- New Money

- Posts

- 💸 U.S. Strikes Iran Nuclear Sites....

💸 U.S. Strikes Iran Nuclear Sites....

Happy Sunday,

Angelo here!

Soooo the US bombed Iran. Whether you agree or disagree, one thing to note is that the markets always react poorly to geopolitical news, but always short lived.

We may see some turbulence in the future, but remember we will most likely bounce back!

Today’s edition:

- Geopolitical tensions is rising fast…..

- 5 ETF’s to invest in

- Delayed gratification

Read time: 3 min 30 seconds

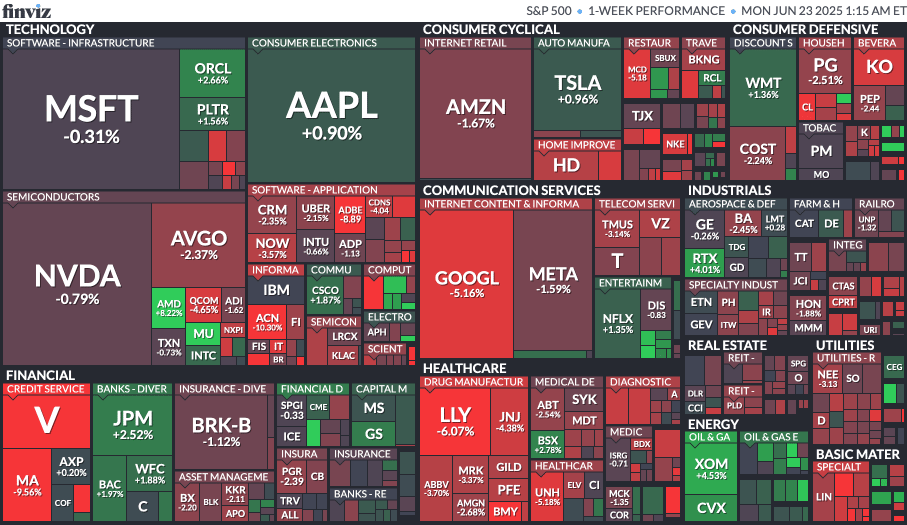

📉 Market Recap

The market was pretty choppy, and as we head into the new week everything looks down….

S&P 500: -0.6%

Nasdaq-100: -0.2%

Bitcoin: -1.4%

What happened in the last 7 days?

S&P 500 6/15 - 6/21

🧨 Geopolitical Tensions Flare (Again)

Over the weekend, Trump tweeted that the U.S. launched strikes on three nuclear sites in Iran.

This is adding to the already shaly tension in the middle east, putting us in the continentela spotlight.

This hasn’t hit markets yet since it happened outside trading hours — but expect volatility if it escalates.

As of now stock futures are sliding down, as oil is up. We will see if there is a more drastic drop on monday.

Oil prices moved higher, but stocks surprisingly held steady for now.

Geopolitical news always send the market tumbling, but are historically short lived. I for one, is just praying that this dies down quick and no more bloodshed occurs,

🏦 Fed Holds — But the Clock’s Ticking

The Fed kept rates at 4.25%–4.5% for the fourth straight meeting.

Officials expect higher inflation through summer, but also weaker growth and rising unemployment.

Most still project two rate cuts before year-end, but the internal split is growing.

Markets are pricing in cuts — but not fully convinced they’re coming anytime soon.

🚀 Big Movers: Reddit, Circle, Oscar

Circle ($CRCL)

The stablecoin issuer exploded +675% since its IPO earlier this month.

Now worth over $20B — one of the hottest new crypto stocks out.

I wasn’t able to invest in it, but mannnnnnnn the fomo is kicking in! (jk)

Reddit ($RDDT)

Stock jumped 25% after announcing new AI-powered ad tools.

Early tests show AI ads are outperforming standard ones — and investors are betting on future ad revenue.

Oscar Health ($OSCR)

Surged +53% this week

Got swept up in social media hype and is now being labeled the “next meme stock.”

The fundamentals are strong and hopefully will keep climbing!

🤖 AI Arms Race Heats Up

Meta’s building a monster AI team.

They just hired Scale AI’s founder, GitHub’s ex-CEO, and investor Daniel Gross.

Meta stock is up +7.4% this month and +38% YTD.

Zuckerberg is betting big — aiming to compete directly with OpenAI and Anthropic.

Everyone’s racing to lock down top AI talent and infrastructure before the next wave hits.

PS. if you haven’t checked out Cluely, they are making waves in the AI start up space, as well as marketing…

💰 Wealth Tip of the Week

The best piece of advice I ever received about investing was:

“Keep it simple, stupid.”

And that’s exactly what I’ve done.

50–75% of my entire portfolio is in ETFs — because they simplify investing, reduce stress, and still deliver strong long-term returns.

If you’re new to investing, this is where I’d start.

An ETF (Exchange-Traded Fund) is basically a basket of stocks.

Instead of betting on one company, you’re spreading your money across dozens (or even hundreds) — instantly.

It’s how I got started. And it’s still how I invest today.

Here are 5 ETFs I personally like and why (not financial advice):

1️⃣ VOO – S&P 500 ETF

Tracks the top 500 companies in the U.S. — including Apple, Microsoft, Amazon, and Nvidia.

Tracks: S&P 500

Historical return: ~10% annually

Expense ratio: 0.03%

Great for: Stability, steady growth, and a solid foundation

Why I like it: It’s the backbone of my portfolio. You’re betting on the U.S. economy long term.

2️⃣ VTI – Total U.S. Stock Market ETF

Covers the entire U.S. market — large, mid, and small-cap stocks (over 4,000 companies).

Tracks: CRSP U.S. Total Market Index

Historical return: ~10% annually

Expense ratio: 0.03%

Great for: Diversification across the whole U.S. economy

Why I like it: Owns nearly every public U.S. company in one ETF — a full-market “set it and forget it” option.

3️⃣ QQQM – Nasdaq-100 ETF (Tech & Growth)

Focuses on the 100 largest non-financial companies in tech-heavy sectors like software, AI, and semiconductors.

Tracks: Nasdaq-100

Historical return: Over 40% in 2023

Expense ratio: 0.15% (lower than QQQ’s 0.20%)

Great for: Long-term growth and innovation exposure

Why I like it: Lets me ride the tech wave without picking individual stocks.

4️⃣ GLD – SPDR Gold Shares ETF

Gives you exposure to physical gold without needing to store it yourself.

Tracks: Physical gold held in bank vaults

Historical return: ~8% annualized since 2000

Expense ratio: 0.40%

Great for: Hedging against inflation and market volatility

Why I like it: Gold tends to hold up when everything else crashes. I don’t overweight it, but I like having a slice.

5️⃣ SCHD – Schwab U.S. Dividend Equity ETF

Focuses on companies with strong balance sheets and consistent dividend payouts.

Tracks: Dow Jones U.S. Dividend 100 Index

Dividend yield: 3.5%–4%

Expense ratio: 0.06%

Great for: Passive income and long-term compounding

Why I like it: You get paid just for holding it. I reinvest the dividends to buy more shares automatically.

✅ These ETFs give you exposure to:

Large-cap U.S. companies (VOO)

Full U.S. market (VTI)

Tech and innovation (QQQM)

Safe-haven asset (GLD)

Passive income/dividends (SCHD)

You don’t need all 5.

I started with just VOO, and it was more than enough to get my money growing.

Start simple. Stay consistent. Let time do the heavy lifting.

Not financial advice!!!

🧵 Thread of the Week

Delayed gratification has been my driving factor to my “success”.

Grinding on my business without making any money in the first year…

Investing everyday even though I was broke and was constantly losing money…

Delayed gratification is key.

See y’all next week 🫡

- Angelo Castillo

PS. I want to make newsletter the best newsletter possible. If you have any suggestions, constructive criticism please let me know! Fill out this form here.