- New Money

- Posts

- System

System

This is exactly how I save 50% of my income

Happy Sunday,

Angelo here! Welcome to New Money, where we go over weekly tips to help you build your wealth, one dollar at a time.

Today’s edition:

How to hack your brain to save more money

The exact accounts you should be keeping your money in for the best return

Uber offers more than driving, tariff news is still coming, and more

Read time: 3 min 10 seconds

💰 Wealth Tip of the Week

If you’ve ever tried to get your savings in order, chances are you’ve failed a lot.

When I was trying to stop spending all my money on things that weren’t serving me (like weekly Chipotle bowls), I kept failing too.

But I finally learned an important lesson: You can't rely on willpower alone. You have to outsmart your brain.

So here are six proven, science-backed ways to save your first $10,000 faster.

1. Set a Trap for Your Future Self

In Homer's Odyssey, Ulysses had his crew tie him to the mast so he couldn't give in to the Sirens' tempting songs.

You need to set a similar "trap" for your impulsive future self.

If you’re struggling to save, the hack here is to make it more difficult to spend.

Those are definitely going to the extreme, but the point is: The harder it is to buy something, the less likely you are to do it on impulse.

2. Automate Your Money System

After a long day of making thousands of decisions, your brain is mentally exhausted, making it easy to give in to temptation.

If you’ve been around for a while, you know my favorite thing to talk about is automating your savings because you need to make it seamless.

The process goes like this:

Set up your paycheck to automatically flow a portion into your investment accounts.

Automatically deposit a fixed percentage into your dedicated savings accounts (like your emergency fund).

Set up autopay for all bills and subscriptions.

With this method, I spend a couple of minutes a month managing my money and save more than ever before. And I walk you through it in my recent YouTube video—check it out here.

3. Hack Your Dopamine

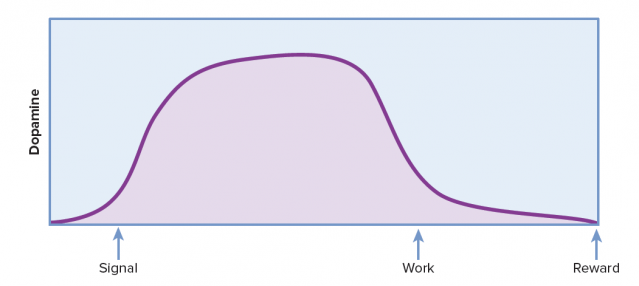

Most of the pleasure you get from a purchase is released during the anticipation of the purchase, not after you get the item itself. That's why that new gadget loses its shine after a week.

Impulse buys are driven by a temporary dopamine hit, but they lead to an average of $3,300 a year wasted on purchases people regret.

So the next time you see something you want to buy, follow these steps:

Open your phone and create a list of possible purchases. Write the item down.

Force yourself to wait 30 days before you buy it.

For most people, after 10, let alone 30, you realize you didn't actually want the item in the first place. It was just a temporary impulse, and you’ve saved yourself that money.

4. Replace, Don't Accumulate

Sometimes you have to buy something because the old item is broken, worn out, or too small.

This is where the 1:1 Rule saves you money and prevents unnecessary accumulation.

Only buy something new if you are replacing something that is broken or worn out.

Try to buy the replacement secondhand. Older, vintage items from thrift stores are often better quality and more affordable than new items.

Once you get the replacement, the old item has to go. Sell it on eBay or donate it. This prevents clutter and forces you to be intentional about what you buy and own.

5. Create Strong Habits

It can be hard to consistently force yourself to do something new, like tracking your spending, because it's not part of your normal routine.

This is where habit stacking comes in. Made famous by James Clear in his book Atomic Habits, the concept is simple: Use an existing habit to trigger a new one.

For example, after you make your morning coffee, spend 5 minutes auditing your finances.

Soon checking your spending will become an automatic after making coffee, and it no longer feels like an extra chore.

Your brain loves routines, so use this to your advantage.

6. Perform Quarterly Financial Audits

Let’s talk about one of the biggest hidden expenses out there: subscriptions.

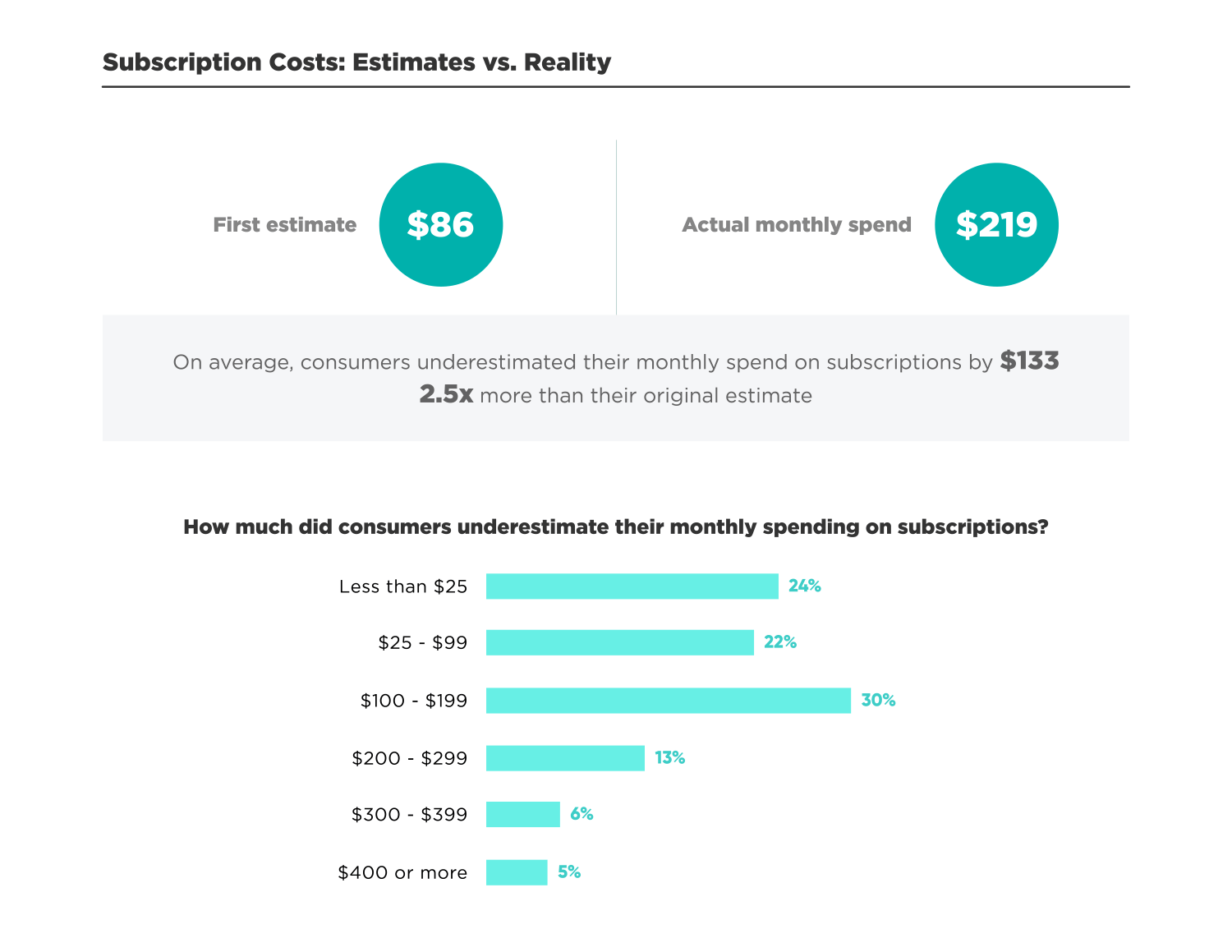

The average person typically guesses they spent $86 a month on subscriptions. But research has found they were actually spending $219 a month. That’s a big chunk of money that’s not serving your-term goals.

The solution is to do a deep dive on your finances every three months.

This way, you can see where your money is going and cancel unused subscriptions.

And if you don’t quite catch those hidden subscription fees on time, send an email to the company asking for a refund for that month. You’ll be surprised how often you get your money back.

If you've struggled to save, it's not a lack of motivation. It's a lack of system.

Start by choosing one of these strategies today and implement it with the goal of consistency, not perfection.

Can’t wait to see where your savings take you.

📉 Market Recap

Check out some of the biggest stories shaking up money, markets, and momentum this week.

Uber will let you make money without driving

JPMorgan is investing in U.S. national security

Tariff updates aren’t over, and they could cost you

OpenAI is still booming and now designing AI chips

I want your honest take! Are you enjoying the market recap? |

Market Overview

👀 In Case You Missed It

Where should you be keeping your money? I’m breaking it down for you in this vid

See y’all next week 🫡

- Angelo Castillo

How did you like today's newsletter? |

Disclaimer: This is not financial advice or investment recommendations. The content is for informational purposes only, and it should not be considered as legal, tax, investment, financial, or other advice.

Some of the links are my affiliate links. If you click on these links and sign up/purchase something, I may earn a small commission at no additional cost to you. This helps support me and allows me to continue creating content for you. I only promote products and services I genuinely believe in. Thank you for your support!