- New Money

- Posts

- Buckets

Buckets

The 3-account system that manages my $700k+

Happy Tuesday,

Angelo here! Welcome to New Money, where we go over weekly tips to help you build your wealth, one dollar at a time.

For those who care about my personal life (we’re friends right?), I’m moving back to SF again this week.

I’ve spent the last few months back at home deciding on which city to move to and I’ve decided to give SF another try (but in a different location).

This is a luxury apartment, which a diabolical and very SF rent price.

Reply to this email with your best guess and I’ll let you know if you’re close 😢

Back to business.

Today’s edition:

The 3-account system that killed my money stress

Why $10k should earn you $350/year, not $39

Rare earth minerals, AI revamps and more…

Read time: 2 min 50 seconds

💰 Wealth Tip of the Week

Every time money hits your account, you’re forced to decide:

Can I spend this? Should I save it? What if something comes up next week?

So you delay the decision.

And delayed decisions quietly turn into bad ones.

Somewhere along the way, the internet decided the fix was complexity.

Buckets. Sub-accounts. Labels for every dollar.

I tried that once.

It looked organized until it felt exhausting.

That’s when I realized that I just built a system so complicated I stopped wanting to do it anymore.

So I stripped everything down to three accounts.

And the moment I simplified it, money finally started to feel easier to manage.

Let me walk you through them.

1. Checking: Money In, Bills Out

Your checking account isn’t where wealth is built.

It’s where money passes through.

The biggest mistake most people make is letting thousands of dollars just sit there doing nothing.

How did ChatGPT do 😭? |

Money in checking earns nothing.

Inflation quietly chips away at it.

And psychologically, excess cash feels like permission.

For example, $5,000 sitting there doesn’t feel like “allocated money.”

It feels like available money.

So here’s how you can simplify it:

Calculate monthly expenses (rent, utilities, groceries, subscriptions)

Add $100-300 buffer for unexpected costs

That's your checking target then everything else goes to savings or investments

Use a zero-fee account with mobile banking

The role of checking: handle today, nothing else.

2. High-Yield Savings Account: Your Safety Net

This is where your emergency fund lives.

A high-yield savings account (HYSA) does two important things:

It keeps money safe

It keeps it separate

That separation matters more than people realize.

When emergencies share space with spending money, they get spent.

Most traditional savings accounts earn around 0.39% APY which is basically nothing.

I've been personally using Chime, which earns ~3.50% APY.

Here's the math:

$10,000 in a regular savings account = $39/year

$10,000 in Chime's HYSA = $350/year

That's $311 extra just for parking your money in the right place.

And right now, Chime has a limited-time offer: up to $350 bonus when you set up qualifying direct deposits.

Here's how to set up your HYSA:

Open a Chime high-yield savings account.

Start with 1 month of expenses, then work toward 4-6 months.

Don't touch this unless it's an actual emergency.

3. Investment Account: The Long Game

This is where money finally starts working without you micromanaging it.

An investment account is where you park money you won’t need anytime soon.

Think 5–10+ years and let time do the heavy lifting.

Here’s the part most beginners miss:

Retirement accounts are just investment accounts with tax perks.

How they work:

401(k): Your employer sets this up. You invest pre-tax dollars from your paycheck.

Many employers match contributions. That's free money if you contribute.

Roth IRA: You open this yourself at a brokerage (Fidelity, Vanguard, Schwab).

You invest after-tax dollars, but all withdrawals in retirement are tax-free.

That’s why these come first.

Inside these accounts, you're buying index funds or ETFs. Basically baskets of stocks that track the market.

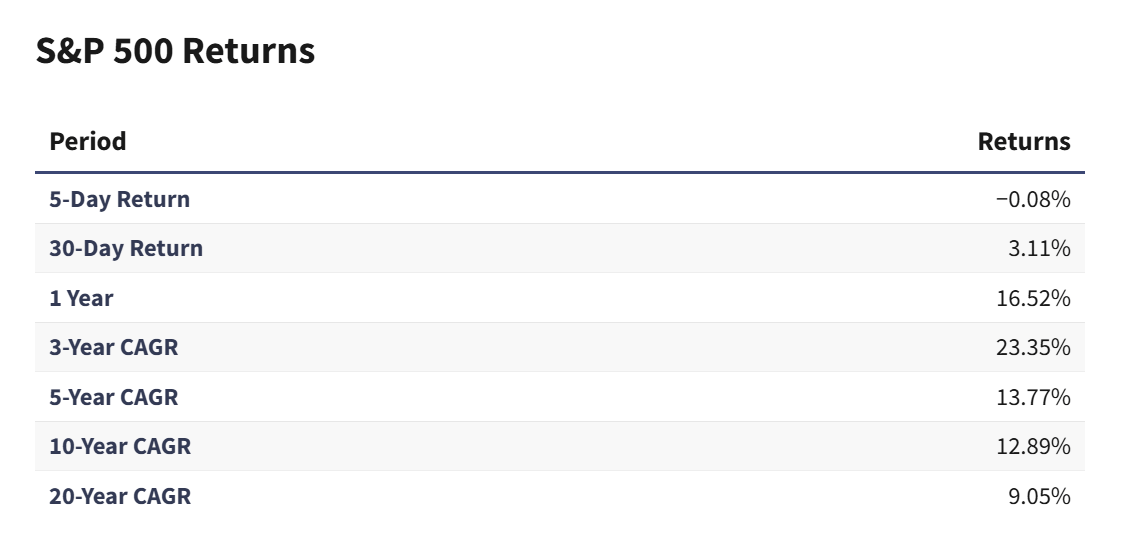

For example, S&P 500 index funds, which have historically averaged ~10% a year over long periods.

If you invest $500/month starting at 26, and let it grow at ~10%,

you could end up with over $2 million by your early 60s.

Most of that money isn’t what you contributed.

It’s growth doing the work because you started early.

How to approach this without overthinking it:

Start after you’ve got an emergency fund

If your employer offers a 401(k) match, contribute enough to get the full match (don't leave free money on the table)

If you don’t have 401(k) match, open a Roth IRA at Fidelity, Vanguard, or Schwab

Inside the account, buy low-cost index funds or ETFs (VOO, VTI and QQQM)

Set up automatic contributions so you invest consistently

Here’s a link to a free app to see everything i’m investing in 👉 See My Portfolio

You don’t need 47 different accounts and a PhD in economics to build wealth.

You need three accounts with clear purposes:

Checking – handles today

High-yield savings – protects tomorrow

Investment account – builds the future

If this changed how you think about organizing your money, hit reply.

I'd love to hear which account you're prioritizing first.

Where are you right now in your financial journey? |

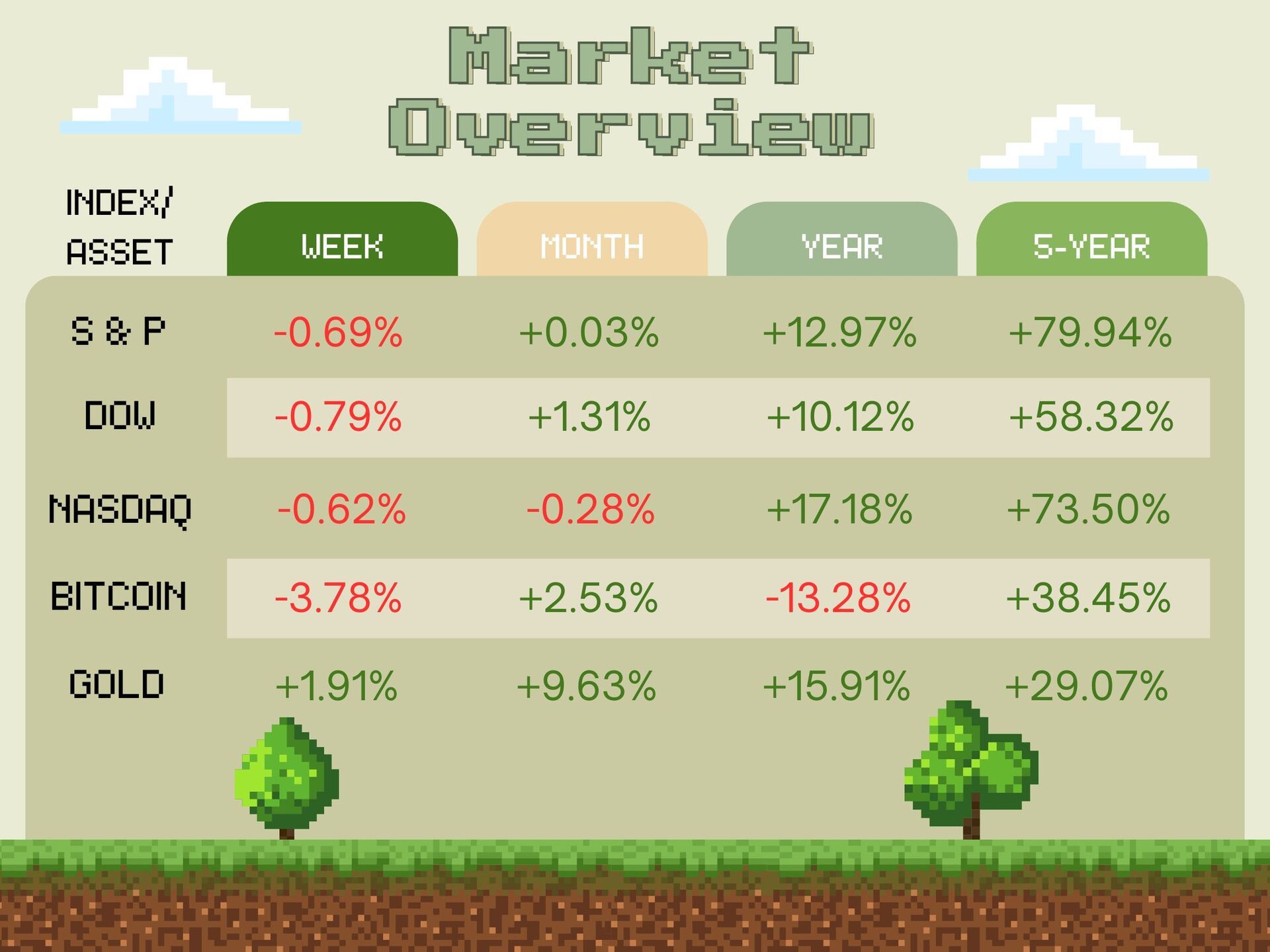

📉 Market Recap

Check out some of the biggest stories shaking up money, markets, and momentum this week.

Trump signals long-term U.S. access to Greenland’s rare earth minerals via NATO framework

Apple plans to revamp Siri into a built-in AI chatbot to catch up in the AI race

Amazon rolls out AI health tool tied directly to patient medical records

Netflix shares fall as investors focus on margins and $83B Warner deal

Market Overview as of 01/23/2026

👀 In Case You Missed It

You're probably wasting money on at least 5 of these 23 things right now 👀

See y’all next week 🫡

- Angelo Castillo

How did you like today's newsletter? |

Disclaimer: This is not financial advice or investment recommendations. The content is for informational purposes only, and it should not be considered as legal, tax, investment, financial, or other advice.

Some of the links are my affiliate links. If you click on these links and sign up/purchase something, I may earn a small commission at no additional cost to you. This helps support me and allows me to continue creating content for you. I only promote products and services I genuinely believe in. Thank you for your support!