- New Money

- Posts

- Retire

Retire

Your path to freedom starts with your real retirement number

Happy Monday,

Angelo here! Welcome to New Money, where we go over weekly tips to help you build your wealth, one dollar at a time.

Today’s edition:

The simple math behind your real retirement number

Why most people overestimate what they actually need

Nvidia slips, oil drops, and more

Read time: 3 min 40 seconds

💰 Wealth Tip of the Week

How much money do you actually need to never work again?

If you ask around, most people will give huge, random guesses like $1.8 million.

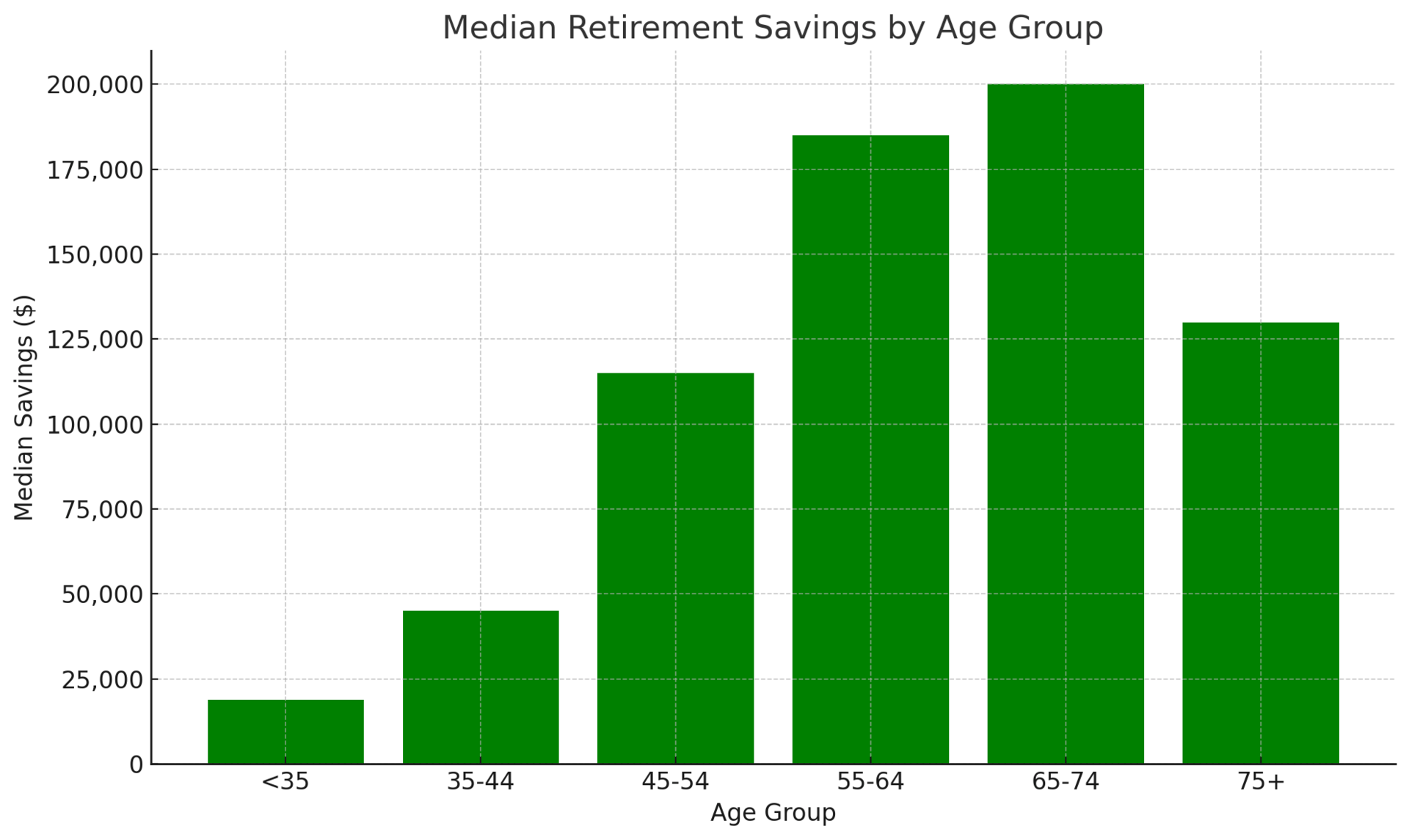

But here’s the wild part: the median American retiree has around $200,000 saved, and 82% say they’re doing “at least okay.”

So what’s going on?

Are people secretly struggling… or is the number we’ve been told completely wrong?

The truth is simple: your real retirement number is probably way smaller than you think.

Today, I’ll show you the beginner-friendly steps to figure it out.

1. Forget the $1M Scare Number

You'll see big numbers like $1.8 million thrown around as the retirement "target."

But here's the truth: those numbers are just guesses based on opinion.

That’s exactly what happens here. People see $1.8 million and assume that must be what everyone needs.

But your retirement number is simply based on your yearly spending:

If you spend $40,000 a year, you don’t need millions in retirement.

If you spend $60,000 a year, your retirement number increases.

If you spend $25,000 a year, your number becomes much smaller.

Don’t let anchoring push you into panic.

Your number should come from your real life, not someone else’s formula.

2. Find Your Real Retirement Number

Your retirement number is simply the total amount you need saved and invested

that lets you withdraw money each year without running out.

This idea comes from Bill Bengen’s updated research used in FIRE (Financial Independence, Retire Early), and the math is simple.

The 4.7 Rule:

Your anticipated yearly spending in retirement ÷ 0.047

That’s your “money machine” that can safely pay you every year in retirement without the risk of running out.

For example:

You want to spend $40,000/year in retirement

$40,000 ÷ 0.047 = $851,064 saved and invested

That’s your real retirement number. (It’s usually much lower and more achievable than people think.)

3. Build Your Savings and Safety Net

Most people assume retiring early requires a huge income.

But in FIRE, the thing that actually moves you forward is your savings rate.

There are two parts:

1️⃣ Your Savings Rate (Progress)

This is how much of your income you KEEP each month.

Here’s how to do it:

Calculate your current savings rate: (Total you save monthly ÷ your monthly income)

Pick a goal:

20% = solid

30% = strong

40%+ = FIRE territory

Automate your savings at the start of the month so you save before you spend.

Increase your income or savings by 1–5% every quarter. Small upgrades compound fast.

Track it monthly so you stay consistent and motivated.

2️⃣ Your HYSA (Safety)

While your savings rate determines your speed, a HYSA protects you from setbacks.

HYSA is best used to:

Hold your emergency fund

Store short-term savings while building your investments

Keep a cash buffer so you don’t panic-sell your investments

Not all HYSAs are equal. I compared the best ones! 👉Click here for my top HYSA picks!

4. Invest Simply

Most beginners get overwhelmed because investing looks complicated.

But the truth is, a simple portfolio is all you need for long-term growth.

It’s the most powerful part of the whole journey because it controls how quickly your retirement number becomes real.

Here’s an easy setup:

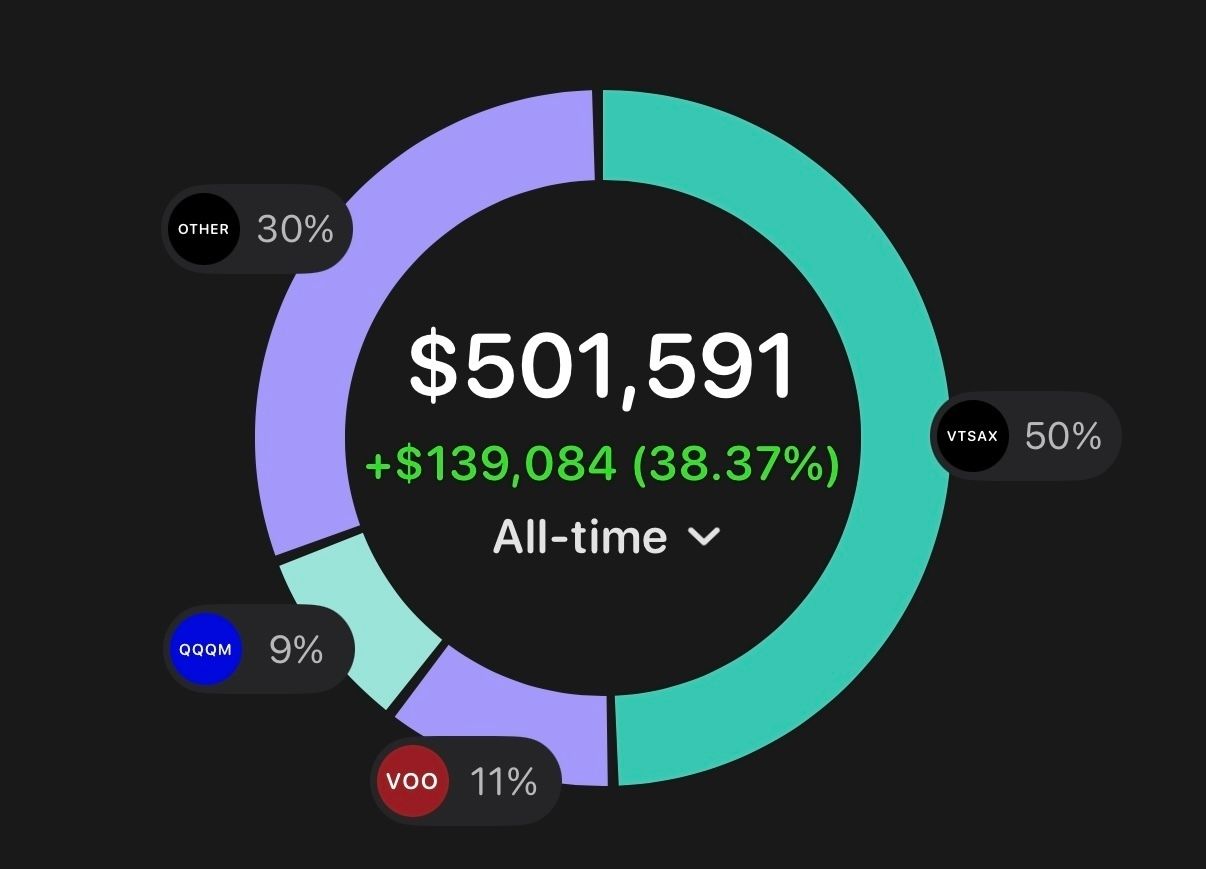

50% — (VTSAX) Total US Stock Market

11% — (VOO) S&P 500

9% — (QQQM) Nasdaq 100

30% — “Other” Bucket

If you’re curious to see exactly what I invest in, 👉 Click here to view my full portfolio.

5. Use a Roth IRA to Grow Faster

The smartest long-term home for your earned income is a Roth IRA.

Think of it as a container that makes your investments work harder for you.

Here’s why it’s so powerful:

Your investments grow tax-free

Your withdrawals in retirement are tax-free

You can invest in index funds, ETFs, and most simple portfolios inside it

It compounds quietly for decades without extra work

How to use it:

Open a Roth IRA (Fidelity, Vanguard, or Schwab are great beginner options).

Add your simple portfolio inside it (VTSAX, VOO, QQQM).

Automate monthly contributions.

Aim to max it out if you can ($7,000/year if you’re under 50).

Let it grow because this is long-term wealth and you can’t withdraw your earnings until 59½.

Retirement only feels hard because no one teaches the system. You’re on the right path.

You’ve got this, and I’m excited where your financial freedom journey takes you.

📉 Market Recap

Check out some of the biggest stories shaking up money, markets, and momentum this week.

Nvidia reported big profits but tech stocks still fell

Oil drops as peace talks progress and gas could get cheaper

Bitcoin keeps sliding and is close to breaking below $80,000

Jobs data is delayed and chances of a rate cut are dropping

Market Overview

👀 In Case You Missed It

Not sure how to reach $100K in your 20s? I walk you through it in this vid.

See y’all next week 🫡

- Angelo Castillo

How did you like today's newsletter? |

Disclaimer: This is not financial advice or investment recommendations. The content is for informational purposes only, and it should not be considered as legal, tax, investment, financial, or other advice.

Some of the links are my affiliate links. If you click on these links and sign up/purchase something, I may earn a small commission at no additional cost to you. This helps support me and allows me to continue creating content for you. I only promote products and services I genuinely believe in. Thank you for your support!