- New Money

- Posts

- Trump plays Catan with China...

Trump plays Catan with China...

and we might be losing.....

Happy Sunday,

Angelo here! The market took a breather, but Trump is not done with this tariff war, and neither is China.

It’s almost like he’s playing a bad game of economic Catan, and China is public enemy #1.

Let’s break everything down. Today’s edition:

- The escalating trade war with China

- How I save 50%+ of my income

- Where your favorite company create its products (it’s china)

Read time: 4 min 40 seconds

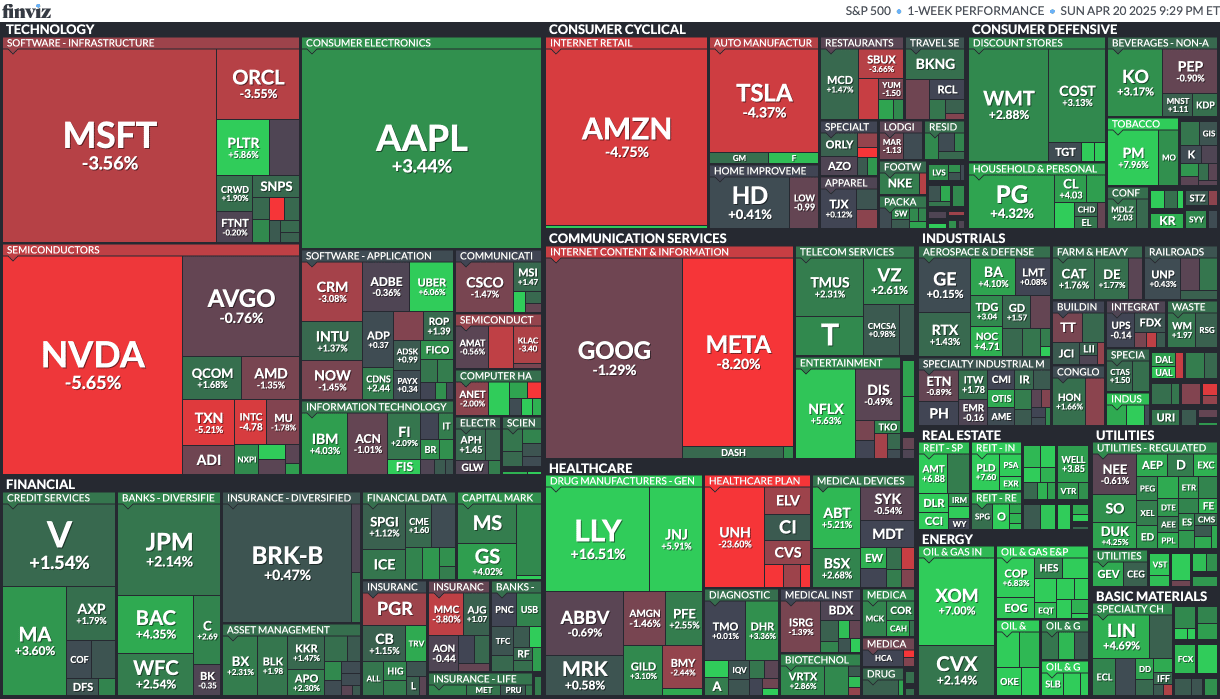

📉 Market Recap

Markets finally took a breather — but don’t get too comfortable.

S&P 500 ended up in the positive 0.52%

Nasdaq-100 barely fell 0.3%

The big headline this week: Nvidia got smoked.

The U.S. banned exports of Nvidia’s H20 AI chips to China for “national security concerns” (lol)

Nvidia expects to lose $5.5 billion — nearly 14% of its quarterly revenue

Stock dropped 7% in a single day

China makes up 13% of Nvidia’s revenue & is now ramping up production for domestic chips. (Huawei somewhere celebrating)

Other chipmakers weren’t spared either:

ASML fell 4.5%

TSMC dropped 5% after missing earnings

This isn’t just about Nvidia — the U.S. and China are back in a full-blown tech trade war. And it’s starting to hurt.

To clap back…. China just weaponized minerals

China placed new export controls on seven rare earth elements, requiring exporters to obtain special government licenses to ship them out

These are essential for F-35 jets, Tomahawk missiles, MRI machines, electric vehicles, laptops/smartphones, and even cancer treatments

China processes 90% of the world’s rare earths, and the U.S has one rare earth mine….. Mountain Pass in California 😅

Meanwhile, Netflix quietly crushed earnings.

EPS up 25% to $6.61

Revenue came in at $10.5B

They’re no longer using subscriber growth as a KPI, but now are only reporting profit…..which is huge!

Forecasting 15% revenue growth and 44% earnings growth next quarter

Long-term goal? Aiming for a $1 trillion market cap by 2030

Netflix is one of my favorite stocks on my watchlist right now. They aren’t affected by any of this tariff drama and are DOMINANT in the streaming industry!

Now I do think we may have seen the bottom, as the market starts to rebound over that massive overreaction we had the following week. However, if things keep playing out the way it is right now, expect it to be a very choppy recovery!

(not financial advice )

See My Entire Portfolio! 🌸

If you want to see my entire portfolio and see my thoughts on the market in real time, follow me on the Blossom app! It’s like Twitter but for DIY investors.

100% free and a way for me to put my money where my mouth is by showing you what I invest in!

💰 Wealth Tip of the Week

I save 50%+ of my income every month.

BUT I am still able to:

Eat out

Buy coffee

Travel

& Enjoy my life

Here’s how I do it:

1. I automate everything.

As soon as my paycheck hits, a fixed % gets automatically transferred into my savings and investments.

No decisions. No emotion. Just auto-pilot.

It forces me to live off what’s left, and I adjust my lifestyle around that.

2. I focus on the big 3: housing, transportation, and food.

These three eat up most of your money — fix them first.

Housing: I’ve lived with roommates, moved home, and kept rent lean.

I am a strong believer in moving back home with family after college (if you can).

I have plenty of friends who moved into $2,000+ apartments and are struggling every day because of it.

Not because they can’t afford it, but because they had to accept a job they didn’t like just to survive.

If you are in college or just graduated, consider moving back home or living with roommates.

Living alone is overrated.

(Just my opinion, reply if you disagree)Transportation: I drive a cheap, paid-off car (2017 Toyota Corolla) and wasn’t lazy and shopped around for cheaper car insurance regularly.

Car insurance has risen 25-50% over the past year and will most likely keep rising with the tariffs.

The easiest way to save a couple of hundred bucks a month is to compare rates and switch.

Yeah, yeah, it’s boring…. I know.

But I’d rather answer a few surveys and click a few buttons than pay $300+ a month on insurance…

Here is the tool that I used to save some moneyFood: I cook, meal prep, and cut out the $15 takeout habit. I used to be a frequent doordasher.

But I used to justify it because I was “working”.

But in reality, I was lazy and addicted to junk food.

The best decision was deleting Uber/Doordash and committing to cooking 90% of the time.

Your body and wallet will thank you.

Small cuts help, but if you don’t lock in these 3, nothing else matters.

3. I increased my income.

You can only really save so much.

There comes a point where, in order to save more money, you have to sacrifice your happiness and livelihood.

That is something I am no longer willing to do.

Once I created my systems, cut back on everything that I could, there was only one more option left.

Earn more.

You can only invest as much as you save, and you can only save as much as you earn.

You don’t need to start making $10,000/ month or start some sort of business.

But would $500 a month… $100 a month help?

That’s gas money, utilities, or your weekly fun money!

It’s not as hard as you may think to make an extra $500 a month.

In fact, here is a video about 8 side hustle ideas you can start right now. 👇

🧵 Thread of the Week

China… China… China… 🤣

The Chinese suppliers have been clapping back and exposing all of America’s top fashion brands.

I’ve always thought this was common knowledge.

The fact that fashion brands use Chinese factories to create their goods and mark them up 1000%.

But what I did not expect to see was homes and Tide Pods.

The more you know!

See y’all next week 🫡

- Angelo Castillo

PS. I want to make newsletter the best newsletter possible. If you have any suggestions, constructive criticism please let me know! Fill out this form here.