- New Money

- Posts

- Paradox

Paradox

Why I look poor to get rich

Happy Monday,

Hope you had a great weekend! I’m writing this from the tan beaches of Bali! The best thing about having a remote business is that this is considered a “work trip”.

Which it technically is, because I’m gonna GRIND!

Let’s get straight to business.

Today’s edition:

How Mark Zuckerberg and Warren Buffett spend their money

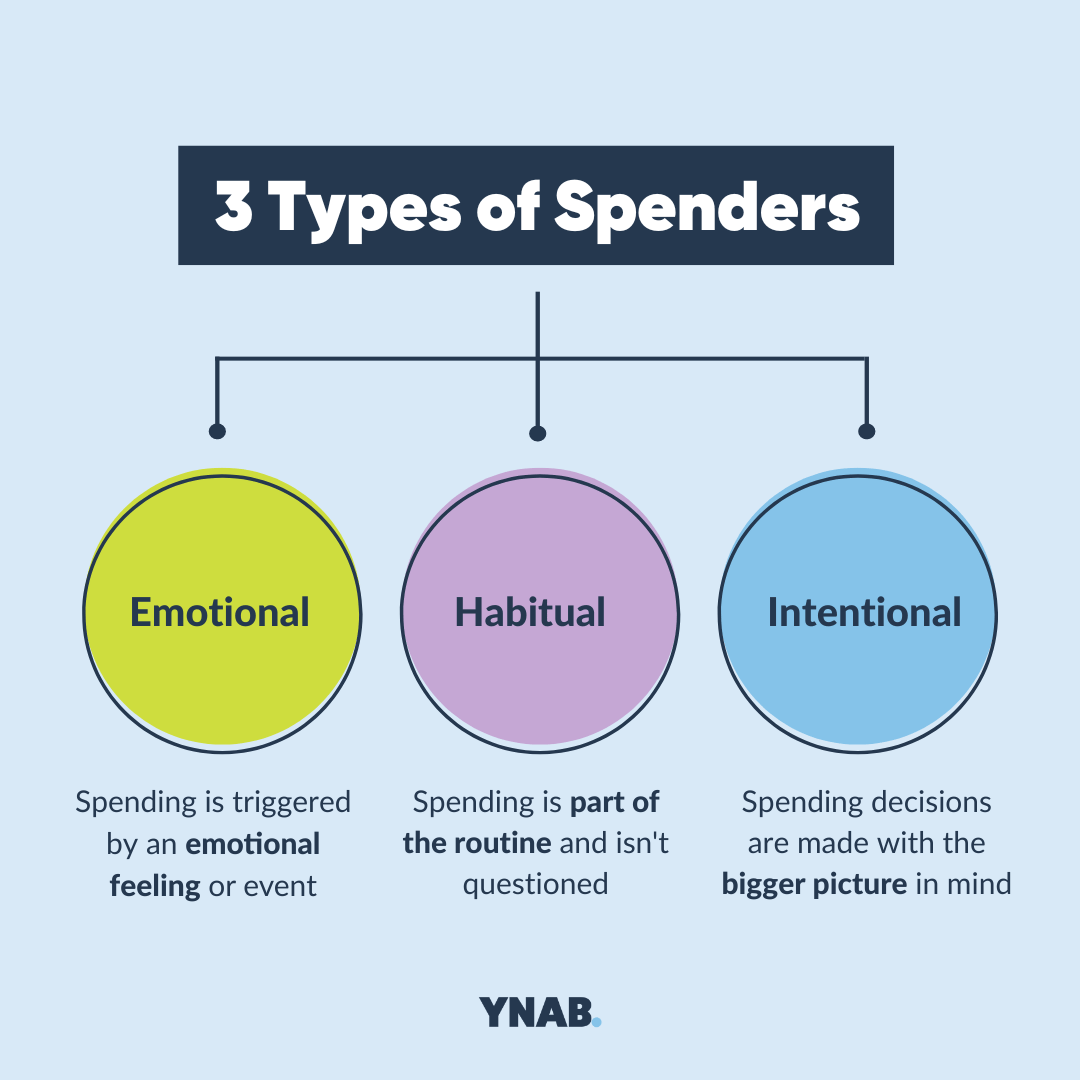

The path to stopping emotional and habitual spending

TikTok is here to stay, Disney+ will cost you, and more

Read time: 3 min 40 seconds

💰 Wealth Tip of the Week

When I got my first big paycheck, I was convinced I had to look the part.

I went out and bought brand new Rayband sunglasses and Yeezy shoes. For one day, I felt like a millionaire.

But the thrill of this lifestyle creep was gone by the next day, and I was just left with a smaller bank account and a new desire for the next "thing."

I learned a hard lesson that day, a lesson the wealthiest people on earth already understand, and I’m here to share it with you too, so you don’t have to learn it the hard way.

Wealth is about freedom, not flash

The richest people on the planet, like Mark Zuckerberg and Warren Buffett, don't live lavishly. Zuckerberg wears the same gray shirt every day, and Buffett drives a 2014 Cadillac with hail damage.

Just scroll down a Reddit rabbit hole to learn the “poor things” wealthy people still do to save money.

To them, money is a tool to build generational wealth and achieve financial freedom, not a means to acquire every new gadget.

Warren Buffet is the king of this mindset, and he uses his wealth to build a fulfilling life instead of purchasing fancy luxury items.

This is because he understands the psychology behind wealth that most people don't.

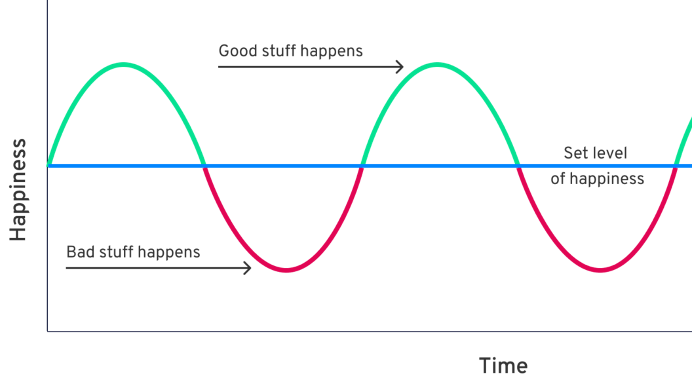

Let’s take the hedonic treadmill, for example. This is the idea that no matter what we buy or achieve, our happiness eventually returns to baseline.

When you buy that brand new iPhone, you’re over the moon. But that new phone thrill fades over time, leaving you back where you started and wanting the next model.

So the cliche saying does ring mostly true: Money can’t buy happiness.

But what your money can buy is freedom: the freedom to walk away from a job you hate, to spend time with your family, to travel.

It gives you the resources to invest in what matters to you.

Money on its own doesn’t create happiness, but when you use it to buy back your time and build a life aligned with your values, it becomes one of the most powerful tools for lasting fulfillment.

So how do you achieve this? By looking poor.

Learning to "look poor" has helped me save half my income. I’m not living lavishly, and I’m not living miserably with the bare minimum.

Instead, I’m being intentional about purchases and asking: "Will this truly improve my life long-term, or just give me a temporary happiness boost?"

This helps me avoid making emotional or habitual purchases that don’t really serve me or my goals.

Living a more frugal life today will shift your perception of money going forward. Instead of seeing it as a currency to buy things and show off, you'll see it as a tool to make more money, retire early, and live your dream life.

And intentional spending might not be as hard as you think. So let’s walk through the steps to being intentional with your money.

Your Action Plan

Define Your “Why”: The first step to living below your means is to understand your motivation. Why do you want to be rich? Is it to impress people with material possessions, or is it to achieve financial freedom and live a life without worrying about money? A clear "why" will keep you focused and help you resist the urge to overspend.

Do More With Less: Learn to fully appreciate and take advantage of what you already have. Think about your possessions in terms of their purpose. If your phone still works, you don't need a new one. If your car gets you from point A to point B, you don't need a brand-new one. If you truly need an upgrade, be realistic and buy the least of what you need to get the job done.

Automate Your Savings: It's hard to rely on willpower alone to save. Make it easy on yourself by setting up automatic transfers from your paycheck to your high-yield savings account or investment account. I call this the “dumb” investor’s strategy, and you can learn how to do it in my recent YouTube video. By doing this, you're paying your future self first, before you have a chance to spend the money.

At the end of the day, looking poor isn’t about deprivation. It’s about direction.

Every dollar you don’t spend chasing the next trend is a dollar that’s growing quietly in the background to buy back your time and your freedom.

When you shift your focus from impressing others to building a life that actually serves you, money stops being a source of stress and starts becoming your greatest tool.

So start small, stay consistent, and remember: wealth isn’t built by what you show off today.

It’s built by what you quietly stack for tomorrow.

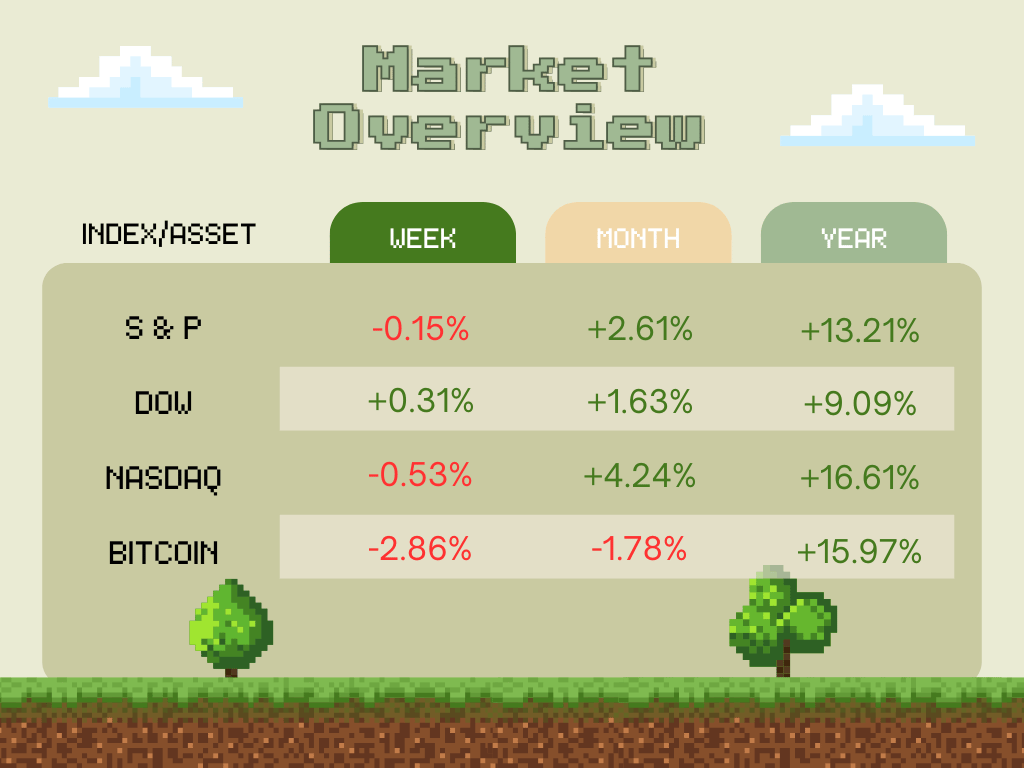

📉 Market Recap

Check out some of the biggest stories shaking up money, markets, and momentum this week.

I want your honest take! Are you enjoying the market recap? |

Market Overview

👀 In Case You Missed It

I’m breaking down exactly what I do every time I get paid to make sure my money works for me, not the other way around. Check it out:

See y’all next week 🫡

- Angelo Castillo

How did you like today's newsletter? |

Disclaimer: This is not financial advice or investment recommendations. The content is for informational purposes only, and it should not be considered as legal, tax, investment, financial, or other advice.