- New Money

- Posts

- Resolutions

Resolutions

This is exactly how to start strong and still finish the year proud

Happy New Year,

Angelo here! Welcome to New Money, where we go over weekly tips to help you build your wealth, one dollar at a time.

Today’s edition:

The smartest system to make money habits stick

Why boring decisions build real confidence

Nvidia chip smuggling, weaker dollar and more…

Read time: 2 min 60 seconds

💰 Wealth Tip of the Week

Every year, I promised myself I’d “do better” with money.

Same pattern. New year. Fresh start.

For a long time, I thought the problem was ONLY discipline.

But here's what finally made sense:

A calm, intentional mindset shapes better decisions which turn into habits, then systems.

So instead of just starting strong in 2026, I’ll share what I built underneath the goals that helped me complete almost everything I committed to by the end of the year.

1. Set the Right Frame

Nothing changed for me until I looked at where my money was really going without trying to fix it yet.

Before goals, budgets, or rules, I needed to see the pattern.

Here’s how to do it:

Write down 3 priorities for this year

(not what should matter, but what actually does)Open your bank app and look at the last 30 days only

Highlight where your spending clearly supports those priorities

Circle what doesn’t

Don’t cut anything yet. The goal here isn’t to “fix” your spending.

It’s to notice where your money and your intentions aren’t on the same page.

When those two start to match, everything else becomes easier to stick to.

2. Build a Monthly Rhythm

I used to think being “good with money” meant paying attention to it all the time.

All it did was make me tired.

Daily money checks create urgency. Avoiding money creates anxiety.

A monthly rhythm solves both.

So once a month, set aside 15 minutes and do this:

Pick one fixed day each month (same day, every month)

Answer only these three questions:

Where did my money go?

Did anything surprise me?

What’s one thing I’ll adjust next month?

By the time you sit down for your monthly check-in, emotions have settled and you’re thinking clearly again. That’s where better decisions come from.

3. Start Small, Stay Consistent

Even good intentions fall apart when they rely on effort.

So the goal here is to make progress happen by default.

That’s why starting small and automation go together.

If you’ve been avoiding investing, don’t start by worrying about returns. You don't have to fund it with a large sum right away. Just go through the process of setting up the account.

I created here a 👉Beginner Investing Checklist for you to get started, and 👉check out here my latest YouTube video where I break it down step-by-step so you can follow along.

Instead of relying on motivation, make it automatic:

Set up automatic transfers to savings and investments ($25 a week, $100 a month — whatever feels manageable)

Automate bill payments and subscriptions

Let the system run without constant attention

When progress runs automatically, you stop negotiating with yourself. And when the step is small, you don’t feel the urge to quit.

That’s how habits stick.

4. Invest In Yourself

In 2026, spend intentionally.

Not all spending is bad but it needs to earn its place.

Money spent on education and skills compounds differently than money spent on things.

They change what you’re capable of next.

But here's what they don't always tell you: this only works if you actually apply what you learn.

Before spending anything ask yourself:

What specific problem does this help me solve? (Not "someday" - right now)

Where will this show up in my life or income? (Vague answers mean skip it)

Will I actually use this soon? (If not, you're collecting, not learning)

The goal isn't to learn everything. It's to learn what moves you forward then use it before you forget it.

When spending builds real capability that shows up in your work or income, it stops feeling like a cost.

It starts feeling like leverage.

5. Become Someone Money Can Stay With

You’ve probably noticed this before that some people just feel calm around money.

That “happy” or confident aura people associate with wealth isn’t luck or mindset tricks.

It’s what happens when someone:

Trusts their systems

Isn’t constantly scrambling

Knows things are handled

And that calm is built through boring decisions, repeated consistently.

This is where the Boring Rule comes in:

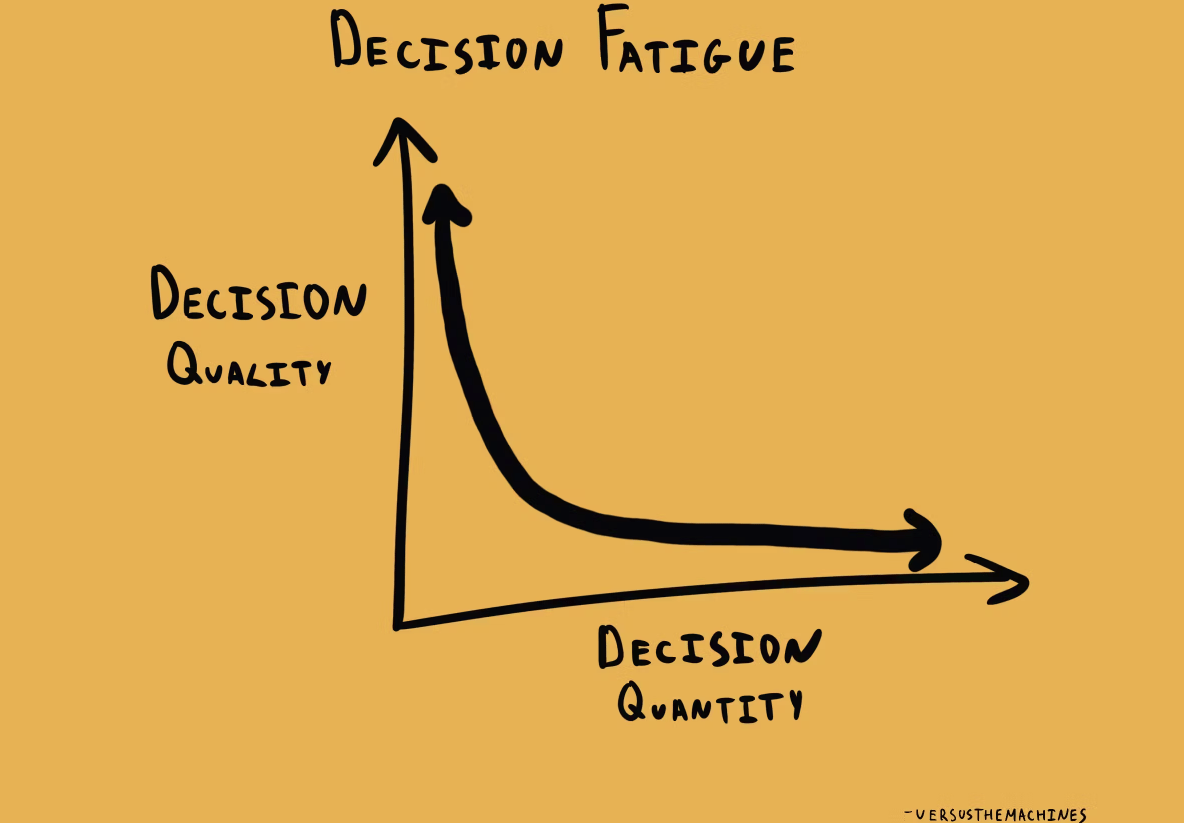

Automate → removes decision fatigue

Delay purchases → kills impulse spending

Save instead of upgrade → stops lifestyle inflation

The Boring Rule

These choices don’t feel impressive at the moment.

But they remove stress, reduce noise, and create stability.

And it’s why money doesn’t just come —it stays.

2026 is about building habits that turn into systems.

I’m excited for you to get started, share your progress, and finish the year proud. You’ve got this!

Where are you right now in your financial journey? |

📉 Market Recap

Check out some of the biggest stories shaking up money, markets, and momentum this week.

OpenAI is paying employees more than any major tech ever did

Nvidia chips being smuggled into China despite export controls

CoreWeave is growing fast in the AI cloud, but is it enough by 2026?

US dollar just had its worst year since 2017 and what the Fed has to do with it

Market Overview

👀 In Case You Missed It

If you’re starting to invest in 2026, avoid these mistakes.

See y’all next week 🫡

- Angelo Castillo

How did you like today's newsletter? |

Disclaimer: This is not financial advice or investment recommendations. The content is for informational purposes only, and it should not be considered as legal, tax, investment, financial, or other advice.

Some of the links are my affiliate links. If you click on these links and sign up/purchase something, I may earn a small commission at no additional cost to you. This helps support me and allows me to continue creating content for you. I only promote products and services I genuinely believe in. Thank you for your support!