- New Money

- Posts

- Markets rallied, First $10K and designer brands

Markets rallied, First $10K and designer brands

it's never what it seems....

Happy Sunday,

Angelo here!

WE FINALLY GOT MONETIZED ON YOUTUBE BABY 🎉

After a long, hard year, I finally got a video to pop and gain almost 60K views + 4,000 watch time hours to unlock that monetization status!

Still a long way to go with my YouTube journey, but I am just glad to be here!

Alright, enough about me patting myself on the back (thank you guys tho fr)

Let’s break everything down. Today’s edition:

- Market’s longest winning streak since 2004

- Why your first $10K is more important than $1M

- Why designer brands burn their clothes

Read time: 4 min 20 seconds

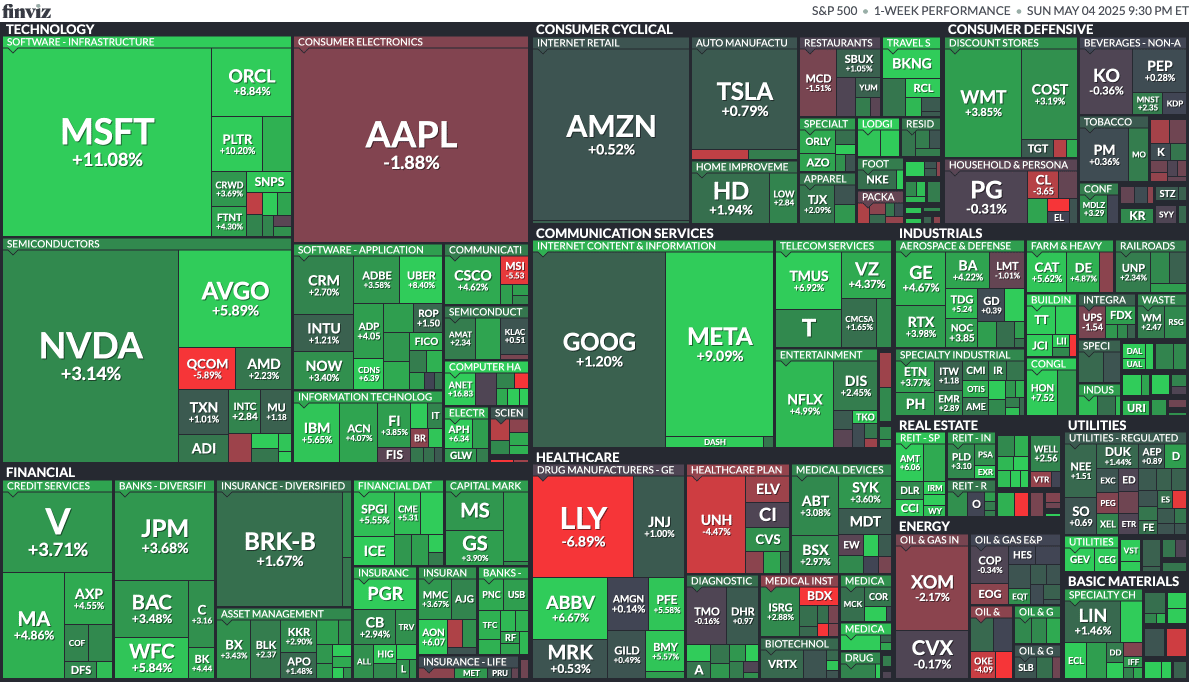

📉 Market Recap

The markets stayed on 🔥 this week.

The S&P 500 notched a 9-day winning streak (the longest since 2004) and officially erased all the losses from the “liberation day” sell-off.

S&P 500: +4.6%

Nasdaq-100: +6.7%

S&P 500 last week

Sooooooo what’s driving the rally?

Here’s a quick breakdown:

However, they did announce a massive $100B buyback + dividend boost, which is cool, I guess….

But in my opinion, Apple is going to have to really start innovating again if it wants to keep its crown.

One thing flying under the radar? GDP just shrank.

Q1 GDP fell by 0.3% (first contraction in 2 years)

Why that matters:

1 quarter of decline = 🚩 yellow flag

2 in a row = 📉 official recession

On the bright side: Consumers are still spending (up 0.7%), holding the economy steady, for now.

In bittersweet news, Warren Buffett announces his retirement

It’s official: Greg Abel has been named Warren Buffett’s successor at Berkshire Hathaway.

Buffett, 94, is stepping back after building one of the greatest investing track records of all time:

📈 Turned a struggling textile company into a $900B+ empire

💰 Delivered 20%+ annual returns for over 50 years

🏆 Held legendary investments like Coca-Cola, Apple, American Express, and Geico

📚 Became a global symbol of long-term, patient investing

Buffett’s philosophy was simple but powerful:

“Be fearful when others are greedy, and greedy when others are fearful.”

Jersey in the rafters, what an absolute legend 👑.

If you haven’t read his legendary letters to shareholders, now’s a good time.

💰 Wealth Tip of the Week

One of the best tips I ever got? 👇

Forget the million….focus on your first $10K.

I didn’t get it at first… but trust me, once you hit it, you’ll understand.

Here’s why:

1. It’s a mental unlock.

Before $10K, money feels out of reach.

After $10K? $50K, $100K… they actually start to feel possible.

You prove to yourself that you can do it.

That new sense of autonomy and self-efficacy makes all the difference and will expedite your journey 10x.

It’s a common phenomenon in psychology that has been studied and tested time after time.

The same applies to wealth creation

2. It creates momentum.

Your first $10K? Takes the longest.

But after that, compounding starts working for you.

Example:

Saving $1K/year at 10% return = ~8 years to reach $10K

The next $10K? Only 4.7 years

Then 3.3 years… then 2.2 years

Your money builds on itself—each $10K gets faster.

The same logic goes to your first 100K and first 1M 👀

3. It’s your safety net.

Most emergencies can be handled with $10K.

A blown transmission, a surprise medical bill, or job loss won’t wreck you.

Stats show nearly 44% of Americans can’t cover a $1,000 emergency.

Having $10K? That puts you in the top tier of financial preparedness.

Plus, that buffer gives you peace of mind—and frees up your energy to focus on making moves.

💡 Bottom line:

Your first $10K is the hardest… but once you hit it?

It’s game over. You’re officially in the wealth-building club.

🧵 Thread of the Week

I have designer clothes with a passion.

First of all they are all made in the same factory in China for 1000x less than what they sell them for.

Second, their “value” is 100% fabricated by psychological strategies, marketing tricks, campaigns, and blackhat tactics like this to make their brand seem more “premium”.

This thread goes deep into one of the many practices they do: They burn their clothes.

They would rather destroy their inventory and lose that money than ever donate or have their clothes end up in Marshalls.

From a business standpoint, I get it.

From a regular dude who has seen too many people struggle to put clothes on their back, this just seems like an utter waste.

What do you think?

See y’all next week 🫡

- Angelo Castillo

PS. I want to make newsletter the best newsletter possible. If you have any suggestions, constructive criticism please let me know! Fill out this form here.