- New Money

- Posts

- How Millionaires Manage Their Money

How Millionaires Manage Their Money

let's copy them!

Happy Sunday,

Angelo here!

Just came back from a business trip to NYC. Spent my time talking to people in the 1%, watching broadway shows, eating good food and getting lost on the subway.

I also went to Google’s HQ for a conference and was able to learn from one of their macroeconomist about their outlook on the economy!

I posted it on my story but here it is if you didn’t see it.

Man I love New York!

Alot has happened in the past week. Let’s break everything down. Today’s edition:

- Market’s incredible rebound (we’re up baby)

- How millionaires manage their money

- Best purchase under $300?

Read time: 5 min 30 seconds

📉 Market Recap

The Market’s bounce-back was truly insane.

After a significant downturn in April, major indexes have rebounded impressively:

S&P 500: Up 2.6% this week, now +19.6% from April lows

Nasdaq-100: Up +25.4% from April lows

Bitcoin: Up +36.7% from April lows

All 2025 losses has been completely erased….. (I hope you invested 😅)

So what happened?

S&P 500 5/11 - 5/16

🧊 Inflation cooled off

Core inflation hit a 4-year low, easing to 2.3% in April

This development has led investors to believe the Fed might pause rate hikes

Lower inflation provides more breathing room for consumers and businesses

🌍 U.S.–China tensions eased off

A “surprise” 90-day pause on tariffs was announced

JPMorgan even cut its recession odds to below 50%

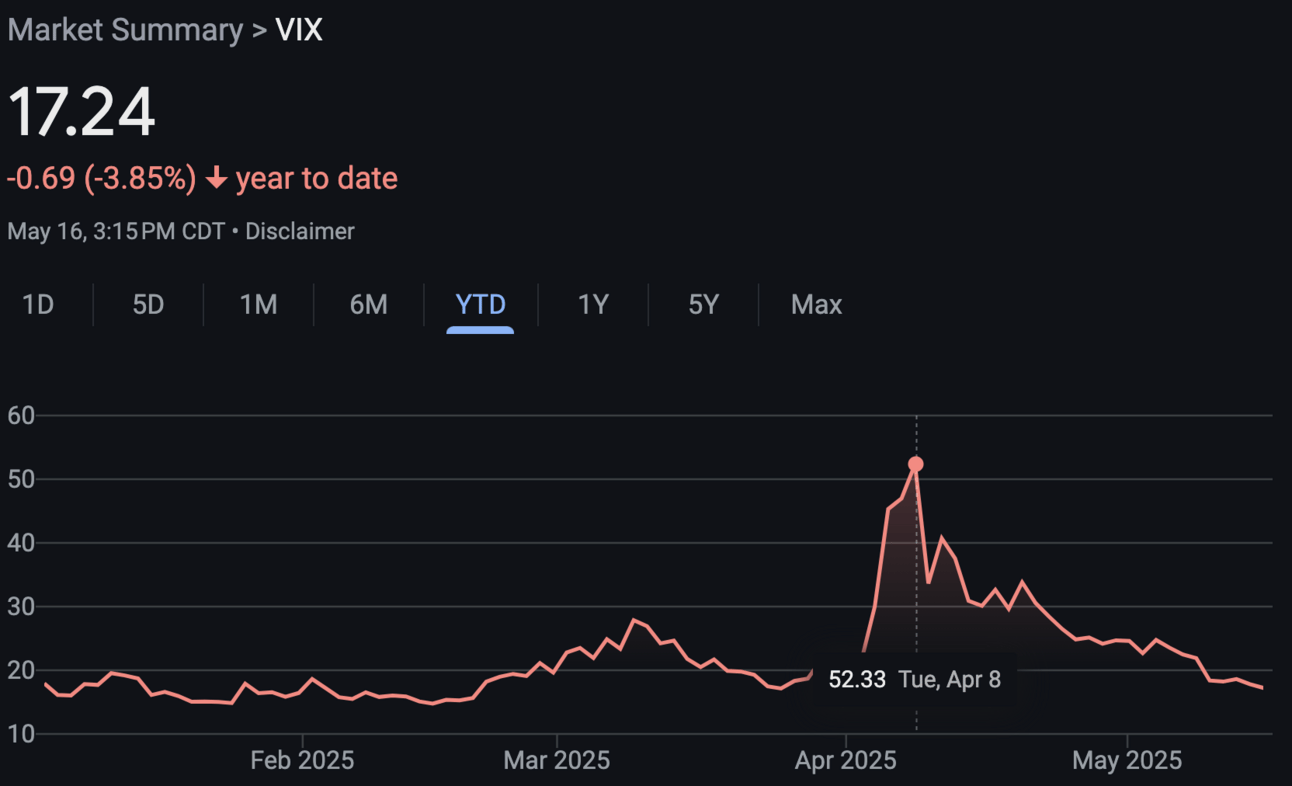

The VIX (Wall Street’s fear gauge) dropped 20% in one week — the biggest single-week drop ever recorded

Although it’s just a pause, a lot of the uncertainty seems to be fading away or at least pricing in.

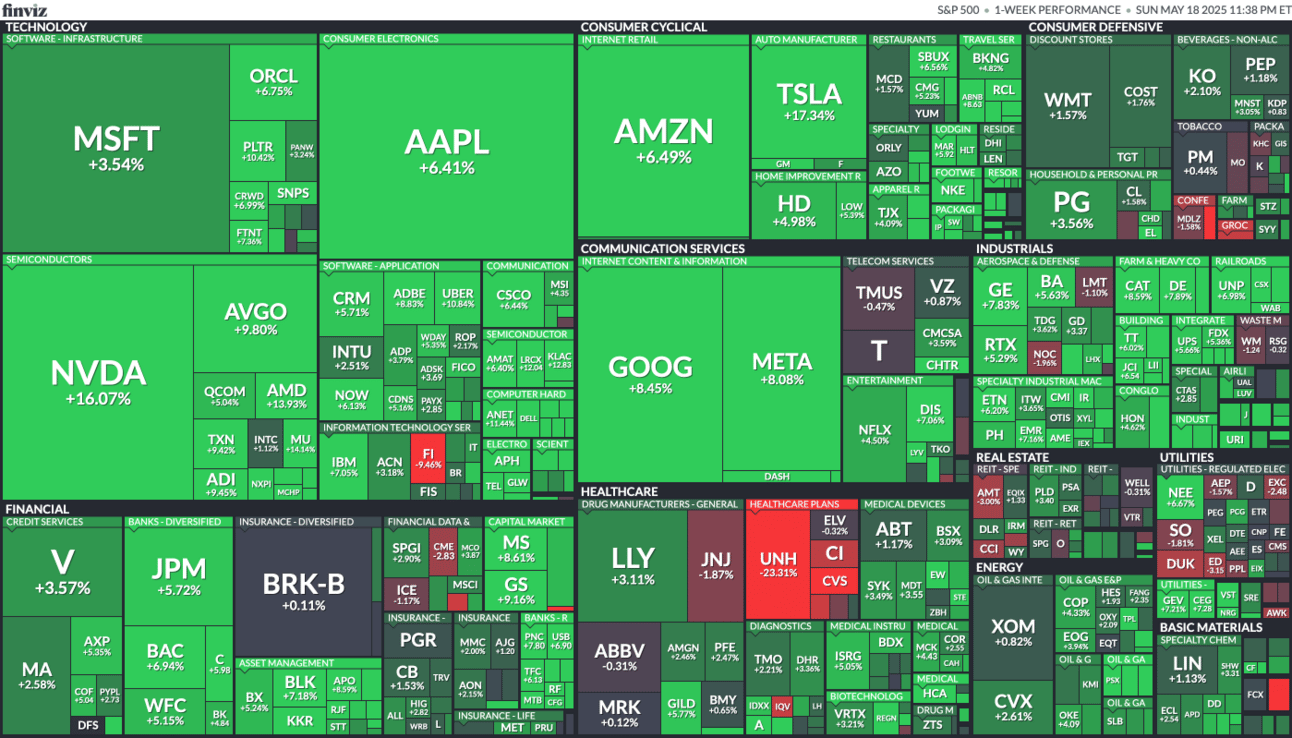

💵 Big Tech earnings delivered

Meta, Microsoft, Google all beat expectations

Apple announced a $100B buyback despite AI delays and weak China numbers

Nvidia and chip stocks continued to surge on AI optimism

⚠️ And yet… the U.S. just got downgraded

Fitch cut the U.S. credit rating from AA+ to AA

Normally this would send markets reeling

But this time? Investors shrugged it off.

It’s also notable to know that this is the same institution that told everyone that the housing market was healthy and fine back in 2008….

We all know how that turned out.

🔻 One last thing to watch: GDP

Q1 GDP was revised down to -0.3%

If next quarter shrinks again, we’re looking at a technical recession

Just something to keep an eye on as the headlines stay bullish

💰 Wealth Tip of the Week

I asked hundreds of millionaires how they manage their money and found that they all do this one this:

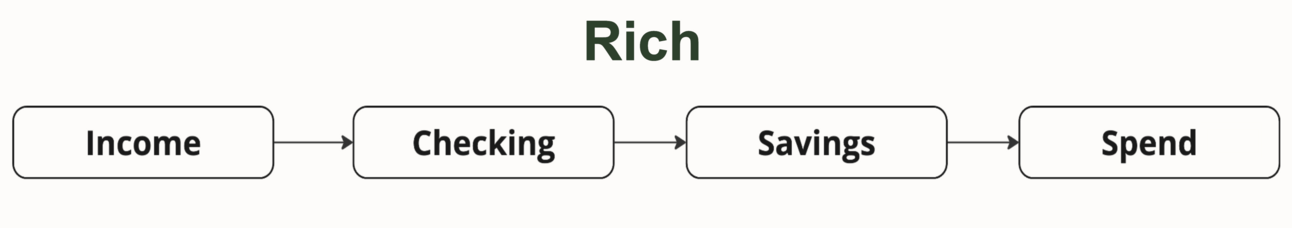

Rich people pay themselves first

It’s one of the oldest wealth principles out there—and it still works.

Here’s the difference:

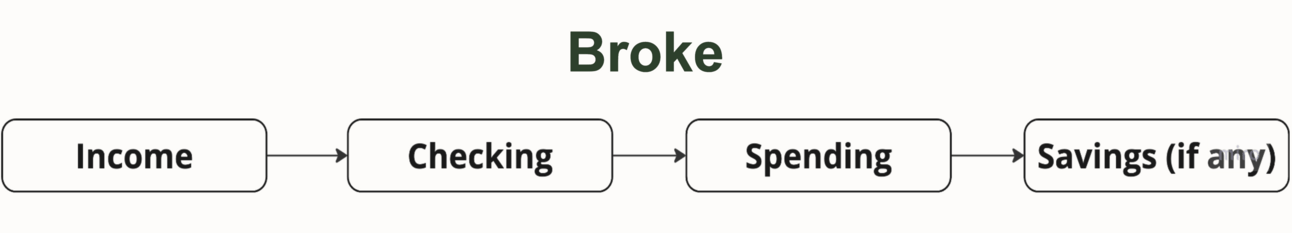

Most people save whatever’s left over after spending.

Rich people flip it: they save first, and spend what’s left.

Why this works:

✅ 1. It creates automatic wealth momentum

You build savings and investments before you even have a chance to spend the money. Spending money is all too easy nowadays. We can have anything we want with a swipe of a card.

On the contrary, saving and investing is hard. YTou have to do so many steps.

This simplifies and automates it.

✅ 2. It makes budgeting easier

You never ask “Can I afford to save/invest this month?”

It’s already been taken care of—just like rent.

Since it’s coming out of your pocket automatically, you don’t have to figure out if you will have anything leftover.

You already saved!

✅ 3. It protects you from lifestyle creep

When your income increases, your savings increase automatically.

This way, you stay humble and ensures your bottom line and savings never falter just because you start making more money.

You lock in the gap and grow wealth without thinking about it.

Here’s how to start:

📌 Step 1: Choose a savings %

Start with 10% of your monthly income. If that feels hard, do 1%. The amount matters less than the habit.

📌 Step 2: Automate that transfer

Set up an auto-transfer the moment your paycheck hits—into a high-yield savings or investment account.

It’s really easy to do, almost every brokerage or bank account allows you to do it.

Takes like a few minutes!

📌 Step 3: Let it ride!

Once it’s gone, act like it was never there. Almost better to forget it!

But if you start to earn more or feel comfortable, increase that %

🧵 Thread of the Week

When I was 19, I took saving money to an extreme. If it wasn’t 100% necessary, I wouldn’t buy it.

I wouldn’t buy new clothes, buy food (at one point) or spend any money on myself.

Although I do attribute that urgent mindset to my “financial success” early on, it made me super depressed and unhealthy.

I now look at money as a tool.

A tool to better my future and current life.

So alongside my investments, I actually do spend money on things that bring me value.

This thread hits home because there are so many things, so many amazing products/services out there that are 100% worth the price.

For me it’s my Oura ring and my Hoka shoes. Both cost a couple hundred dollars, but both have changed my life for the better drastically.

PS. Andrew Huberman gave an answer! Check it out

See y’all next week 🫡

- Angelo Castillo

PS. I want to make newsletter the best newsletter possible. If you have any suggestions, constructive criticism please let me know! Fill out this form here.