- New Money

- Posts

- Elon Crashes Out On Trump

Elon Crashes Out On Trump

the bros are fighting!!!!!

Happy Sunday,

Angelo here!

What a wild week!

We will cover everything, but I did not expect Elon to crash out this much about Trump.

I swear, guys, investing is not supposed to be this entertaining. It’s supposed to be boring, like watching paint dry.

But every week, there is always something new with these two that sends shockwaves across the market…

Good thing, I invest mostly in Index funds & ETF’s 🫡

I want to hear from you. What do you mainly invest in?

I love reading your responses and seeing y’all winning!

Alright let’s get straight to it. Today’s edition:

- Elon and Trump’s very public breakup

- 5 bank accounts you need

- the ultimate crash out

Read time: 3 min 30 seconds

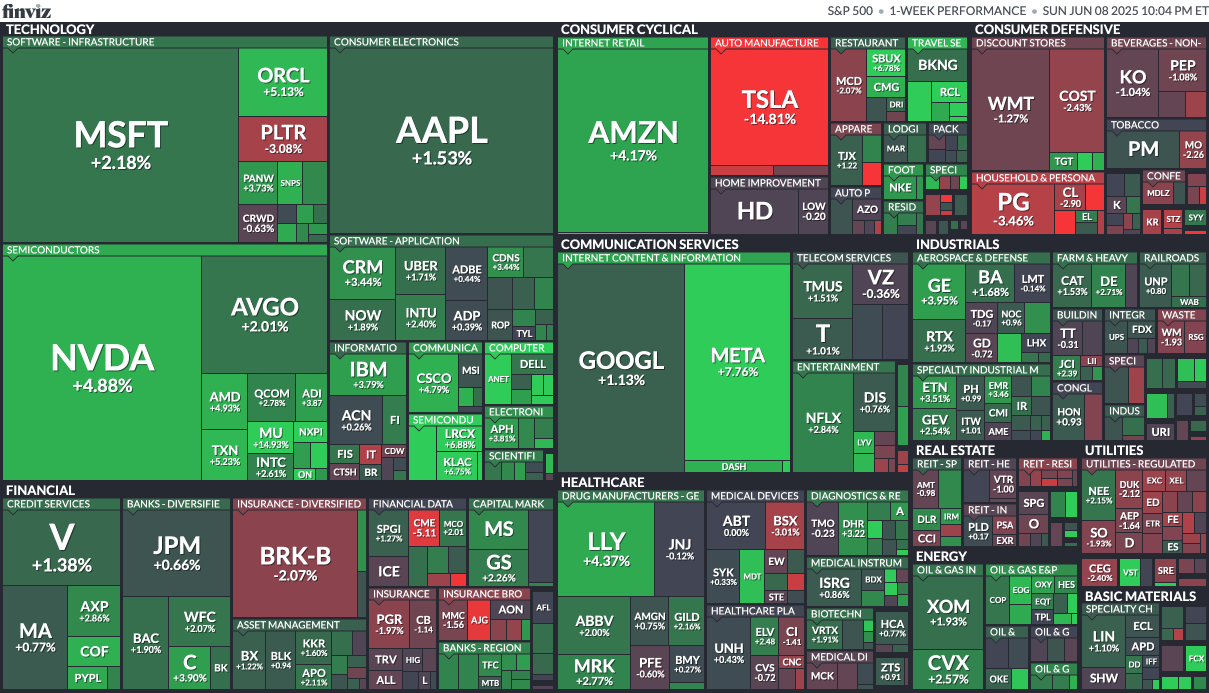

📉 Market Recap

The market this week? Pure madness.

S&P 500: +-0.9%

Nasdaq-100: -1.3%

This week was actually such a circus……

S&P 500 last week

💔 Trump vs. Musk: The Breakup Heard ’Round Wall Street

The Elon x Trump bromance officially collapsed — and Tesla shareholders paid the price.

Here’s a quick timeline of what happened:

June 3 (1:31 PM ET)

Musk kicks things off by slamming the new federal budget bill as a “disgusting abomination,” warning it would increase the deficit and undo cost-saving progress.

June 4 (1:59 PM ET)

Trump reposts Musk’s comments, publicly confirming tensions. Musk doubles down on opposition.

June 5 (12:01 PM ET – 4:43 PM ET)

It explodes:

Trump says he’s “very disappointed” in Musk.

Musk fires back saying Trump would’ve lost the election without him.

Trump threatens to cancel SpaceX and Tesla’s government deals.

Musk escalates fast — calls Trump “ingrateful,” threatens to decommission SpaceX’s Dragon capsule, and drops the Epstein bomb.

By day’s end: Tesla crashes 14%, wiping $150B in value.

This one was my favorite tweet by Elon.

Yeah… not your average policy debate. Here is a complete timeline of this whole sh*tshow 👉 Click here

🤝 China Trade Strategy: Less iPhones, More Independence

Tensions are cooling on the surface — the U.S. and China resumed low-level trade talks — but China’s making quiet power moves:

Container exports to the U.S. fell 40% last month (lowest since 2009).

Smartphone exports dropped 72%, hitting brands like Xiaomi and Oppo hard.

Meanwhile, China is doubling down on domestic chipmaking and EV supply chains, accelerating the “Made in China 2025” plan.

The country is actively cutting reliance on U.S. exports and tech, from semiconductors to energy.

📌 At the same time, Trump extended the EU tariff pause to July 9, temporarily avoiding a 50% tax hike on $321B in trade.

But with Europe and China both reevaluating trade dynamics, this story is far from over

💸 Investor Sentiment: Big Tech Still Owns the Narrative

Even with the Musk/Trump chaos, investors are still buying the AI dip.

$3.8B flowed into tech ETFs last week, especially those tied to semiconductors and cloud infrastructure.

Nvidia’s blowout earnings and Google’s new AI suite have investors betting that the next wave of growth still lies in big tech.

Despite the broader market’s dip, fund managers aren’t pulling out of growth yet.

AI is really changing the game….

⚠️ Uncertainty Still Looms

The bond market is STILL flashing warnings:

Treasury yields are rising again — making borrowing more expensive.

Credit delinquencies and household stress are climbing.

Rate cuts? Maybe… but the Fed is signaling caution.

I don’t have a crystal ball, but if I were a betting man, I would bet that we can expect some volatility in the near future.

Especially when Elon and Trump crash out on each other on Twitter.

💰 Wealth Tip of the Week

You really only need a couple of different bank accounts to set yourself up for life (financially).

Here are the 5 different types of “bank” accounts that you need if you dont want to be broke

They’re simple, free, and take 10 minutes to set up — but can seriously transform your financial future.

Let’s break them down 👇

1. High-Yield Savings Account (HYSA)

What it is: A FREE online savings account that actually pays you to save.

Why it matters:

Traditional banks pay 0.01% (basically nothing).

HYSA pays 4–5%+ — that’s real growth.

Perfect for emergencies, short-term goals, or a future down payment.

How to get it:

Open one online for free. Here are my top recommendations (Axos is my favorite!)

Set up auto-deposits from your checking account every paycheck.

2.Roth IRA

What it is: A retirement investment account that grows completely tax-free.

Why it matters:

You invest post-tax money now, and never pay taxes again.

The earlier you start, the more compound interest works in your favor.

You can withdraw contributions anytime, so it’s more flexible than people think.

How to get it:

Open one with Vanguard, Fidelity, or Schwab (I use Vanguard)

Start with low-cost ETFs like VOO (S&P 500) or QQQ (tech).

it’s op, trust me

3. 401(k) or Solo 401(k)

What it is: An employer-sponsored retirement account (or Solo 401k if you’re self-employed).

Why it matters:

Lowers your taxable income today.

Employer match = free money — don’t miss it.

It’s a great complement to your Roth IRA.

How to get it:

Ask your HR rep if your job offers a 401(k).

Contribute up to the company match (usually 3–5%).

If self-employed: open a Solo 401(k) with Vanguard or Fidelity (I use fidelity)

4. HSA (Health Savings Account)

What it is: A medical expense account with triple tax benefits:

Tax-free contributions

Tax-free growth

Tax-free withdrawals for qualified medical expenses

Why it matters:

Pays for things like doctor visits, dental work, and prescriptions.

After 65, it acts like a second retirement account.

How to get it:

Must be enrolled in a high-deductible health plan (HDHP).

Open one through your job or use platforms like Lively or Fidelity.

5. Taxable Brokerage Account

What it is: A regular investment account with no contribution limits or withdrawal rules

Why it matters:

Use it once you’ve maxed out your Roth IRA and employer match.

Great for medium- to long-term investing (5+ years).

Unlike retirement accounts, you can withdraw anytime (just pay capital gains tax on profits).

How to get it:

Open one with any brokerage. I personally use Webull.

I mainly invest in single stocks in this account.

Just be mindful of taxes when you sell.

🧵 Thread of the Week

This isn’t a thread, but I would consider following Elon and just looking at the barrage of tweets he is unloading.

This is going to send shockwaves throughout the market.

This is literally the richest man alive, beefing with he president.

Can’t get any crazier than this.

The worst part is, we will be the losers…..

So look at it, understand what’s happening, and act accordingly.

See y’all next week 🫡

- Angelo Castillo

PS. I want to make newsletter the best newsletter possible. If you have any suggestions, constructive criticism please let me know! Fill out this form here.