- New Money

- Posts

- Dead people get rich

Dead people get rich

The dumb investment strategy that wins every time

Angelo here!

Hope you had a wonderful weekend! Today I am adding a new segment called “Angelo’s Monthly Portfolio Review”.

I hope you like it!

Lets get to business. Today’s edition:

- How dead people are better investors then the pro’s (copy their strategy)

- New stock positions I added to my portfolio

- Tech earnings are shaking up the market

Read time: 4 min 0 seconds

💰 Wealth Tip of the Week

Here's a stat that'll mess with your head:

“Dead” people make better investors than the professionals.

No, that’s not a joke.

There was a study from 2003-2013 that found their best-performing accounts belonged to people who were “either dead or inactive.”

People who couldn't touch their accounts, couldn't panic-sell, couldn't get “smart” about timing the market.

And they crushed everyone else.

Let’s talk about why.

The Problem Isn't What You Think

Most people think investing is about picking winners.

Tesla vs. Apple. Growth vs. value. Crypto vs. stocks.

Wrong.

The real game? Not being your own worst enemy.

In April, I watched my friends panic-sell everything or straight-up delete their investing apps because the market dropped. Pure emotion.

They either missed the entire bull run that followed or sold too early and left thousands on the table.

Sound familiar?

The Brutal Numbers

Here's what the data actually shows:

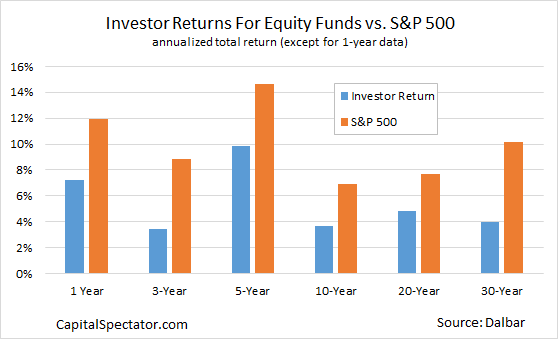

The average investor earned 21% in 2023 while the S&P 500 returned 26%. That’s a 5% behavior gap in just one year.

97% of day traders lose money.

DALBAR's 2025 study confirms: Investment results are more dependent on investor behavior (AKA emotions) than on fund performance.

Capital Spectator with data provided by Dalbar

The math is devastating.

Over 20 years, this behavior gap costs the average investor 4–5% annually, which turns into millions of dollars.

That's the difference between retiring at 55 vs. working until you're 70.

Don’t believe me? Read the breakdown here:

The "Dumb" Strategies That Actually Win

Ready for the plot twist?

The boring stuff works.

1. Dollar-Cost Averaging

Buy the same amount every month, regardless of price. When it's high, you buy. When it's low, you buy more.

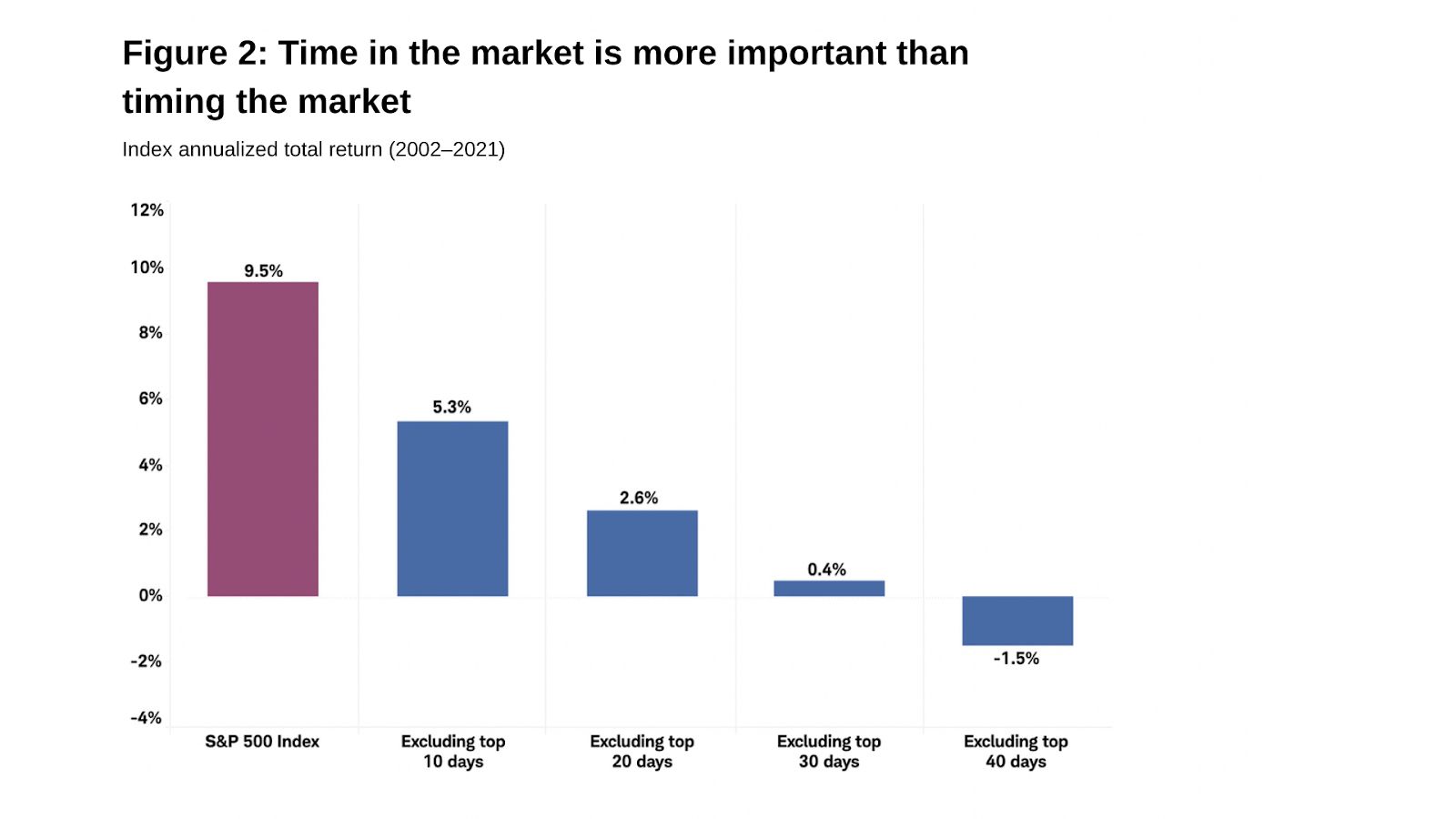

Over the long term, you will out perform anyone who tries to time the market!

Zero skill required plus, you could automate the entire thing!

Remember: Time in the market, beats timing the market

Schwab Center for Financial Research with data provided by Standard & Poor

Check out Schwab’s breakdown to see the numbers.

2. Index Fund Investing

Want to hear Warren Buffett's advice? Put 90% in an S&P 500 index fund and leave it alone.

On average, the S&P 500 has returned 8-12% a year, despite world wars, pandemics and market crashed!

This way you aren’t trying to beat the market but rather matching the market!

Research proves that even professionals can’t even beat the market over the long term.

So what makes you think you can?

Plus, it's good enough for Warren Buffett, it's good enough for you.

Me personally, I have 75% of my portfolio in index funds and etfs!

3. Automation

Remove yourself from the equation entirely. Set up automatic transfers and pretend the money doesn't exist.

Your superpower is being boring.

This way know your money is working for you and you don’t have to lift a finger!

Ready to go on autopilot? Here's exactly how to set it up: 6 Ways to Automate Your Investments.

It takes less time than ordering coffee.

The Science Behind Your Brain

Your brain isn't wired for investing. Here's the proof:

Loss Aversion: You feel losses twice as intensely as gains. So you panic-sell at the worst times.

Dunning-Kruger Effect: You think you can time the market better than professionals who do this for a living. (Spoiler: you can't)

Recency Bias: Whatever happened last month feels like it'll happen forever. Market goes down? It'll never recover. Market goes up? It'll never stop.

These aren't character flaws.

They're human nature.

And they're costing you a fortune.

Your 10-Minute Action Plan

Alright, enough theory. Let's actually do this.

Open your investment app right now.

Set up automatic investing of any amount you won't miss. Start with even $50/week if you can.

Put it in a boring S&P 500 index fund (like VOO or SPY).

Now, these next steps are extreme.

But if you know you can’t handle the rollercoaster of emotions, they’re necessary.

Delete the investing app from your phone. use your computer to increase contributions but don’t check often.

Check your balance RARELY. Once a year. Maybe.

That's it.

No stock picking. No market timing. No gambling.

Just systematic, boring wealth building.

The “boring portfolio” beats 90% of active fund managers over 10+ years.

While Everyone Else Loses Money...

…you’ll be building wealth the most boring way possible.

They'll be checking their portfolios obsessively. You’ll be living your life.

They'll be panic-selling during crashes. Your automatic investments will be buying the dip.

They'll be broke at 65. You’ll be retired at 45.

The choice is yours.

Your move: Reply to this email if you have an automatic transfer set up! Let’s celebrate!

📊 Monthly Portfolio Review

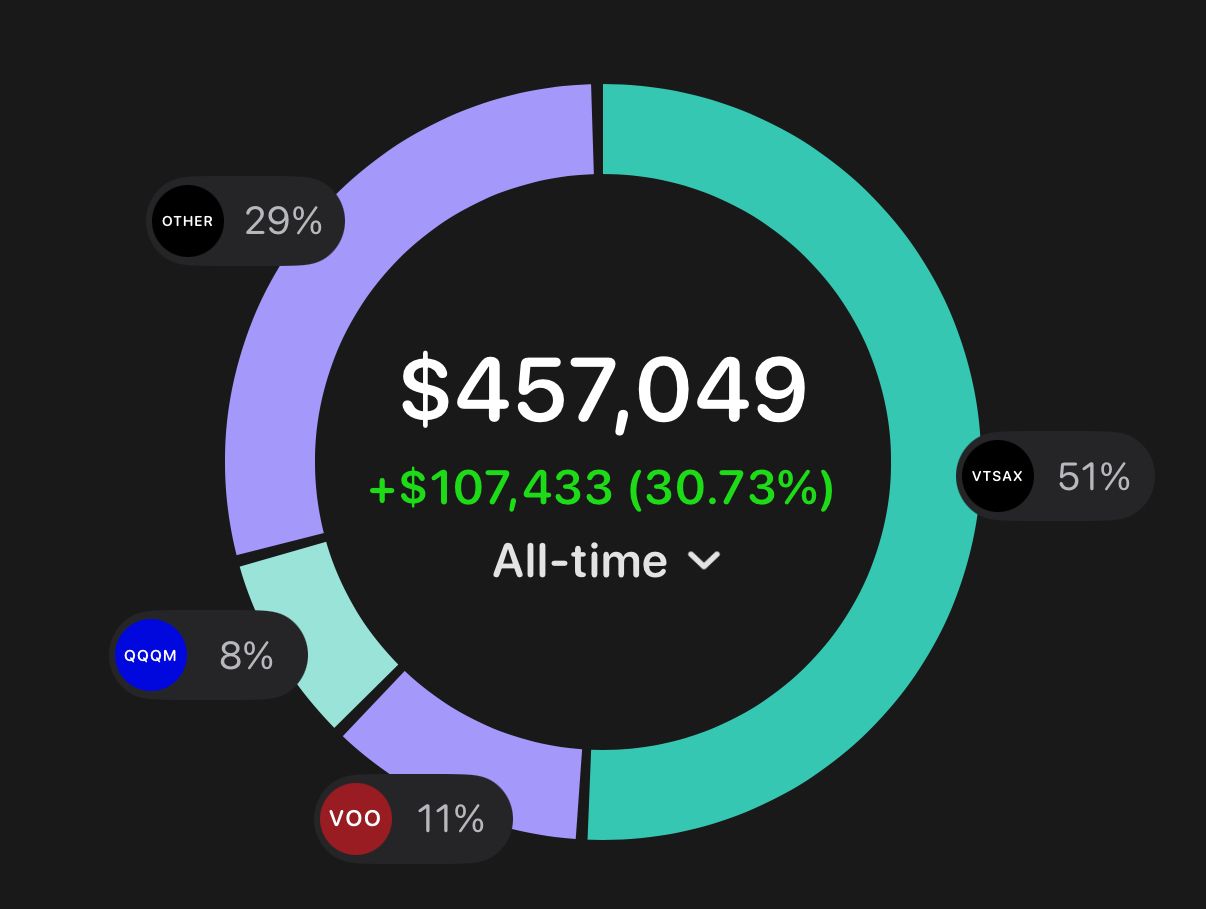

Angelo’s monthly portfolio review - Aug 2025

This is my investing portfolio as of now, I’ve made a couple of moves this past months:

- Started a position in $CRWD ( ▼ 7.95% ) , $MU ( ▲ 2.59% ) $OSCR ( ▼ 3.64% ) $UNH ( ▲ 0.02% )

- Added more to $QQQM ( ▲ 0.87% ) $VTSAX $AMD ( ▼ 1.58% ) $COST ( ▼ 0.26% ) $NVDA ( ▲ 1.02% )

I still have most of my portfolio index funds, but I cannot ignore the opportunity with AI

I think the market is running a little hot, and the economic data hasn’t been the best. So I am steadily buying and keeping my ear to the ground for any more opportunities!

Click here is see my entire portfolio (for free)!

📉 Market Recap

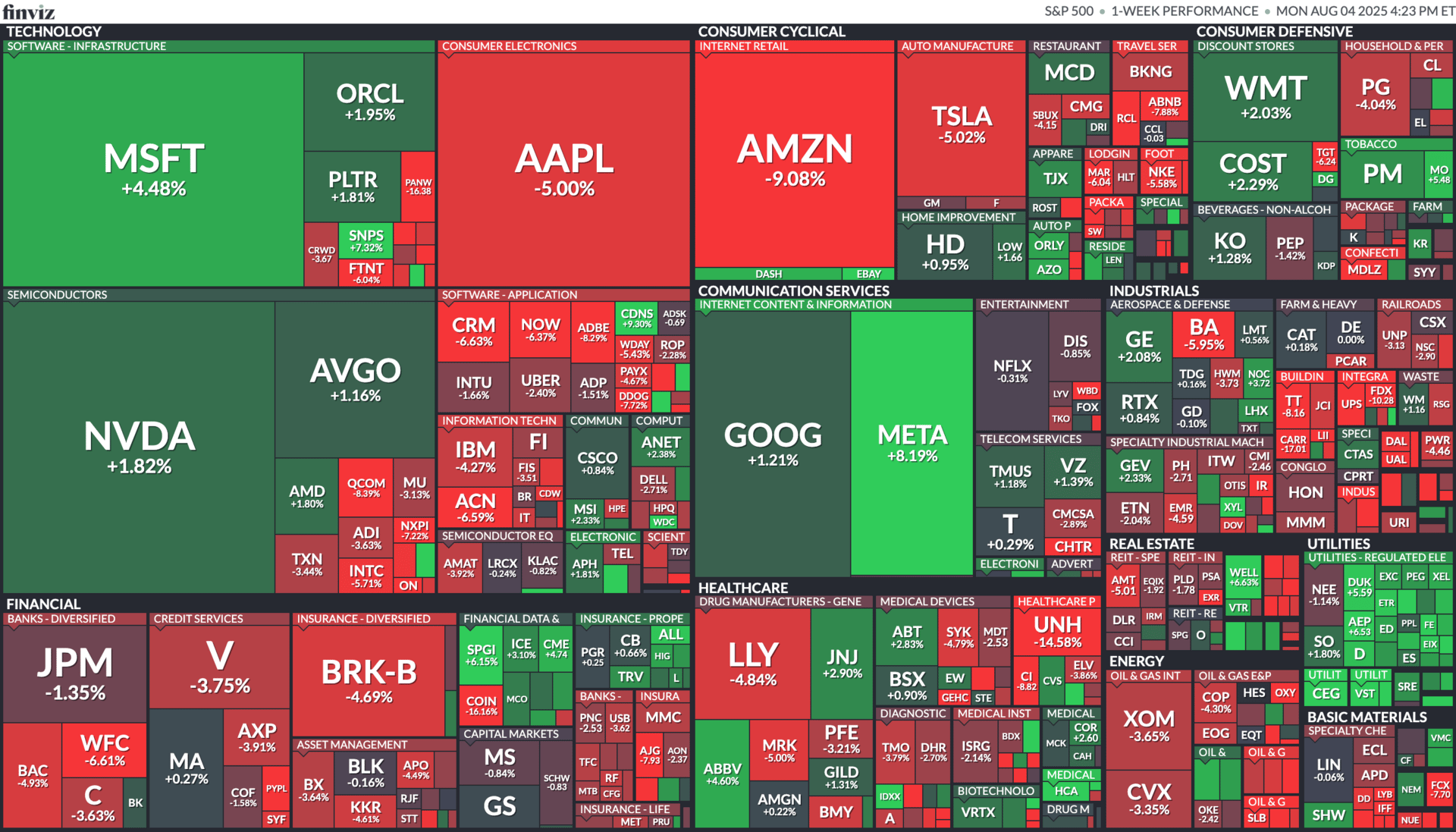

Check out some of the biggest stories shaking up money, markets, and momentum this week.

Meta crushed earnings as Magnificent 7 dominate the U.S. market

The latest late-night tariff news

S&P 500 and Nasdaq hit fresh all-time highs

Figma skyrockets after going public

The end of Amazon? AMZN stocks tank

S&P 500 last week

👀 In Case You Missed It

Here's the breakdown of my 10 income streams (and which ones actually move the needle).

See y’all next week 🫡

- Angelo Castillo

How did you like today's newsletter? |