- New Money

- Posts

- My portfolio

My portfolio

How i'm multiplying my money with compound interest (copy me)

Happy Tuesday,

Hello friends! The past week I was busying spending time with my father at the US open. As I grow older, the more I cherish these moments, so I appreciate the patience if you were waiting for today’s newsletter.

Let’s get straight to it.

Today’s edition:

Inside look into my investment portfolio (what I recently bought)

The exact steps you need to invest your first $1

The end of Amazon account sharing, the Powerball jackpot, and more

Read time: 4 min 10 seconds

💰 Wealth Tip of the Week

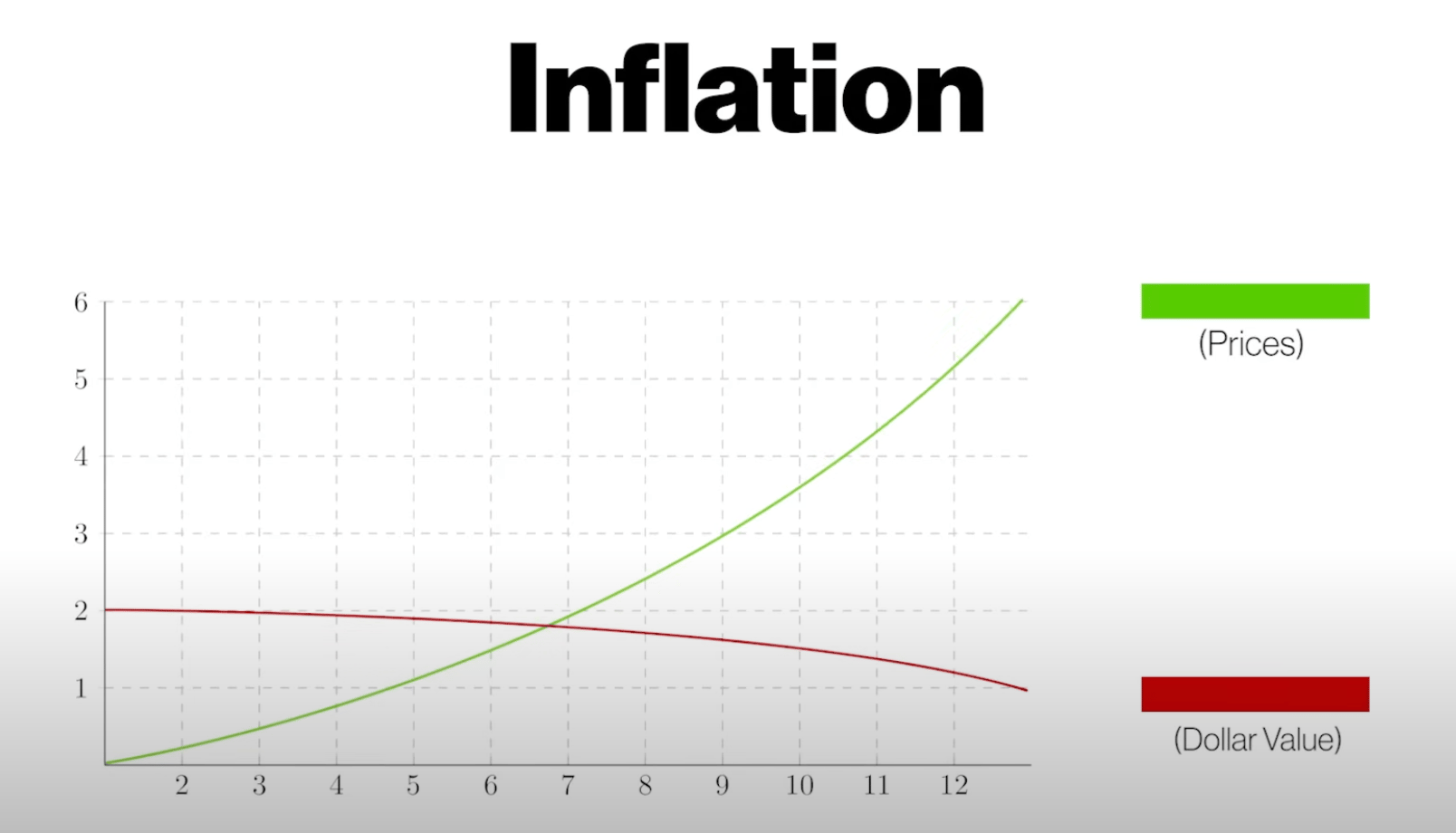

Your $1,000 today will be worth $740 in 10 years.

Not because you spent it.

But because you did nothing with it.

Let’s break it down.

A few years ago, your Chipotle bowl cost you around $7. Now it's $14.

That’s the result of inflation, AKA when the price of items goes up and the purchasing power of your money goes down over time.

And it’s not just your Chipotle bowl. It’s your rent, your groceries, your gas.

Everything costs more while your savings account is still earning 0.01%.

But the secret to beating inflation? Investing.

What To Invest In

So you know you should invest, but there are a lot of different investment options to choose from.

Let’s walk through the main players you’ll hear about when it comes to what to invest in:

Individual Stocks

It’s exactly what it sounds like. You own shares of one specific company (like Apple or Tesla). You’re betting on a single business, so it’s high risk but can also be high reward.

ETFs (Exchange-Traded Funds)

ETFs are bundles of a bunch of stocks that you can buy and sell like a single stock. They’re diversified across different industries (which spreads out your risk) and usually lower cost, which makes them a super great option for long-term, passive investing.

EX: $VOO ( ▲ 0.71% ) $QQQM ( ▲ 0.87% ) $ARKK ( ▼ 1.04% )

Mutual Funds

Mutual funds are similar to ETFs, but with a few key differences. Mutual funds don’t trade instantly on the stock market, so you buy or sell at the end-of-day price. They may also come with minimum buy-in amounts or higher fees.

Check out NerdWallet’s comparison if you want to learn more about the differences between ETFs and mutual funds.

EX: $FXIAX $VTSAX

Bonds

With bonds, you’re basically loaning your money to a company or government. In return, they pay you interest over time and then repay the full amount at the end. They’re lower risk than stocks but also generally offer lower returns, which makes them good for stability in your portfolio, especially as you get closer to your retirement age.

How to Invest

Here’s how to actually get started:

Open Your Account

Open a brokerage account. I use Webull, but you can also use Fidelity, Vanguard, Schwab, or any other trusted, SIPC-insured platform. The important part is simply having a place where your money can grow instead of sitting.Set Up Automatic Deposits

Decide on an amount you won’t miss. It could be $50 a month, $200 a month, or whatever works for your budget. Then set up an automatic transfer from your checking account into your brokerage account. This way, your money moves to your investment account without you having to think about it.

Choose Your Investment

Pick where your money will go after it lands in your account. For most people, a simple option like an S&P 500 ETF (such as VOO or QQQM) does the trick. Your strategy will depend on your age, your risk tolerance, and your goals, but Investopedia offers a solid framework for investing at every age.

Automate Your Buys

Inside your brokerage, set up recurring investments. This means your money automatically buys into your chosen fund every week or month, and it’s arguably the most important step of all because this is where your money will be put to work with compound interest (which Einstein himself called the eighth wonder of the world).Let Time Do Its Work

Once it’s set up, leave it alone. Don’t obsess over daily market swings or try to outsmart the system. The real power comes from letting compound growth build over years (not weeks or months).

(none of this is financial advice! do your own due diligence!)

Why This Matters

If your money isn’t growing, it’s shrinking.

The difference between letting $1,000 sit and putting $1,000 to work right now could mean tens of thousands of dollars down the line.

And the best part is you don’t need to be glued to the stock market or have a finance degree to start.

With automation, your money can grow quietly in the background while you live your life.

So don’t overthink it. Open the account. Set up your deposits. Pick your investment. And then let time do its job.

The sooner you start, the less you’ll need to do later because your money will already be working for you.

So start today, and future you will be so glad you did.

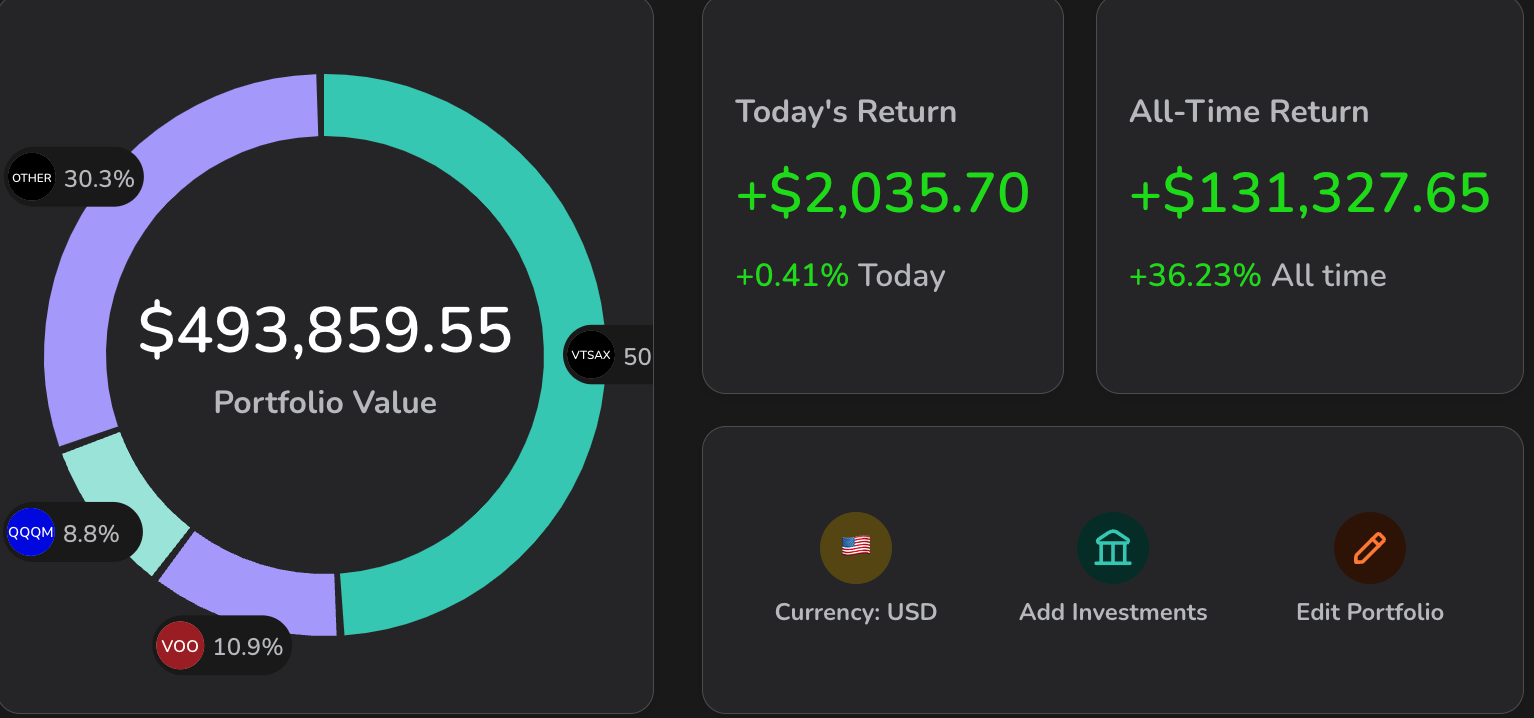

📊 Monthly Portfolio Review

Angelo’s monthly portfolio review - Sept 2025

The market has been wild, but in a good way.

I continued to add to my regular ETFs but also added a couple of positions (get notified exactly when for free here)

I added:

$MU ( ▲ 2.59% ) , $CRWD ( ▼ 7.95% ) and $V ( ▲ 0.63% )

I strongly believe in tech and ai, but also I added Visa for that slow dividend compound machine for more diversification.

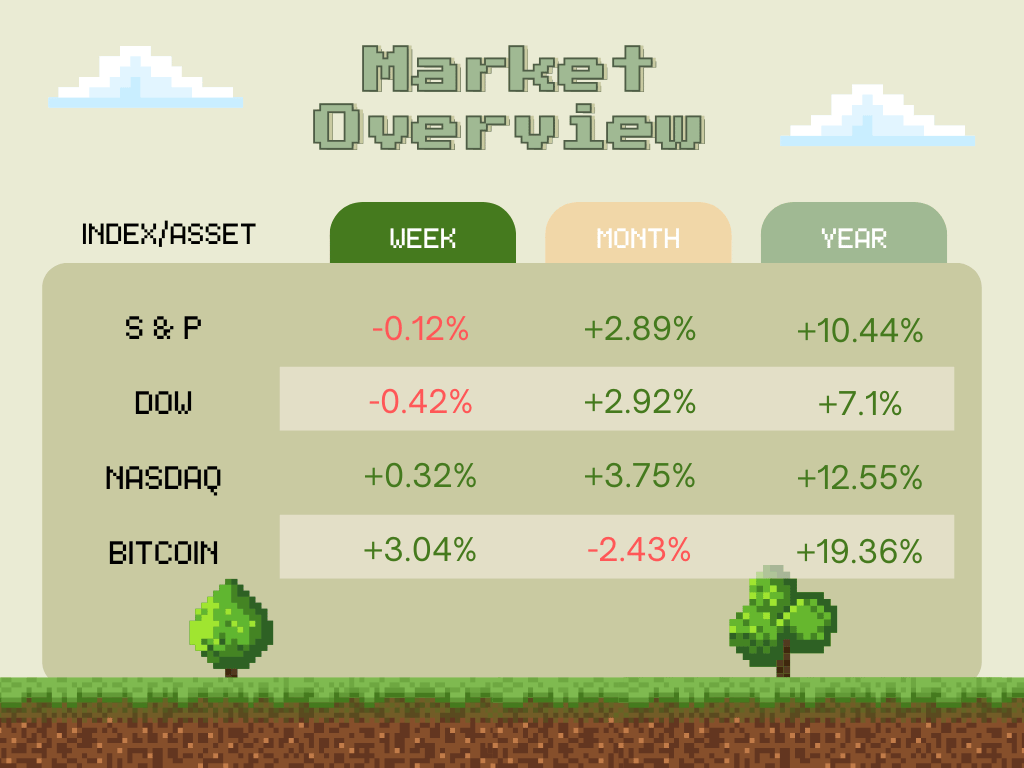

📉 Market Recap

Check out some of the biggest stories shaking up money, markets, and momentum this week.

Amazon is cracking down on account-sharing outside your household

The Powerball Jackpot hits $1.8 million—and even with 1 in 292.2 million odds, Americans are buying in

Trump asks the Supreme Court to reconsider the ruling on his tariffs

Google avoids a breakup with Chrome and Alphabet stock booms

👀 In Case You Missed It

I’m breaking down the lessons I’ve learned investing $400,000+ to give you the info I wish I had when I started!

See y’all next week 🫡

- Angelo Castillo

How did you like today's newsletter? |