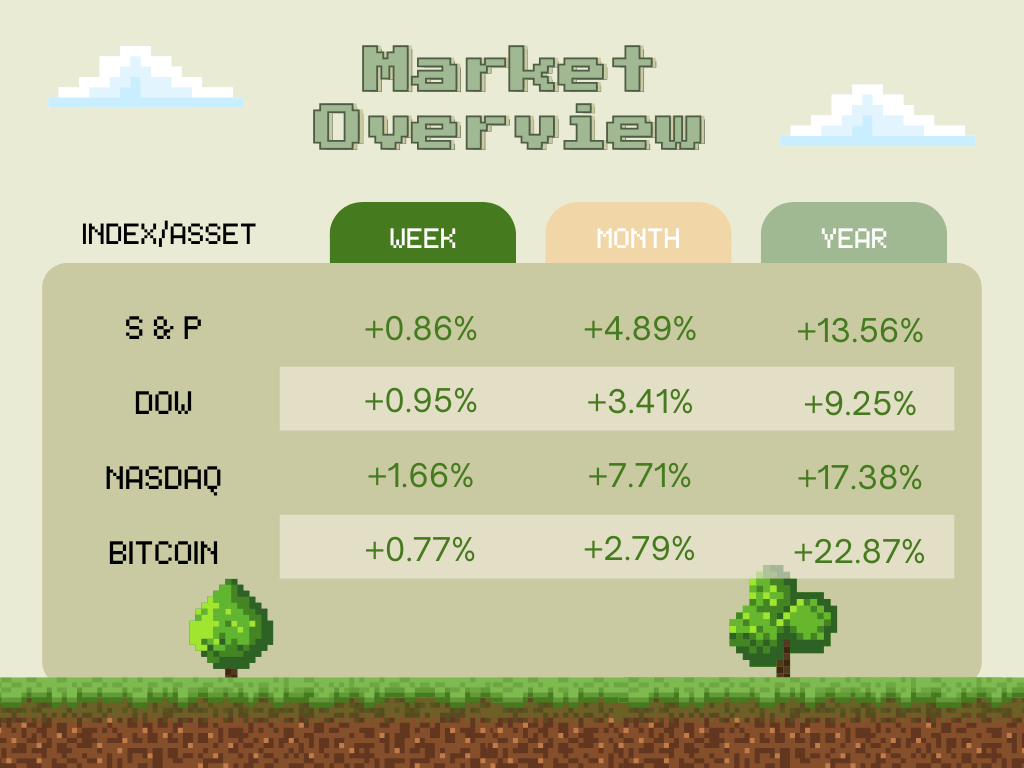

📉 Market Recap

Check out some of the biggest stories shaking up money, markets, and momentum this week.

TikTok could be bought by Oracle to stay around in the US

Elon Musk boosts Tesla shares with $1 billion purchase of stock

The Fed cut interest rates, and what it means for you

Tech giants are investing in UK artificial intelligence efforts

I want your honest take! Are you enjoying the market recap? |

Market Overview

👀 In Case You Missed It

Being rich probably looks different than you think. Let’s talk about why you should look poor to get rich 👇

See y’all next week 🫡

- Angelo Castillo

How did you like today's newsletter? |

Disclaimer: This is not financial advice or investment recommendations. The content is for informational purposes only, and it should not be considered as legal, tax, investment, financial, or other advice.