- New Money

- Posts

- Stay

Stay

The best investing lessons for beginners I learned the hard way

Happy Sunday,

Angelo here! Welcome to New Money, where we go over weekly tips to help you build your wealth, one dollar at a time.

On a sidenote, I am so proud of you for locking in your finances. I’ve been getting so many comments saying “I’ve invested because of you…” and it really warms my heart.

I cannot be prouder of you. Reply to this if you started investing because of my content! Let’s keep it going!

Today’s edition:

Why most people quit investing too early

How boring habits quietly build wealth

Trade deals, AI shifts and more…

Read time: 2 min 80 seconds

💰 Wealth Tip of the Week

The biggest advantage in investing isn’t intelligence.

It’s staying in the game. Most beginners never do.

They start, stop, restart, overthink, panic, and eventually give up.

When I first started investing, I thought progress came from knowing more.

What actually mattered was committing to stay.

And the moment you decide you’re in this for the long run,

you already have an advantage going into 2026.

Let me explain.

1. Ask The Right Questions

If you start driving without a destination, every turn feels urgent.

That’s how most beginners approach investing.

Simply because no one ever explained what to decide first.

So you jump straight to questions like:

What stock should I buy?

Is now a good time to invest?

What if I choose the wrong one?

You can do this instead:

Decide your investing destination: Pick a simple time horizon — 5 years, 10 years, or 20+ years.

Write it down somewhere visible: Notes app, journal, or the top of your investing app. This is your anchor.

This turns investing from panicking at every turn into driving toward a destination you already chose.

You’re no longer trying to be right today but you’re giving yourself time to learn, adjust, and stay in the game.

2. Think Like an Owner, Not a Trader

Even with a destination, I still made mistakes early on.

Because I kept watching prices.

Traders focus on price movement. Owners focus on what they actually own.

That difference matters more than most people realize.

Do this once before you invest:

Write one sentence for why you’re buying. Example: “I’m owning this because it benefits from long-term growth in X.”

Write 2–3 reasons you would sell — based on the business, not the price. Example: “The business model no longer works. Management makes a decision that changes the company’s direction.”

Then follow one rule:

If the price moves, do nothing. Only reconsider if your original reason is no longer true.

That’s how you stop trading and start investing like an owner.

3. Boring and Consistent Beats Smart

There’s a common myth that successful investing requires genius-level intelligence.

It doesn’t.

What it actually requires is behavior you can repeat:

patience

consistency

emotional control

And this is where beginners often get tripped up.

Here’s how to keep it simple:

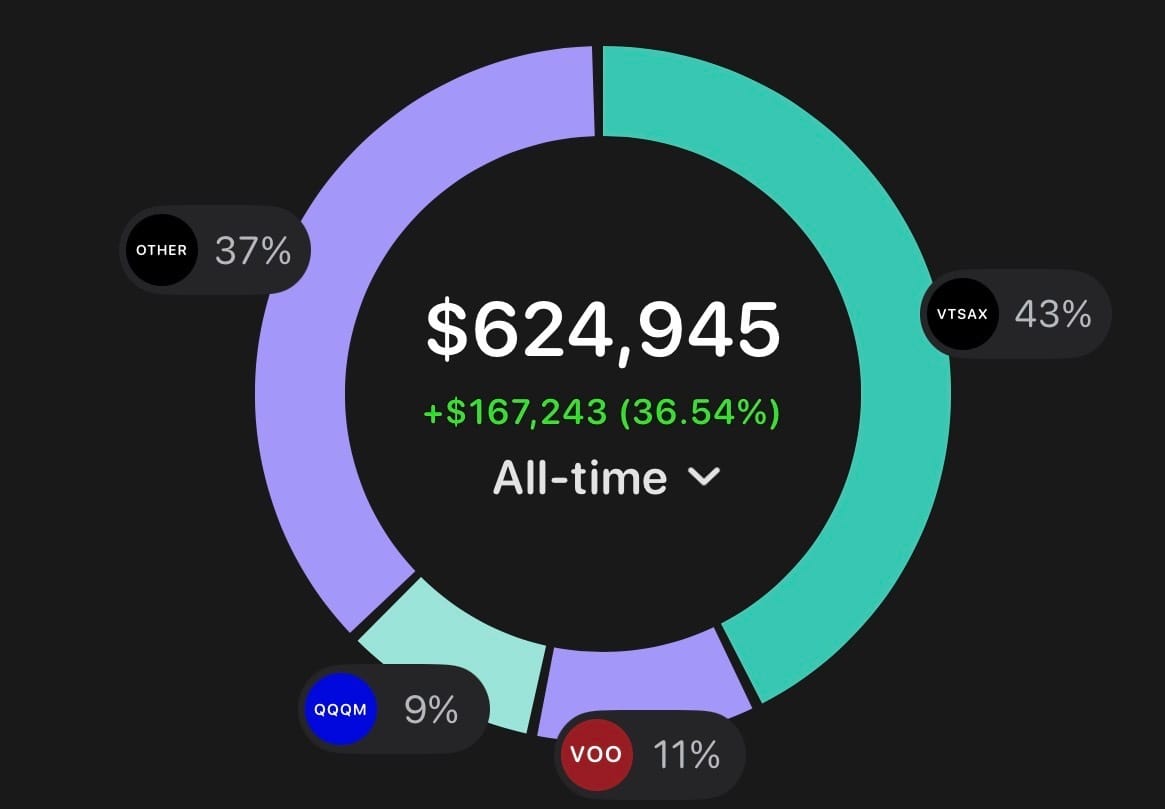

Start with broad index funds. The Big Three beginners often start with:

VOO – tracks the S&P 500 (top 500 U.S. companies)

VTI – tracks the total U.S. stock market

QQQM – tracks the Nasdaq 100 (more tech-heavy)

If you’re curious to see exactly what I invest in, 👉 Click here to view my full portfolio.

Automate everything. Examples: $25 per week, $100 per month, whatever amount you can afford and stick with

Reduce the urge to interfere. Don’t check prices daily. Once a month or even once a quarter is enough.

Boring is stable, repeatable and compounds.

4. Investing Isn’t Just About Getting Rich

Investing isn’t fast money. It’s about not falling behind.

Inflation quietly eats away at your cash. Prices rise whether you invest or not.

If your money isn’t growing, it’s shrinking.

That’s why investing matters — not for excitement, but for protection.

But here’s the part most people skip.

Before you try to grow fast, you need a foundation that won’t collapse the moment something goes wrong.

That means stability first:

Pay off high-interest debt first. Credit cards and similar debt grow faster than most investments ever will.

Build a small emergency fund. Start with a simple goal: one month of basic expenses. I keep mine in a HYSA (high-yield savings account) so it earns 4–5% while staying accessible. 👉 Here are my top HYSA recommendations I personally use.

The best time to start investing was years ago. The second best time is right now.

Stay in the game and I’d love to hear how your investing journey turns out.

Where are you right now in your financial journey? |

📉 Market Recap

Check out some of the biggest stories shaking up money, markets, and momentum this week.

EU-Mercosur trade deal approved, cutting tariffs, facing farmer backlash

Google’s AI regains lead as Gemini outperforms OpenAI models

Trump announces Venezuela oil transfer up to 50M barrels to the U.S., pushing oil prices lower

U.S. job add ~50K in December, boosting odds of Federal Reserve rate pause

Market Overview

👀 In Case You Missed It

If you’re serious about building wealth, you need to understand the parts no one likes to talk about.

See y’all next week 🫡

- Angelo Castillo

How did you like today's newsletter? |

Disclaimer: This is not financial advice or investment recommendations. The content is for informational purposes only, and it should not be considered as legal, tax, investment, financial, or other advice.

Some of the links are my affiliate links. If you click on these links and sign up/purchase something, I may earn a small commission at no additional cost to you. This helps support me and allows me to continue creating content for you. I only promote products and services I genuinely believe in. Thank you for your support!