- New Money

- Posts

- It’s expensive being cheap

It’s expensive being cheap

I thought I was saving money...

Happy Sunday,

Hello from Thailand! If you don’t follow me on IG, I booked a last-minute flight to Thailand with the boys (for 60k points only) and will be here for the next 10 days.

If you have any recommendations, reply and let me know!

Today’s edition:

The 3 money mistakes keeping you broke (and how to fix them)

How to build your credit score fast

Trump’s new plan for retirement accounts

Read time: 5 min 10 seconds

💰 Wealth Tip of the Week

Being smart made me broke.

I followed all the “good” advice: I bought frozen food from Walmart or hot dogs from Costco to save on groceries. I put my savings in a bank account. And cut back wherever I could if that meant saving money.

Turns out, those choices were way more expensive than I thought.

I learned the hard way, so you don’t have to.

Let’s walk through the 3 money mistakes that keep you broke (and how to avoid them) before they cost you a million-dollar future.

Mistake #1: Cheaping Out on Your Health

I used to have terrible health habits, all in the name of saving money. I’d eat the cheapest food possible, cancel my “expensive” gym membership, and overall sacrifice my health to save a few bucks.

I thought I was being smart, but I was actually setting myself up for financial disaster.

Think about it.

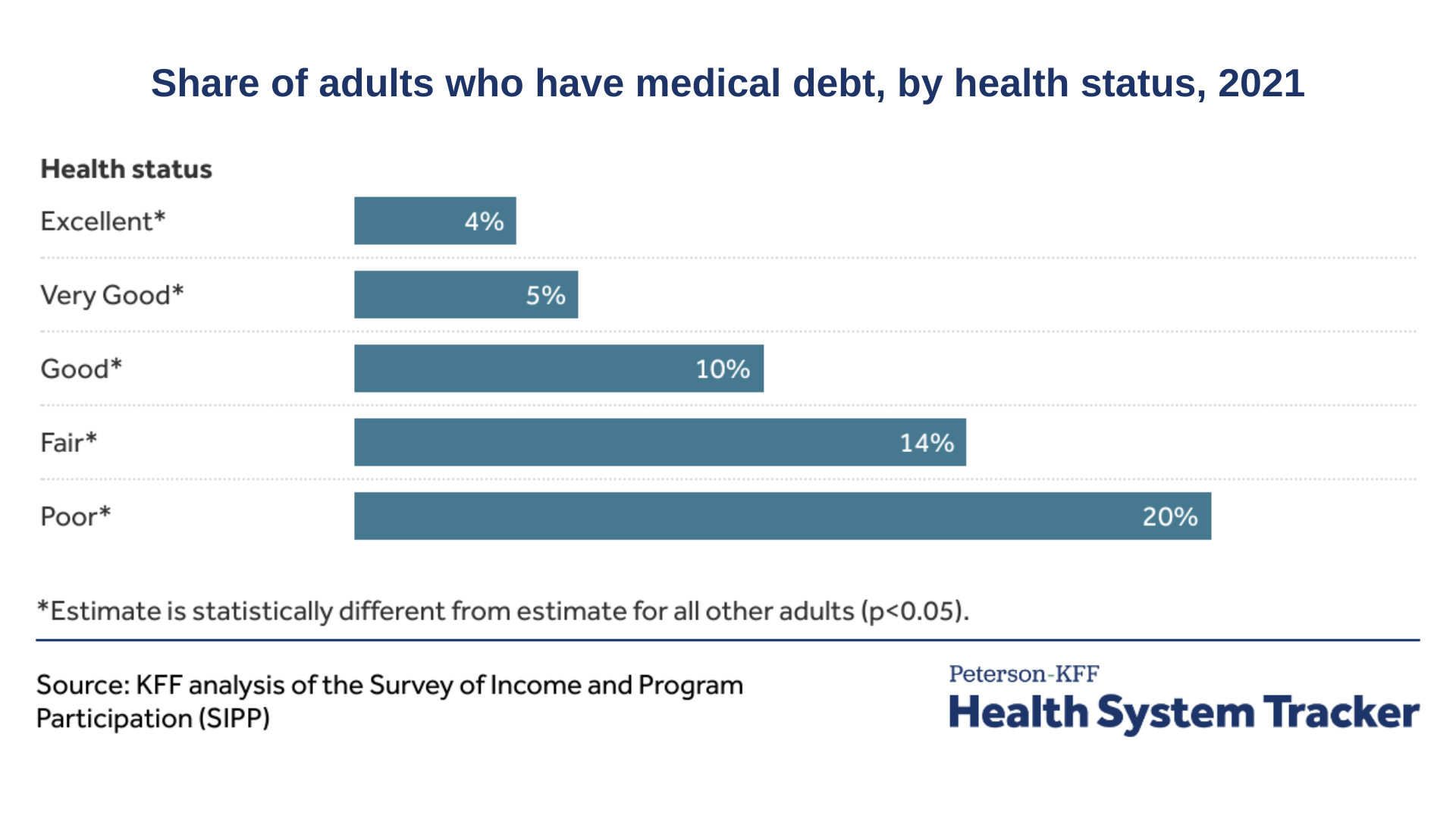

The medical bills from being out of shape could cost you $50,000+ over your lifetime.

That $50/month gym membership? Worth every single penny.

Prevention costs hundreds. Treatment costs thousands.

You can even see the breakdown from Health System Tracker.

But here's what really matters: when you invest in your health, you think clearer, feel better, and live longer.

True wealth is wealth.

What’s the point in having money if you’re too broken down to enjoy it with the people you love?

Which brings us to the next trap…

Mistake #2: Buying a Car You Can't Afford

Look, I know a new car can be exciting.

I’ve had friends who bought brand-new cars thinking it would make them look cooler, help them impress people, maybe even land a girlfriend.

But all it actually got them was a giant monthly bill—and a car that loses value the second it leaves the lot.

Because here's what nobody tells you about cars:

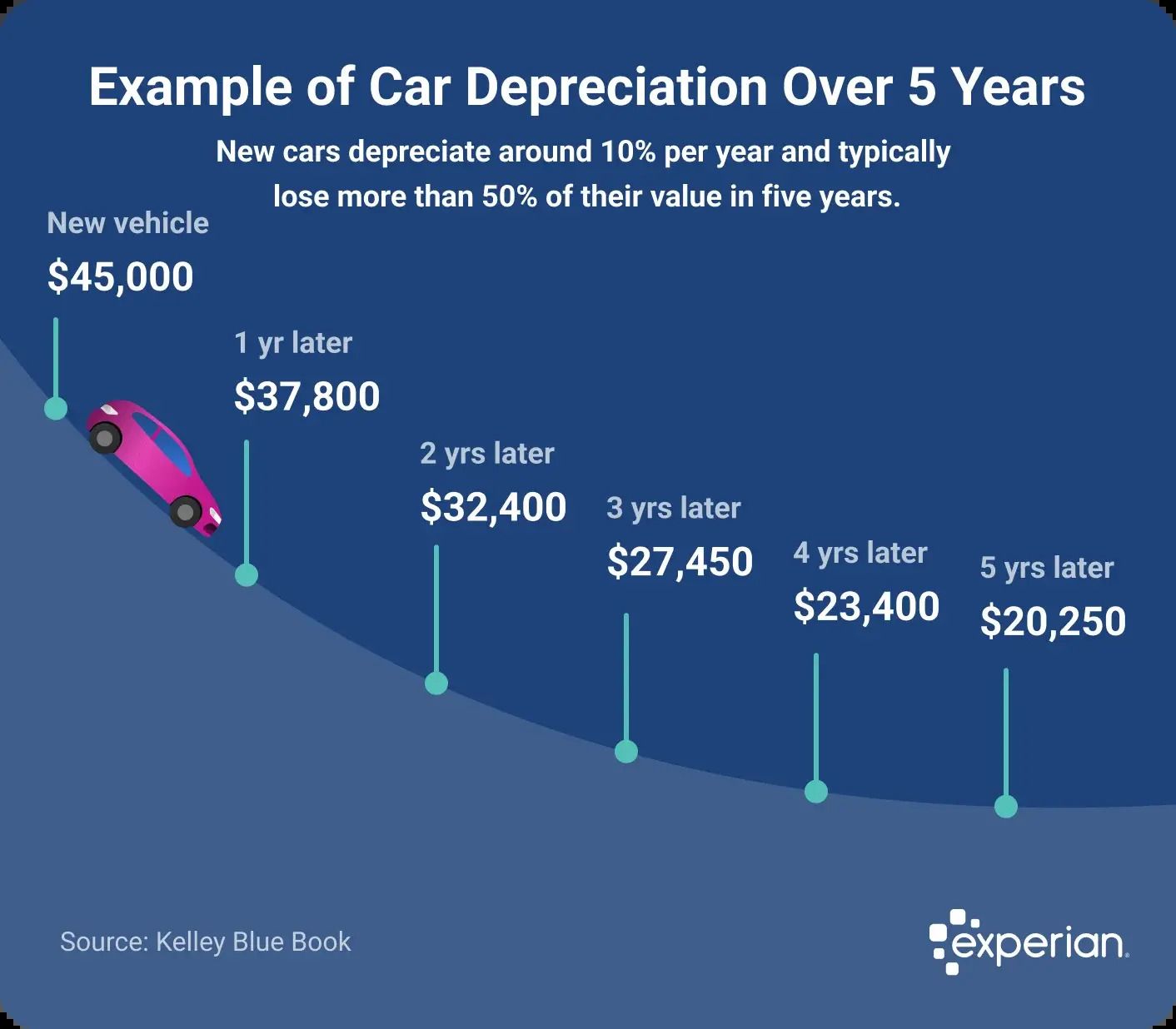

New cars lose about 45% of their value in 5 years.

Need proof? Check it out at Experian

Car Depreciation Over 5 Years - Experian, Kelley Blue Book

Now, let’s get into what you’re losing by buying that new shiny car:

Experian shows the average car payment is $745/month for new, $521 for used.

That’s nearly $9,000 a year—just to own something that’s worth less every month.

Worse than that, it keeps you trapped, paying off a loan for a luxury item that does nothing to build your future.

Because here's the real cost: you could miss out on hundreds (if not millions) of dollars by not investing that money instead.

Mistake #3: Waiting to Invest

A lot of people think investing is something you do later—when you make more, when you’re older, when life settles down.

You tell yourself you’ll just put your money into a savings account until you’re ready to invest.

But the truth is, time is your biggest advantage.

Here’s how compound interest works in your favor:

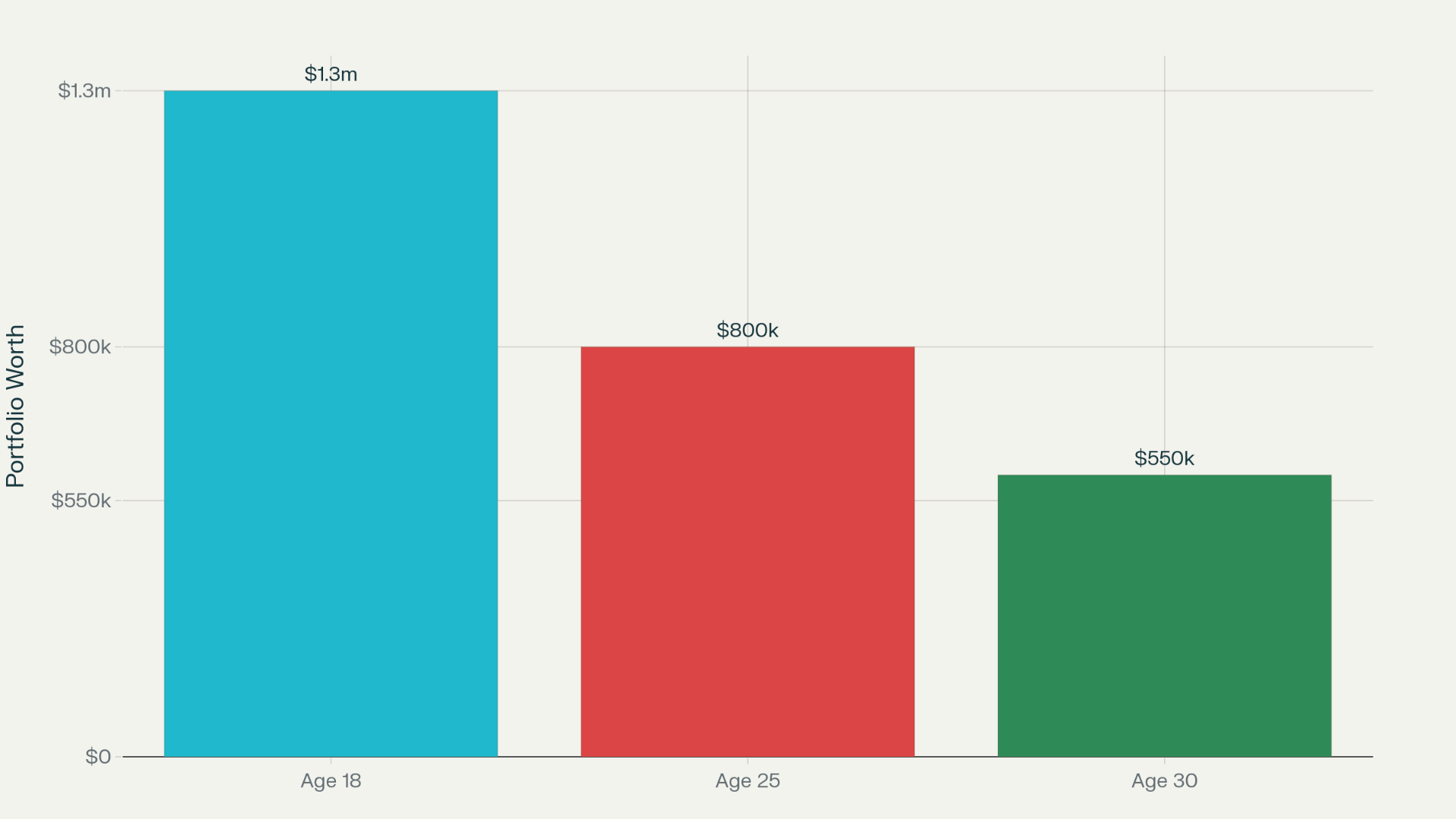

Let’s say you start investing at 18. You invest $250/month at 8%. That investment strategy will get you $1.3 million by age 60.

Wait until 25 to invest that same $250/month? You’ll have $800k at 60.

And if you wait until you’re 30, you’ll end up with $550k.

That’s a $750,000 difference—a quarter of a million dollars gone without spending a dime.

Most people spend years earning money but never put that money to work. And that’s what keeps them stuck: saving hard, working harder, but never actually building freedom.

Don’t just stash your money. Invest it—and let time do the heavy lifting.

The Bottom Line

You're not broke because you don't make enough.

You're broke because of the traps society has caught you in.

But every mistake can be reversed.

Every habit can be rebuilt.

Every dollar saved can be reinvested.

You just need a plan, a little discipline, and time on your side.

So start now. Your future self will thank you.

Your Action Plan (Pick One)

Don't fix everything at once. Choose ONE battle for 30 days:

Build healthy habits: Go on a walk every day or exercise a few times a week. Stop eating out so much (it’s expensive and unhealthy), and aim to eat whole foods instead.

I try to work out 3 to 4 times a week and hit my 10k steps goal. It’s also been one month of being dialed in on my diet, so let’s see where this takes me!

Cut car costs: Calculate how much you can realistically spend on a car each month. A good rule of thumb is to keep all your car-related expenses—monthly payment, insurance, gas, maintenance, registration, and repairs—under 20% of your monthly take-home pay.

If your current car costs more than that, it might be time to rethink your ride.

Start investing now: Open a brokerage account today and invest at least $1—yes, just one dollar. The goal isn’t the amount right now, it’s building the habit.

Then set up automatic investing, even if it’s only $100/month to start. The earlier you begin, the more compound growth works in your favor.

Once you master one of these areas, move to the next.

P.S. Which mistake are you fixing first? Reply to this email and let me know. I want to hear from you.

📊 Don’t Let Bad Credit Cost You Thousands

(in partnership with USAA)

Did you know that 25% of Gen Z don’t even know their credit score?

And over 50% feel anxious just seeing it?

Ignorance may be bliss, but this avoidance affects everything, from car loans to renting an apartment.

And ignoring it will cost you higher interest rates, fees, and stress (not good)

In honor of Perfect Credit Score Day on August 5th, here are the exact tips I used to build a 800+ credit score in my 20s:

1. Never cancel old credit cards.

A portion of your credit score is credit length. So the longer you have it, the better. I personally have never closed any credit cards!

2. Keep your credit usage low

How much of your credit you use affects your score. A good rule of thumb is to stay under 30% if you can. Under 10% is even better!

3. Automate and make full payments.

Never miss a payment and always pay in full! Keep your report clean, it literally takes a couple seconds!

USAA has free tools that show you how to track, understand, and build your credit — so you can take control of your financial future.

It’s simple. It’s free. And it’s built to help you reach that perfect 850.

Learn how to start building your credit → (LINK HERE)

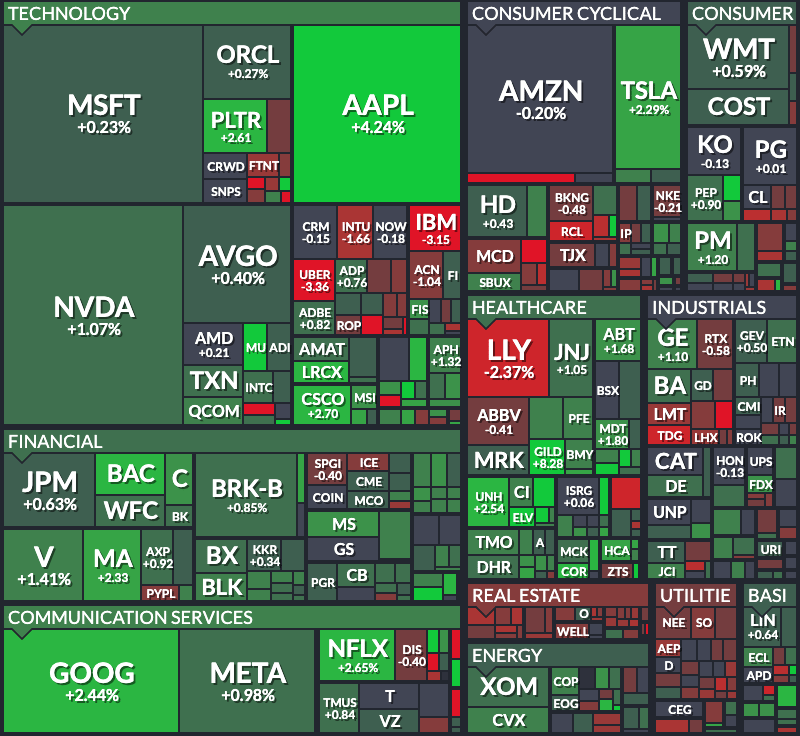

📉 Market Recap

Check out some of the biggest stories shaking up money, markets, and momentum this week.

Crypto in your 401k, Trump's new executive order to change investment options

OpenAI raises $8.3 billion in massive fundraising and valuation hits $300 billion

Nvidia chips illegally shipped to China from the U.S.

Apple shares jump, following tech trend of strong earnings and new AI features (also a $100B pledge to invest in the US)

Trump-Putin Summit could shake up the markets next week (hopefully all good things)

S&P 500 last week

👀 In Case You Missed It

Check out the “dumb” strategies I swear by to grow my portfolio to over $400,000.

See y’all next week 🫡

- Angelo Castillo

How did you like today's newsletter? |