- New Money

- Posts

- Procrastination makes you poor

Procrastination makes you poor

How $1 actually equals $15

Greetings from Thailand!

Just spent the last 10 days in Thailand with my hometown friends, relaxing on the beach while still making money through my investments.

This is the level of freedom I dreamed about, and I want to help you get there as well.

Today’s edition:

How to multiple your money starting with $1

Strategies to uncover hidden cash you always had

Is Amazon the new Doordash? Plus, AI in China, Trump’s tariffs, and more

Read time: 4 min 40 seconds

💰 Wealth Tip of the Week

I thought I needed a lot of money to get rich. I was wrong.

So one day I said, screw it.

I started tossing in $20 here, $40 there, whenever I could into the stock market.

It felt small, almost meaningless at first. But over time, those tiny, consistent deposits snowballed into hundreds of thousands of dollars.

Here’s how you can put that same principle to work for you—starting right now.

The $1 Experiment (why starting early matters)

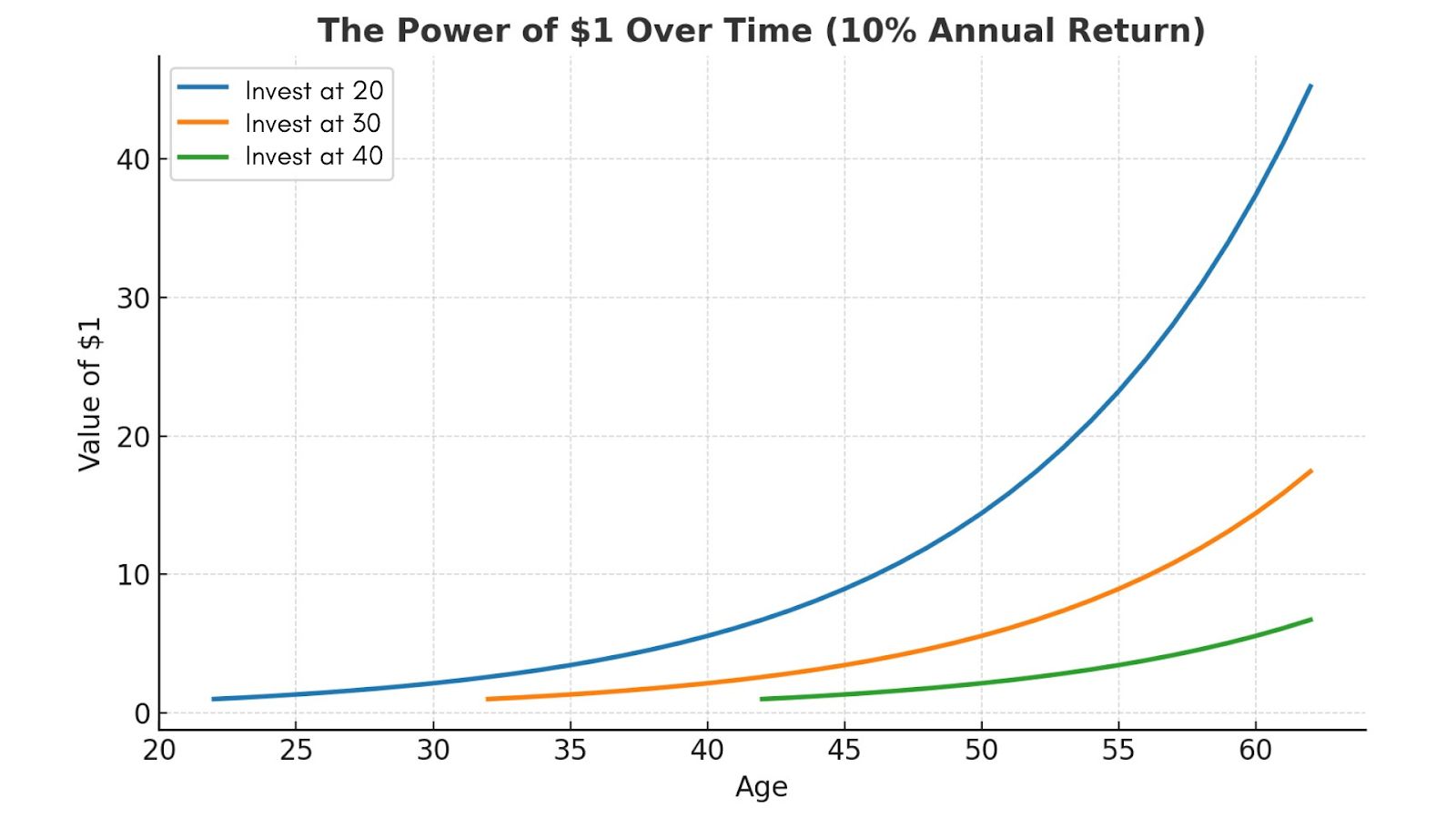

Let’s say you invest $1 in the stock market with a 10% annual return.

Here’s how much it grows by age 65, depending on when you start:

Start at 20 → $1 becomes $72.89

Start at 30 → $1 becomes $28.10

Start at 40 → $1 becomes $10.84

Start at 50 → $1 becomes $4.19

The Compounding Power of $1 Over Time

Same dollar. Same return. Completely different outcomes.

That’s the magic of time and compound interest.

But…how does compound interest actually works

Compound interest is simply money making money… which then makes more money. Think a snowball rolling downhill.

Check out Investopedia’s breakdown for a walkthrough.

Here’s an example:

If you start with $10,000 and earn 10% returns, you’ll end the year with $1,000 in interest, $11,000 total.

That next year, you’re earning interest on your $10,000 plus the extra $1,000 you earned in interest. So year 2 at 10%, you’ll earn $1,100 in interest, putting your total at $12,100.

And that process repeats for as long as you keep your money in the market.

It starts slow—like watching paint dry—but over decades, that growth curve turns vertical.

That’s why the first decade of investing is priceless. Every early dollar you put in gets 40 years of compounding behind it. Wait even just 10 years, and you won’t just lose “a bit” of growth—you’ll cut your potential in half.

Charlie Munger, Warren Buffet’s right-hand man said:

And here’s why he’s right:

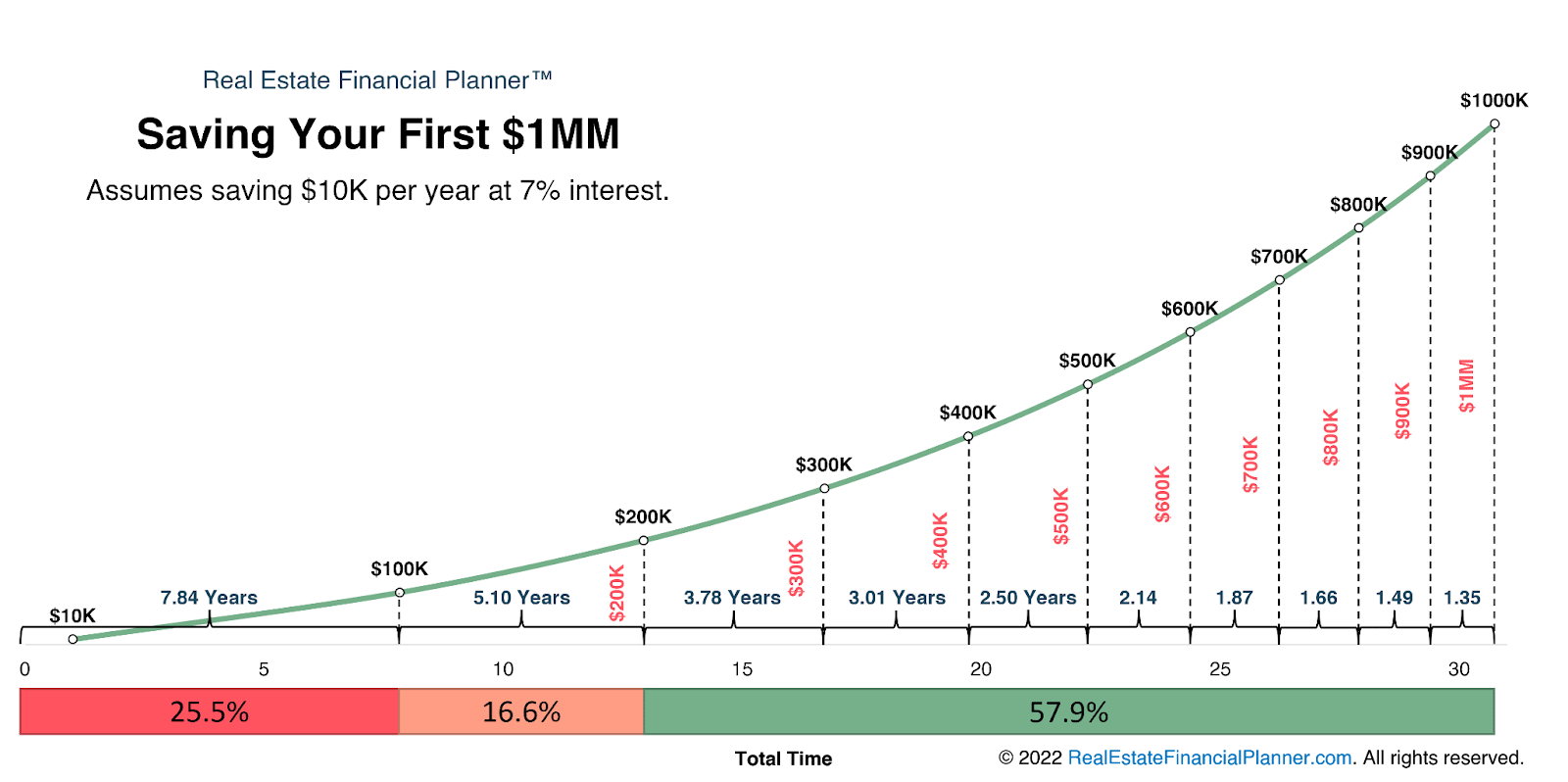

The First $100k (Slow & Painful)

At 7% annual returns, if you invest $15,000/year, you’ll hit $100k in about 7 years.

By then, ~85% of your $100k will be money you put in yourself. Only the rest comes from growth. You’re still doing most of the heavy lifting.

The Second $100k (Fast & Fun)

Once you have $100k, it starts earning $10,000/year in growth—without you lifting a finger.

Keep investing $15,000/year, and you’ll go from $100k to $200k in just 4 years.

This time, a much bigger slice comes from your investments working for you, and you contributed a smaller percentage of the second $100k.

That’s the turning point where wealth building starts to feel less like pushing a boulder uphill and more like watching it roll in.

Find Your Investment Money

So if you’re ready to put compound interest to work for you, here’s the exact 4-step process I used to find the extra money to invest:

Step 1: The Subscription Audit

Log into your bank or credit card apps and scan the last 90 days of charges. Take screenshots of every recurring payment you see. Then, cancel anything you haven’t used in 30+ days — yes, even that “free trial” you forgot to cancel six months ago.

Target win: $50–$150/month back in your pocket.

Step 2: The “Stuff Sale”

Pick five items you haven’t touched in half a year and list them on Facebook Marketplace or OfferUp. Think electronics, workout gear, handbags, books — anything collecting dust. Price them to sell fast, not for max profit, and watch the cash roll in.

Target win: $200–$500 one-time boost.

Step 3: The Bill Negotiation Blitz

Call your internet, phone, and insurance providers. Use this script: “I’m reviewing my bills and considering switching. What’s the best rate you can offer me?” Fifteen minutes per call is all it takes, and you’ll be shocked how often you get a discount just for asking.

Target win: $30–$80/month in reduced bills.

Step 4: The Direct Deposit Split

Log into your payroll system and set up an automatic transfer: 10% straight into a separate “investment” savings account. If your paycheck is $3,000/month, that’s $300 automatically saved before you even see it — no willpower required.

Target win: 10% of your monthly income toward your future.

The Math: Follow these four steps, and you could free up $200–$400/month (that’s $2,400–$4,800 a year) to invest without feeling like you’re living on scraps. The best part? You can do it in a single afternoon.

Set a calendar reminder to repeat this process every six months. Your money has a sneaky habit of slipping away — this is how you catch it before it’s gone.

Why This Works

When I first made these small changes—canceling subscriptions, renegotiating bills, and investing the difference—it didn’t feel life-changing.

I wasn’t suddenly rich.

But looking back a few years later, I realized those early dollars were doing the heavy lifting.

That’s the secret most people miss: wealth doesn’t show up in a single night. It builds in layers—slow at first, then faster, then suddenly exponential.

Your first $1,000 invested might not look impressive, but it’s the foundation for the first $100,000.

And that first $100,000 is the hardest (and most important) you’ll ever earn.

The point isn’t to overhaul your entire life in a week. It’s to start now, with what you have, and keep going.

Because one day, you’ll look back and realize that the little steps you almost ignored were the reason you made it big.

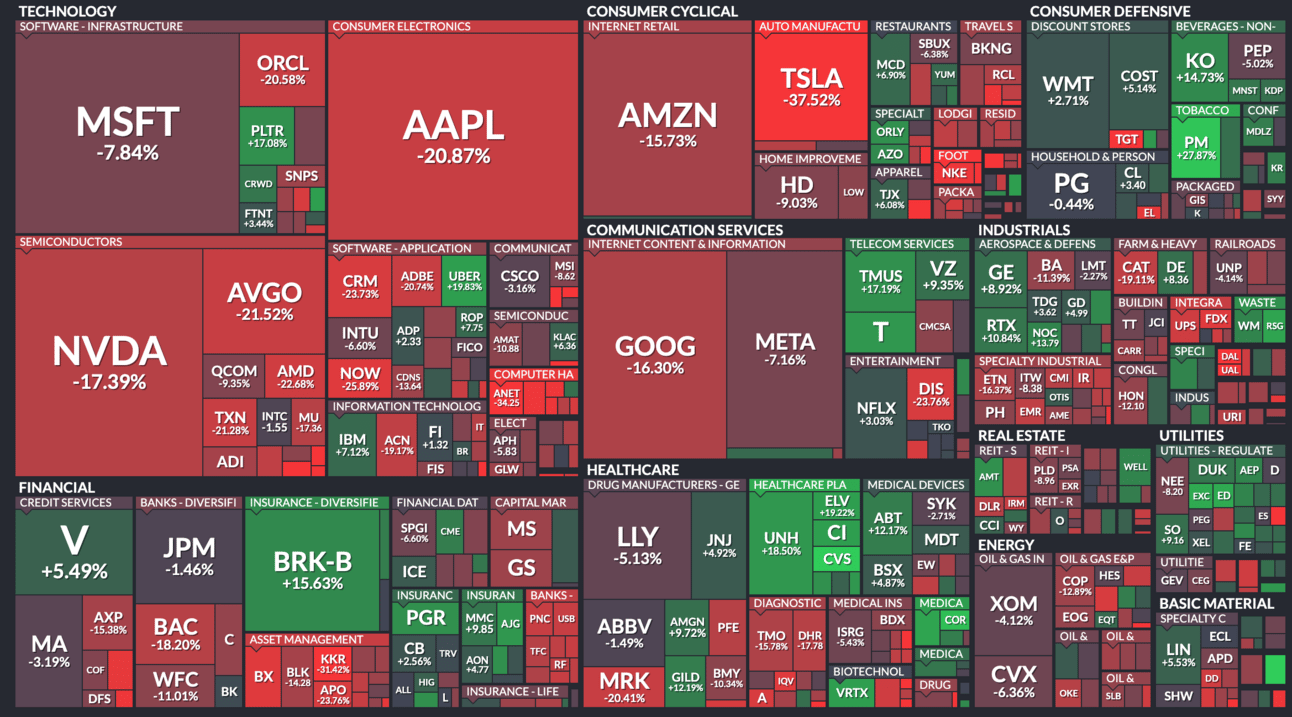

📉 Market Recap

Check out some of the biggest stories shaking up money, markets, and momentum this week.

How Big Tech firms are navigating Trump’s tariffs

Amazon expands same-day food delivery, shaking up supermarket and delivery stocks

The job market is still down, with 20-something guys seeing the worst of it

The Fed could cut interest rates in the next few months

China leading the AI market has U.S. companies and policymakers worried

S&P 500 YTD

👀 In Case You Missed It

Don’t believe you can actually save money? Check out how I save 50% of my income.

See y’all next week 🫡

- Angelo Castillo

How did you like today's newsletter? |