- New Money

- Posts

- Escape

Escape

Escaping the rat race starts here

Happy Monday,

Angelo here! Welcome to New Money, where we go over weekly tips to help you build your wealth, one dollar at a time.

Today’s edition:

The 4-step framework that breaks you out of the rat race

Why your money leaks away after payday

AI chips get cheaper, Amazon cuts costs, and more

Read time: 3 min 15 seconds

💰 Wealth Tip of the Week

Ever feel like no matter how much you earn, your bank balance still ends up close to zero? I’ve been there too.

When I first started working, I thought the ONLY solution was just to make more money.

But even as my income grew, I was still broke by month-end. And I’m not alone.

A MarketWatch Guide survey found that even people making six figures still live paycheck to paycheck.

That’s when it hit me: the real rat race isn’t your 9-to-5.

It’s how fast money disappears the moment it hits your account.

Let’s break down the simple framework that helped me finally stop that cycle.

1. Know Where It Goes

Think of your bank account like a sinking boat. Money flows in when you earn and leaks out when you spend.

If you don’t find and fix those leaks, you’ll always struggle to stay afloat, no matter how much you earn.

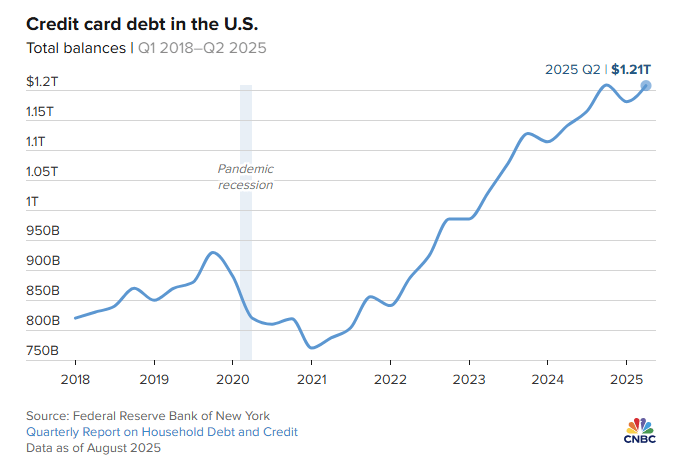

For example, Americans owe $1.21 trillion in credit-card debt. Not from lack of income, but lack of awareness.

Most of those leaks happen right after payday, in the small stuff you barely notice.

Impulse buys, unused subscriptions, or things you don’t even care about slowly drain your balance.

Track every expense for one month and notice the flow. You’ll be surprised how awareness alone starts to patch those leaks.

2. Face the Numbers

Once you’ve tracked your spending, it’s time to make sense of it.

Think of this as finding your Three M’s:

Money In: how much you earn each month

Money Out: how much you spend

Money Left: what remains after you’ve spent, saved, and lived your month

The goal is to increase how much is left over each month and keep it growing over time.

As Morgan Housel writes in The Psychology of Money, building wealth has little to do with income and a lot to do with how much you keep.

Once you see the full picture, you start feeling in control.

3. Rewire Spending Habits

Even with a plan, spending habits can sneak back in.

You see something you want, imagine how good it’ll feel, hit “buy,” and get that instant dopamine rush.

As James Clear explains in Atomic Habits, every habit follows a loop — cue, craving, response, reward.

How to stop the loop:

When you see something you want, don’t buy it right away.

Add it to a “waiting period” list and give yourself 72 hours before deciding.

If the urge fades (and it usually does within 48 hours), cross it off the list.

But make sure your money moves before you even get the chance to spend it.

Automate your system so managing money becomes simple:

70% covers living expenses, 20% automatically goes into savings and investments, 10% is set aside for emergencies.

Automate the transfer to a high-yield savings account every payday. With this setup, you spend a couple of minutes a month managing your money and save more than ever before. And I walk you through it in my recent YouTube video—check it out here.

That small pause and pre-commitment keep your spending intentional instead of impulsive.

4. Play Offense

You can only save so much before there’s nothing left to cut.

If you want to grow faster, you have to earn more.

According to Bankrate’s 2025 survey, 1 in 4 Americans now have a side hustle, earning around $885 a month.

Here are some smart, real-world side hustles you can consider:

Walk dogs through Wag! or Rover – flexible, easy to start, and perfect if you love pets.

Offer rides or errands for seniors via SilverRide – help elderly clients get to appointments or run errands safely.

Rent out your car on Turo – make money when you’re not using your vehicle.

Become a home-cooked meal host with Eatwith – turn your love for cooking into a shared dining experience.

Freelance your skills on Upwork or Fiverr – write, design, edit, or consult based on what you already know.

Sell digital products on Gumroad or Etsy – create templates, guides, or tools that keep earning even while you sleep.

Spend one focused hour this week exploring how your skills could help someone else. One simple idea can be the start of your next income stream and if you need inspiration, check out my YouTube video here!

If you’ve felt stuck in the rat race, the way out isn’t harder work. It's a better system. Build it once, stay consistent, and freedom follows.

Can’t wait to see where it takes you.

📉 Market Recap

Check out some of the biggest stories shaking up money, markets, and momentum this week.

Cheaper AI chips on the horizon as Qualcomm rivals Nvidia

Amazon trims 30,000 jobs as AI boosts productivity

Trade talks return: could this finally lower import costs?

Google’s new nuclear deal could make AI cleaner and energy cheaper

Market Overview

I want your honest take! Are you enjoying the market recap? |

👀 In Case You Missed It

Want to know the 9 habits that got me to $600K by 24? I'm breaking down everything in this vid

See y’all next week 🫡

- Angelo Castillo

How did you like today's newsletter? |

Disclaimer: This is not financial advice or investment recommendations. The content is for informational purposes only, and it should not be considered as legal, tax, investment, financial, or other advice.

Some of the links are my affiliate links. If you click on these links and sign up/purchase something, I may earn a small commission at no additional cost to you. This helps support me and allows me to continue creating content for you. I only promote products and services I genuinely believe in. Thank you for your support!