- New Money

- Posts

- I’m 24 with $419,000 invested — here’s what I’ve learned

I’m 24 with $419,000 invested — here’s what I’ve learned

I never knew retiring early was an option until.....

Happy Sunday,

Did you miss me? I’ve been reading your feedback and making a few upgrades to the newsletter, and I want to know what you think—let me know your thoughts at the end.

Now let’s get into it. Today’s edition:

- 5 Lessons I’ve Learned from Investing $419,428.30

- The Price of Bitcoin, Donuts, Trade Deals, and More

- My Full Investment Portfolio, No Gatekeeping

Read time: 4 min 20 seconds

💰 Wealth Tip of the Week

I’m 24 years old, and my investment portfolio just passed $419,000.

Before you roll your eyes, no, I wasn’t born rich. Far from it.

I grew up in an immigrant household where money was a taboo topic. Investing? That was a casino game for rich people on TV, not for families like mine who hid cash under mattresses and hoped for the best.

When I started out, I had just a few hundred bucks to my name and made nearly every mistake in the book.

But here’s what I learned: those mistakes were the best teachers I could’ve had. And now I’m sharing the 5 biggest investing lessons that changed everything for me.

Let’s dive in.

1: It’s riskier NOT to invest

I used to believe that investing was risky — too risky. But here’s the real danger:

Not investing guarantees you’ll lose money.

Inflation eats away at your savings quietly, constantly. A dollar in your checking account today? It buys less tomorrow. In fact, at just 2.8% inflation, your money loses half its value every 25 years.

Here’s an example:

In 2013, a McDonald’s Quarter Pounder meal cost $5.39.

In 2024? That same meal is $11.99 — a 122% increase.

Your money is literally shrinking in power while you sleep. So if your cash isn’t growing, it’s dying.

2: You don’t need to be rich to invest, you invest to get rich

When I started, I only had a few hundred dollars to my name. An 8% return on $100 felt pointless, like “Why even bother?”

But I had it backwards. Investing isn’t for the rich.

It’s how you get rich.

Starting small taught me two powerful things:

1. Failure was cheap.

My first investment was cannabis stocks (I know) …. I lost pretty much 99% of what I invested. But the good part was, I only invested $100 (which was everything I had at the time).

So that small mistake was priceless because it taught me a valuable lesson which saved me THOUSANDS.

2. Discipline paid dividends.

Since I started broke, I had to really get surgical with my budget. I had cut back on DoorDash and start side hustles just to invest more. That hunger led to a six-figure business and allowed me to invest more than I thought was possible.

3: Retirement is a number, not an age

I thought retirement = 65 years old. Government says you're done and you don’t have to work anymore, the end.

Wrong.

Retirement happens when your money earns more than your lifestyle costs.

Thanks to investing, I’m on track to hit my retirement goal of $3M decades before most people.

Using the 4% rule

- Want $60K/year? You need ~$1.5M invested.

- I’m aiming for $120K/year → so I need ~$3M.

I'm at $419K now and investing $5–7K/month. Based on projections, I’ll hit that goal far earlier than I ever thought possible.

And it all started with a few hundred bucks and some low-cost index funds.

4: Your emotions are your worst enemy

Investing isn’t just about what you know. It’s about managing your emotions.

I’ve panic-sold during market drops. I’ve chased hype stocks. I’ve watched my logic evaporate in the face of fear, FOMO, and flashy crypto headlines.

To beat my own brain, I built guardrails:

- I automated my investments.

- I treated investing like a bill I couldn’t skip.

- I stopped reacting to the news.

- I only invested in long term investments.

Consistency > timing. Emotion is the enemy. Systems will always win.

5: Keep it simple, stupid

At first, investing felt overwhelming. Confusing jargon, gazillion accounts and investment types.

Then I realized: it doesn’t have to be this hard.

I stuck with:

Low-cost index funds like VOO, VTI, QQQM

Automated investments

No market-watching, no research stress

I made investing boring—and that made it work.

No one taught me this stuff. I had to screw up again and again to figure it out.

I’m not here because I did everything right — I’m here because I failed alot and kept going.

So if you're still figuring it out, trust me: you're not behind. You're just getting started.

Stay consistent, stay curious, and never count yourself out.

📉 Market Recap

Check out some of the biggest stories shaking up money, markets, and momentum this week.

Meme Stocks are back with donuts leading the charge (who got in 👀)

Google smashed Q2 earnings amid scaled AI efforts (I love google sm)

Congress passed the GENIUS Act: Crypto regulations incoming (ALT RALLY)

Japan and Trump struck a deal with 15% tariffs (more tariff drama…)

Bitcoin surged past $120K for the first time ever (LFG)

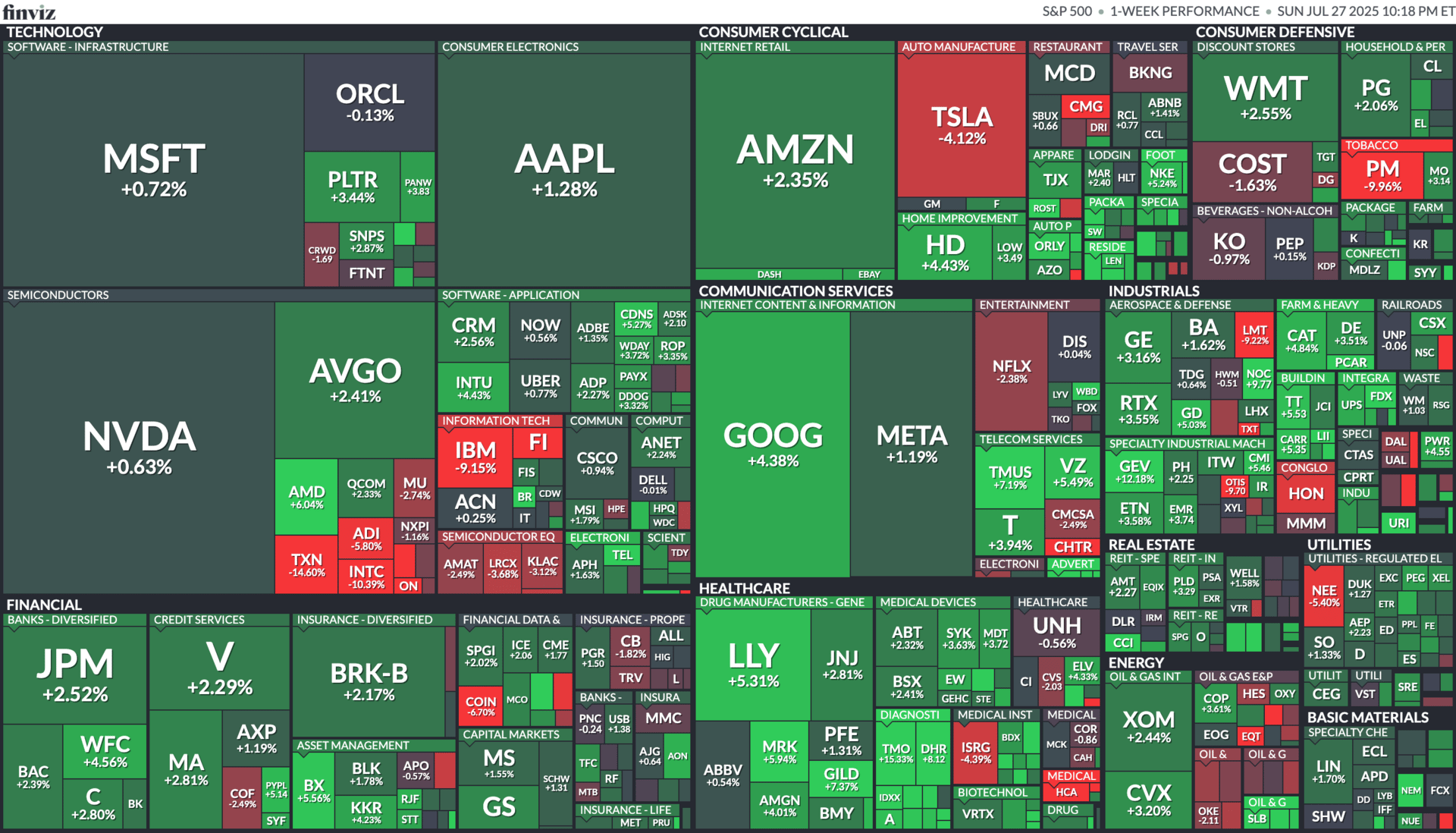

S&P 500 last week’s performance

👀 In Case You Missed It

Want to see the receipts? Here’s a full view of my investment portfolio that walks through the results and lessons I’ve learned after 5 years of investing.

See y’all next week 🫡

- Angelo Castillo

PS. I want to make newsletter the best newsletter possible. If you have any suggestions, constructive criticism please let me know! Fill out this form here.