- New Money

- Posts

- My secret

My secret

This is what the 1% do with their money

Happy Monday!

Had a wonderful time presenting at Fincon this weekend!

Got a chance to explore Portland, network with some crazy successful entrepreneur and really just catch up with old friends :)

It’s time like this where I can’t help but feel incredibly grateful that I started posting on social media 5 years ago.

God bless the hustle.

Today’s edition:

The budgeting framework you won’t hate

How to reach $100k the smartest way

GameStop + bitcoin, new iPhone prices, and more

Read time: 3 min 10 seconds

💰 Wealth Tip of the Week

I used to think building financial freedom meant saying goodbye to coffee, movie nights, and basically everything that makes life worth living.

But I was wrong.

You can build financial security without gutting your life along the way.

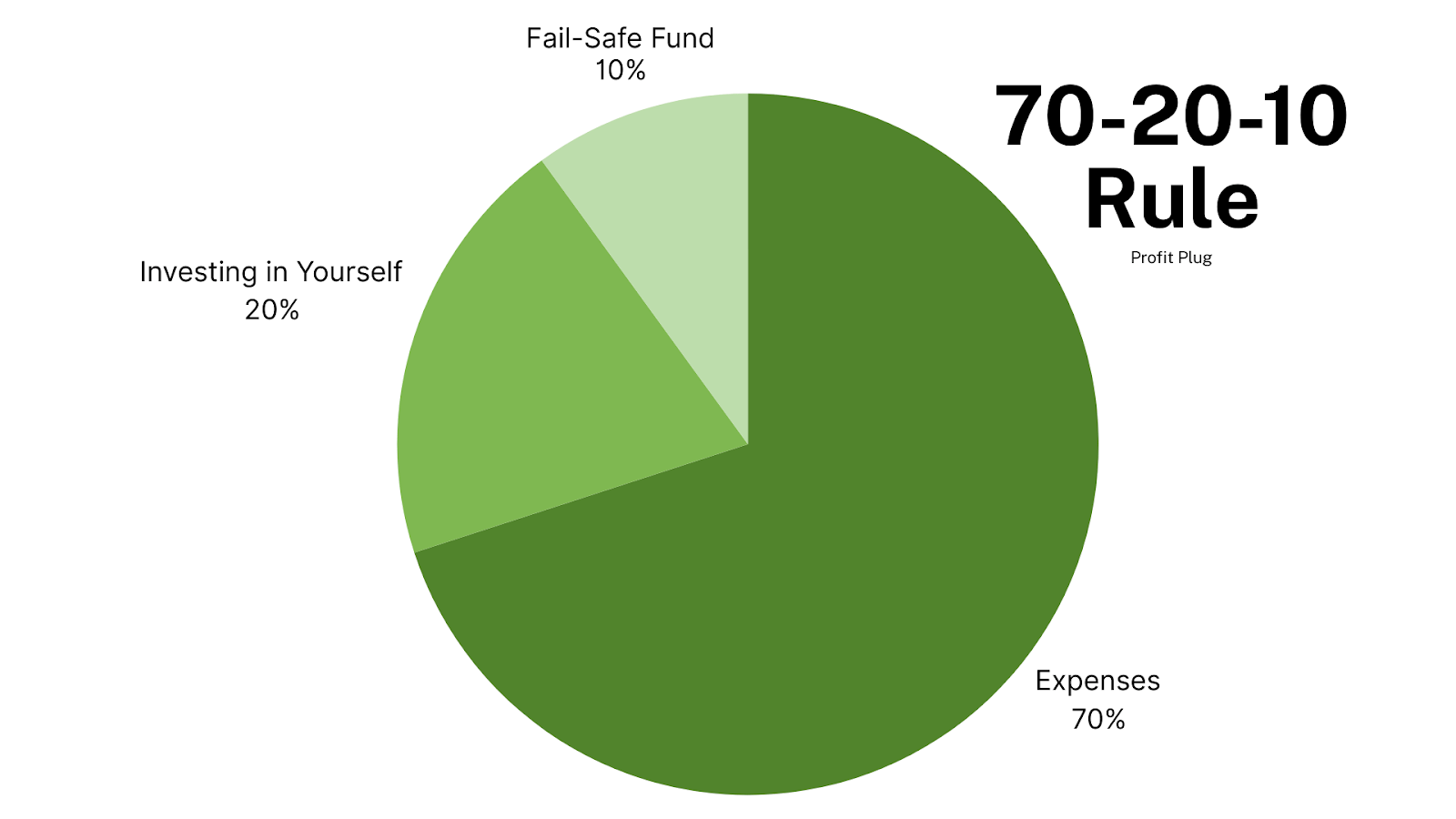

The game-changer has been the 70-20-10 rule: a realistic budget used by the top 1% that acknowledges we're humans, not financial robots.

Here’s how it works:

The 70-20-10 Rule

70%: Living Expenses + Lifestyle

70% of your income goes toward your everyday life, like housing, groceries, bills, and yes, the fun stuff like eating out or Netflix.

Instead of suggesting you cut expenses to the bone, this approach gives you enough breathing room to cover your living expenses and still have enough left over for purchases you enjoy.

It's like following a sustainable diet instead of crash-dieting. You're in this for the long haul, not just a miserable month.

Before spending, ask: Does this bring value or enjoyment, or could that money serve me better elsewhere?

You’re not saying no to everything. You’re just choosing what actually matters to you.

20%: Investing for Future You

This is the wealth-building section. 20% of your income goes into investments that compound over time.

Think retirement accounts like your 401k or Roth IRA and regular taxable brokerage accounts where you put your money in the stock market and simply let it grow.

You can also invest in yourself through skill-building, like courses, certifications, or tools that increase your earning power (and therefore your investing power), and that will pay dividends forever.

10%: Your Fail-Safe Fund

The 10% bucket is your emergency fund for when life gets messy. Aim for 3–6 months of living expenses in case your car breaks down, you’ve got an unexpected medical bill, and so on.

I’m telling you: There's something incredibly powerful about knowing you'll be okay if life throws you a curveball.

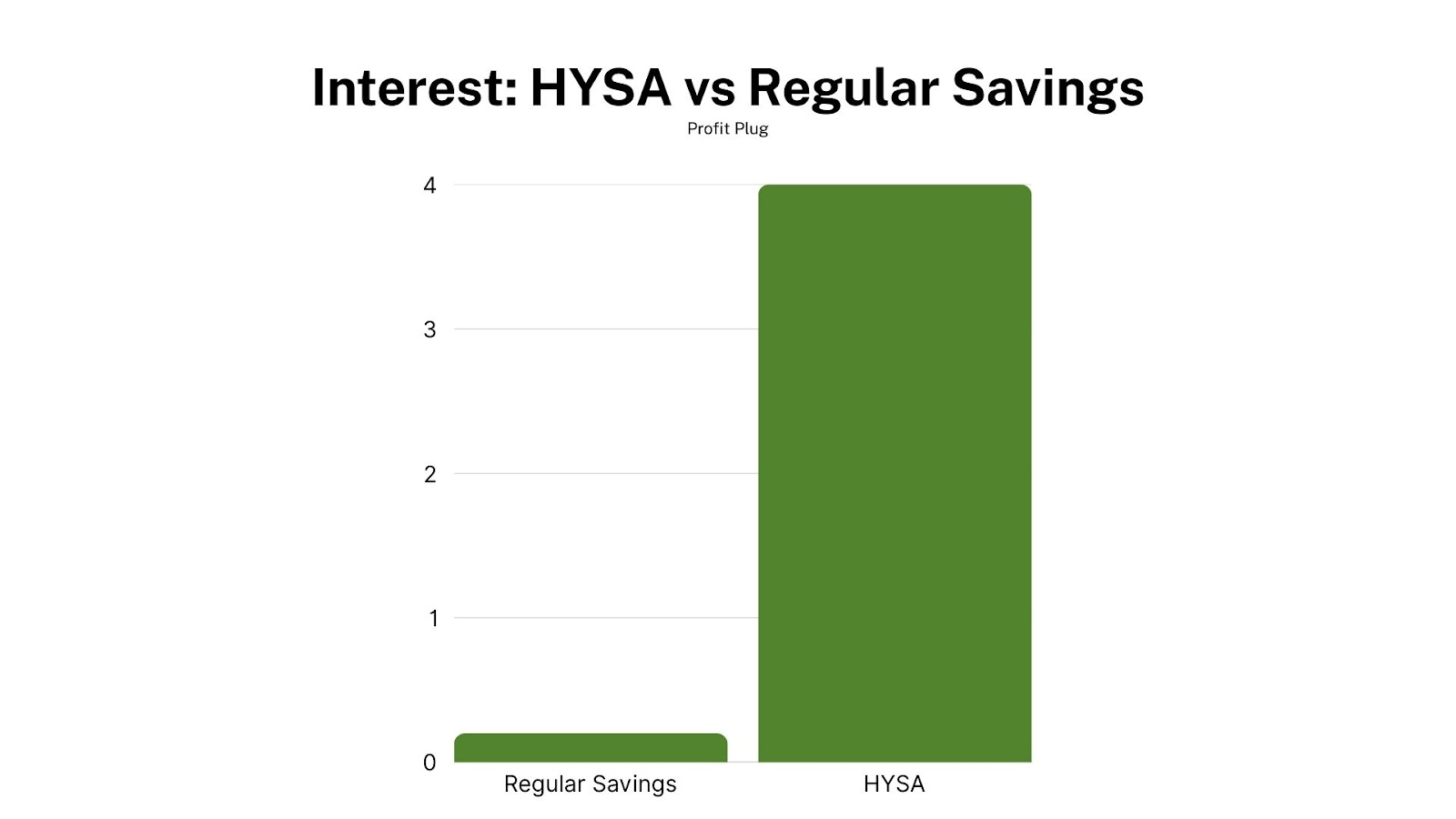

The secret here is to put your emergency fund in a high-yield savings account (HYSA) earning 4–5%, not a traditional savings account paying pennies.

You can compare the top HYSA accounts here.

Remember that the 70-20-10 rule is just a baseline. Always aim to lower your expenses and increase your investments wherever you can.

Your Action Plan

Here are the three simple steps to put the 70-20-10 rule into action and take control of your finances.

Track Your Spending: Before you can adjust, you need to know where your money is going. Use a budgeting app or just a simple spreadsheet to review your last month's bank and credit card statements. Track where your money is going to understand your spending habits.

Determine Your Spending and Savings Targets: Once you know your current numbers, you can set your goals. For example, if you make $5,000 a month, your targets are:

$3,500 (70%) for living expenses and lifestyle.

$1,000 (20%) for investments.

$500 (10%) for your emergency fund.

Use this to check where you're currently over or under your target percentages and make adjustments as needed.

Automate Your Financial Future: This is the most important step because it removes the temptation to spend money you've earmarked for savings and investments. Set up automatic transfers from your checking account to your investment accounts and your HYSA. You can set these transfers to happen on payday so the money is moved before you even have a chance to spend it.

Building financial security doesn't have to mean a life of deprivation.

It can simply mean being intentional with your money so you can build the life you want, both today and in the future.

The 70-20-10 rule is your roadmap. Start small, automate your finances, and watch your future self thank you.

Beyond the 70-20-10

The 70-20-10 rule is a great starting point for anyone looking to gain control of their finances.

But once you've mastered it, you can level up to a strategy I personally use: reverse budgeting.

Instead of calculating your spending first, reverse budgeting flips the script.

You decide how much you want to save or invest each month first, and then you can spend the rest guilt-free. For me, I save and invest at least 50% of my income every month, and once that's done, the remaining 50% is mine to spend however I want, without having to track every single purchase.

This method puts your wealth-building goals first and removes the stress of micromanaging your day-to-day spending. It's the ultimate form of financial freedom because you've already secured your future.

To learn more about how I save 50% of my income, check out my recent YouTube video here!

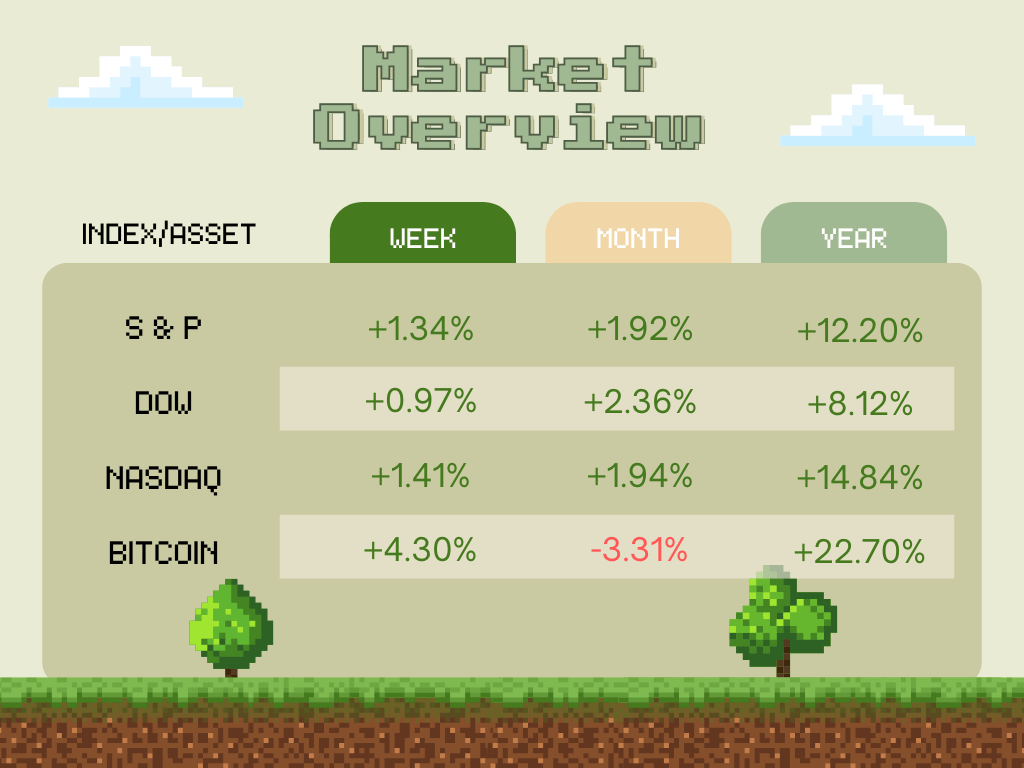

📉 Market Recap

Check out some of the biggest stories shaking up money, markets, and momentum this week.

Market Overview

👀 In Case You Missed It

Now that you’ve got your budget locked down, let’s level up your investing game with my proven strategies to reach $100k.

See y’all next week 🫡

- Angelo Castillo

How did you like today's newsletter? |

Disclaimer: This is not financial advice. The content is for informational purposes only, and it should not be considered as legal, tax, investment, financial, or other advice.